– by New Deal democrat The Bonddad Blog Industrial production, one of the premier series the NBER has historically used to declare recessions vs. expansions, has faded in importance since China was admitted to regular trading status in 1999. As you can see in the first graph below, both total and manufacturing production peaked in 2007. Further, manufacturing has continued to fade, as its post-pandemic peak has not equaled its 2010’s peak either: In March, total production increased 0.4% from an upwardly revised, by 0.2%, February; but it is still down -0.6% from its September 2022 post-pandemic peak. Manufacturing production increased 0.5%, but is also down, by -0.2% from its post-pandemic peak as well: Before the “China shock,” a

Topics:

NewDealdemocrat considers the following as important: Hot Topics, production, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

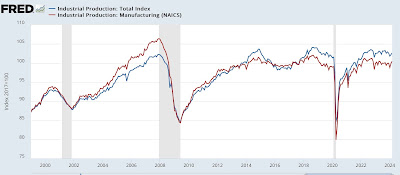

Industrial production, one of the premier series the NBER has historically used to declare recessions vs. expansions, has faded in importance since China was admitted to regular trading status in 1999. As you can see in the first graph below, both total and manufacturing production peaked in 2007. Further, manufacturing has continued to fade, as its post-pandemic peak has not equaled its 2010’s peak either:

In March, total production increased 0.4% from an upwardly revised, by 0.2%, February; but it is still down -0.6% from its September 2022 post-pandemic peak. Manufacturing production increased 0.5%, but is also down, by -0.2% from its post-pandemic peak as well:

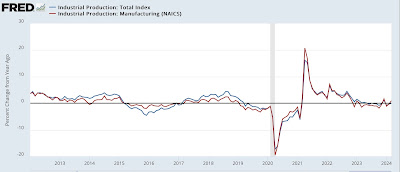

Before the “China shock,” a YoY downturn in industrial production almost always meant recession. As the YoY graph below shows, there was a significant “industrial recession” in 2015-16 without any generalized economic downturn:

Whether the 2019 downturn would have resulted in a recession by itself had the pandemic not intervened will always remain an unanswered question. But again in 2023 production was again down YoY with no recession. As of March, manufacturing production is flat YoY, while total production is now up by 1.0%.

Bottom line: while March was positive, the overall trend remains generally flat.

Retail sales faceplant; industrial production continues 16-month streak of weakness, Angry Bear, by New Deal democrat.