When I start to get comments and questions from some of the more expert authorities on healthcare such as Merrill Gooz, Andrew Sprung, Steve Early (Suzanne Gordon), and Kip Sullivan; I start to feel pretty good about some of my commentaries or comments. This last go around on Gooz News in the comments section, we were talking about “Fee For Service” Medicare and “Medicare Advantage” plans. The one issue I am experiencing is a 67% increase in the...

Read More »Democrat’s Domestic Infrastructure Investments Paying off

November 15, 2023 . . . Representative Chip Roy (R-TX) scolding his colleagues: “One thing. I want my Republican colleagues to give me one thing. One. That I can go campaign on and say we did. One! Anybody sitting in the complex, if you want to come down to the floor and come explain to me, one material, meaningful, significant thing the Republican majority has done besides, ‘Well, I guess it’s not as bad as the Democrats.’” In contrast,...

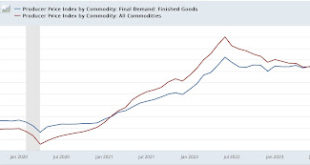

Read More »Real retail sales consistent with continued slow growth, aided by a continuing decline in commodity prices

If you have been following NDd, you will note one of the biggest issues with the economy is supply chain. Most notably shortages of raw material, components, and finished products. Similar occurred in 2008 and my own belief is this is a recurrence of similar. I believe much of this could have been prevented. Beyongd that remark, I will let NDd tell you how falling costs impacts the economy. Real retail sales consistent with continued slow growth,...

Read More »Just Some More Politics Today

House politics today as most Repubs and Dems support the House funding bill. Democrat Jake Auchincloss of Massachusetts and Mike Quigley of Illinois voted against the passage of the House Speaker Mike Johnson’s stopgap funding bill to avert a government shutdown. With the two Dems, Ninety-three Republicans voted against it also. The bill passed. A similar bill as what former House Speaker Kevin McCarthy supported. The Democratic House leadership,...

Read More »Creating Workplace Flexibility in the Health Care Industry

I know Dean Moore from a German Company in upstate New York where we both worked. Great area to be. the Germans operated like they had a board up their backs. Working in Germany was fun and I got to explore on weekends on their dime. As it was, I left after three years. Dean followed a year or so later. Dean Moore is vice president of work/life at St. John’s, a full-service senior care provider with options that range from independent living to...

Read More »Using the FBI to go After Political Opponents

There is growing split between Dems and Repubs as political opponents beyond just beliefs. The chart (below) comes from a March 2022 PEW report. Notice the shift of Republicans to the right. I always thought Newt Gingrich was the cause of the split between Dems and Repub House members with the Repubs moving further to the right. Dems have pretty much stayed where they were in political beliefs. This in the House and the Senate. The one antagonist...

Read More »Freedom wins the elections

Infidel’s commentary covering the recent referendums in Ohio and elections in Virginia, Kentucky, Pennsylvania, Kansas, and Rhode Island. All of which were ending in resulting in wins for people. And of course, most if not all reflecting Democratic party views on the various issues. In the end, “democracy and individual freedom still remains vigorous in the US.” Infidel 753, Freedom wins the elections, Infidel753 Blog Yesterday’s...

Read More »Except for fictitious shelter and motor vehicle insurance and repairs, consumer inflation is thoroughly contained

It appears inflation is coming down this year and probably into next year also. Maybe Biden will not have to twist the Fed’s arm to get them to lower the Fed rate. Except for fictitious shelter and motor vehicle insurance and repairs, consumer inflation is thoroughly contained – by New Deal democrat The October CPI report confirmed yet again what I have been saying for months: except for fictitious shelter, both headline and core inflation...

Read More »Rooting out Communists, Marxists, Racists, and Radical Thugs

Successful Economy or failing economy, this person of no distinction should be denied the presidency. November 13, 2023, Letters from an American, Prof. Heather Cox Richardson In a speech Saturday in Claremont, New Hampshire, and then in his Veterans Day greeting yesterday on social media, former president Trump echoed German Nazis. “In honor of our great Veterans on Veteran’s Day [sic] we pledge to you that we will root out the...

Read More »Changing Social Security Sooner Rather Than Later, Avoiding a Shortfall

I was following the links in Dale’s latest commentary on Social Security and clicked in to see what Dale was discussing in his commentary. I was able to web capture the chart (below) which I believe accurately depicts what Dale is writing about in his commentary. The chart is a depiction of a one tenth of one percent increase yearly for the employer and the employee. There are other solutions to the short fall of Social Security funding. As...

Read More » The Angry Bear

The Angry Bear