Oddly I am back here posting. Even more oddly I am posting on the topic I am paid to address. I start by noting two things. About one year ago, many macroeconomic forecasters predicted that a recession would have started by now in the USA. I forget who placed the probability at 100%. In spite of sltightly disappointing 0.4% (1.6% if annualized) real GDP growth in the first quarter of 2024, we are not in a recesion. What went right ? The presumed cause of a recession was the sharp shift to contractionary monetary policy in a effort to fight inflation. In this post, I will focus mostly on domestic demand. Briefly, high interest rates can cause a recession by causing an appreciation of the national currency which causes a sharp decline in net

Topics:

Robert Waldmann considers the following as important: Featured Stories, Hot Topics, politics, recession 2024, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Oddly I am back here posting. Even more oddly I am posting on the topic I am paid to address. I start by noting two things. About one year ago, many macroeconomic forecasters predicted that a recession would have started by now in the USA. I forget who placed the probability at 100%. In spite of sltightly disappointing 0.4% (1.6% if annualized) real GDP growth in the first quarter of 2024, we are not in a recesion. What went right ?

The presumed cause of a recession was the sharp shift to contractionary monetary policy in a effort to fight inflation.

In this post, I will focus mostly on domestic demand. Briefly, high interest rates can cause a recession by causing an appreciation of the national currency which causes a sharp decline in net exports. This may have been important in 2981-2, but it usually isn’t a huge deal for the huge USA. In any case exchange rates haven’t shifted much, nor have real exchange rates, because most US trading partners have had inflation similar to US inflation. I think that’s the explanation. The shift to contractionary monetary policy occurred at roughly the same time in many countries, so there was not much shift in interest rate differentials of exchange rates.

So I mainly look at domestic demand (AKA absorption). The larges element is consumption which has continued to grow. Consumption mainly tracks disposable income with the rest of variation explained by changes in wealth . Wealth is high due to high house prices and the (illusory wealth) from the national debt. No surprise. Government consumption plus investment remains stable. The issue is investment which should decline with high interest rates. I will disaggregate investment.

FIrst it is the sum of fixed capital investment and inventory investment. Inventories follow final sales so inventory investment is (almost entirely) expalained by the change in final sales, which have grown. No surprise.

Fixed capital investment is divided into residential (the real puzzle) and non residential. Non residential investment is divided into investment in structures and investment in equipment and software (I am old enough to remember when this was called investment in equipment). The cost of investing in equipment and software is almost all depreciation (not interest) which is almost all due to techological obselescence. It tracks the change in GDP which has continued to grow, so no surprise there.

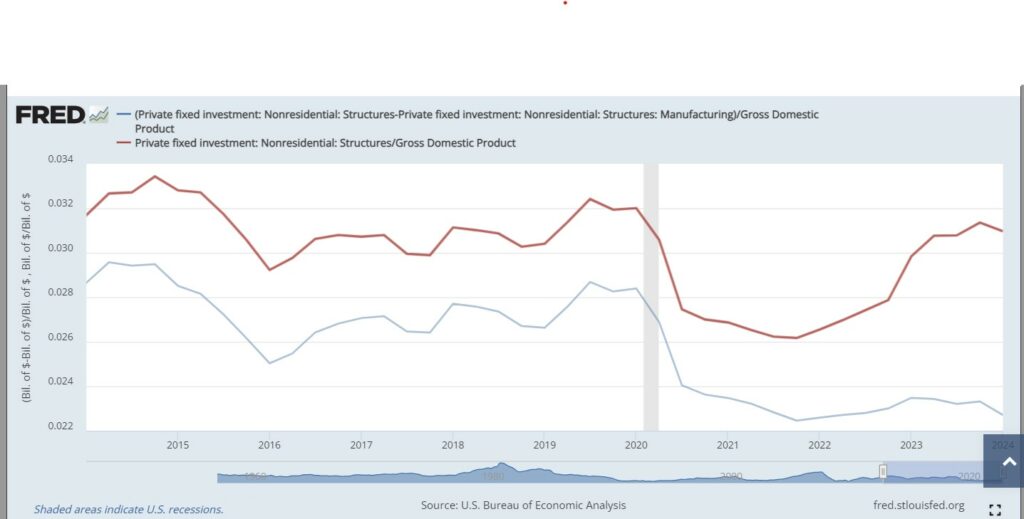

The puzzle is why has investment in structures held up. I will discuss non residential structures first. A fairly small part of that is investment in manufacturing structures AKA factories. This is a small amount of demand, because factory buildings are large but simple. However, the increase has been dramatic with investment in manufacturing structures roughly doublin. This can be explained by the incentives in the CHIPS act and the IRA – fiscal policy not working as aggregate demand but as incentives for private demand. In fact that is almost the whole story. Other non residential investment in structres fell dramatically during the Covid epidemic and then remained low. This makes sense as people worked from home reducing demand for office space, and purchased things to be delivered reducing demand for retail space (Amazon structures keep appearing in remote places but, like factories they don’t cost much).

