How restrictive are “real” interest rates? – by New Deal democrat This post is inspired by a Xtweet from Paul Krugman this morning, in which he pointed out that if we measured inflation the same way it is done in Europe, the Yoy% change would be only 1.7%. That got me wondering, since the primary difference is how shelter inflation is measured, just how restrictive is current Fed policy across a number of the most important inflation measures? Let’s begin by reviewing what the current YoY% changes in consumer prices are using the harmonized index (red), CPI les shelter (gold), headline CPI (dark blue) and core CPI (light blue): As I pointed out when the CPI was reported last week, ex-shelter consumer prices are only up 1.8% YoY, while

Topics:

NewDealdemocrat considers the following as important: August 2024, restrictive interest rates, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

How restrictive are “real” interest rates?

– by New Deal democrat

This post is inspired by a Xtweet from Paul Krugman this morning, in which he pointed out that if we measured inflation the same way it is done in Europe, the Yoy% change would be only 1.7%. That got me wondering, since the primary difference is how shelter inflation is measured, just how restrictive is current Fed policy across a number of the most important inflation measures?

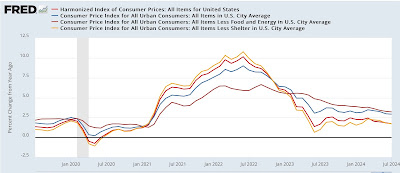

Let’s begin by reviewing what the current YoY% changes in consumer prices are using the harmonized index (red), CPI les shelter (gold), headline CPI (dark blue) and core CPI (light blue):

As I pointed out when the CPI was reported last week, ex-shelter consumer prices are only up 1.8% YoY, while headline inflation was 2.9%, and the core measure was 3.2%.

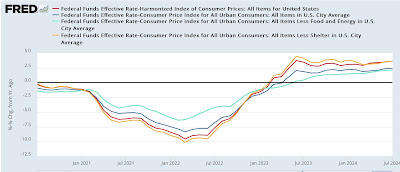

The Fed funds rate has remained at 5.33% for the past year. That means that the “real” Fed funds rate for headline inflation is 2.4%, 2.1% for core inflation, and 3.6% for both CPI less shelter and the harmonized index:

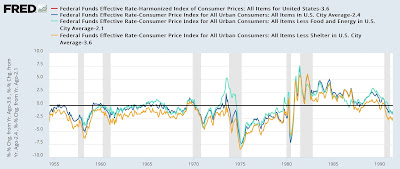

That’s certainly tight compared with the previous few years. But how does it compare historically? Below I subtract the current “real” Fed funds rate to show each metric at the 0 line, and divide into two segments better to show the historical record:

Before 1982, the current “real” Fed funds rate is higher than at any time except in the year or so before recessions, and also during the 1966 slowdown. Since the turn of the Millennium, it is also higher than at any time except for the lead-up to the Great Recession. On the other hand, the real rate was higher durning almost all of the 1980s and mid- to late-1990s.

Since the 1980s and 1990s are remembered as periods of prosperity, is that such a big deal?

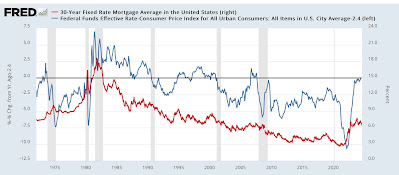

Well, remember that during both of these decades interest rates, and in particular mortgage rates, were in an almost persistent rate of decline. Indeed, it is only when they stopped declining for 3 years or more that recessions occurred:

By contrast, mortgage rates have been at or close to 15-year highs for the past two years.

In other words, going back 60 years, “real” interest rates have only been this high in the year or two before recessions, except for those periods when households could free up more cast to spend by refinancing their mortgages at lower rates.

It is hard to escape the implication that if the Fed does not start lowering rates very soon, it has brought about recessionary conditions.