The current level of investment in structures other than manufacturing structures at less than 2.4% of GDP is very low (trough of great recession low, commercial property bubble burst in 1991 low — sorry I didn’t show those years). It hasn’t declined after the shift to tight monetary policy. I guess these are structures that are really needed (new shopping centers in new housing developments) and the increased cost from increased interest rates are passed on to consumers.

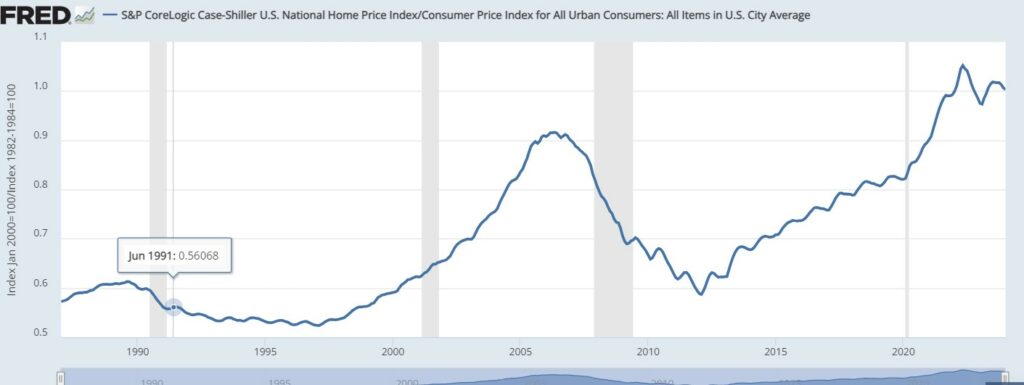

The remaining huge puzzle is residential fixed investment. Why are people buying houses ? The relative price is very high – higher than in 2006 at the peak of the (last???) bubble

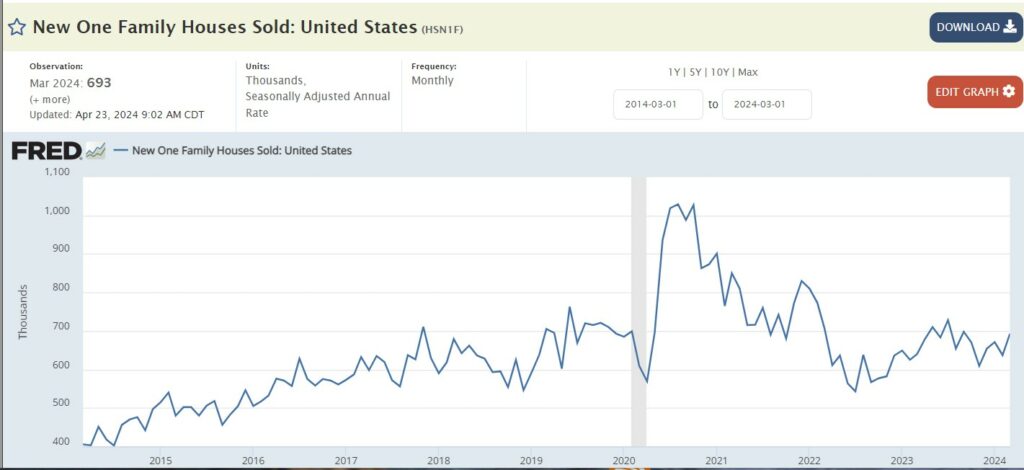

But that’s not the half of it. Mortgage interest rates are very high (and long term expected inflation isn’t). Yet new homes are being purchased.

I don’t understand this (which is key). I have some guesses. My first guess is that people are willing to pay the huge prices (and huge interest on the mortgage) because they are convinced prices are going up so it is a good investment. This could be yet another bubble or could be a rational forecast. There are other possibilities.

Work from home creates demand for home offices. This is an explanation of the huge increase in rents on newly signed leases in 2021-2022 (still working through to average rents which explains a lot of persistent inflation). It also applies to owner occupied housing in two ways. People might want a whole house not an apartment to have a home office. Also, high rents encourage buying even if the price is high (this isn’t enough — a 20% increase in rents does not make buying now sensible without something else going on).

Two other things. The prolonged period of low construction post great recession means that square feet per adult are way below trend. It might be that a housing shortage implies people who need some space are buying even with high prices and mortgages.

Finally, Brad DeLong had an idea (I don’t know if it is on his substack). High mortage rates lock in people paying low interest mortgages. This can include boomers who would otherwise move to smaller houses. My reaction is to ask which boomers still have mortgages. But some can if, for example, they moved and each time moved to a larger house. Or if they moved from a depressed area, selling a house for very little and bought a much more expensive house in a booming area. Or, especially, if they took out home equity loans. It still seems odd to me that equity in a large house would not make it possible to buy a small house without a new mortgage. There is also a possibility that people who move from a house with a low interest rate mortgage don’t sell but rather rent it taking advantage of high rents (I know a couple who are doing this).

In any case, I find the determination to buy a house even now when everything is against it puzzling