Real average hourly wages and real aggregate payrolls for October – by New Deal democrat With yesterday’s report on October consumer prices, we can take up two of my favorite measures of how the working/middle class is doing – real average non-supervisory wages, and real aggregate payrolls. Real average wages for non-supervisory workers declined -0.1% for the month. They are -5% below their pandemic lockdown peak (which, recall, was...

Read More »October CPI reports total inflation increases at a 3.5% annual rate

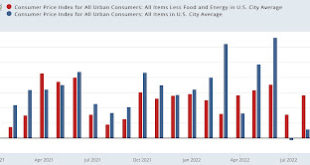

October CPI report: total inflation increasing at 3.5% annual rate, core inflation minus shelter increasing at 2.8% annual rate in the past 4 months – by New Deal democrat For a full year now I’ve been hammering the fact that the official CPI measure of housing inflation, “owners’ equivalent rent,” seriously lags actual house prices as measured by the most popular housing indexes. I said then, and I have reiterated almost every month since,...

Read More »Democrats wrest control of Michigan Legislature for first time in almost 40 years

I lived in Michigan for 27 years having moved from Madison Wisconsin. If I had my choice, we would have stayed in Madison. It was damn cold in the winter. We were still able to do things though. Michigan was not quite the same. It was never really home for us. Just too many things not right. The politics were deeply Republican in our county. The roads were in poor to fair condition, taxes were too low, and the county favored business. Voting...

Read More »Jobless claims: still holding steady

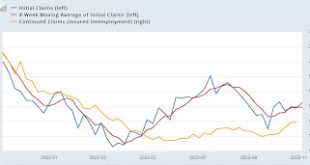

Jobless claims: still holding steady – by New Deal democrat Initial jobless claims rose slightly, by 7,000, from one week ago to 225,000. The 4 week average declined -250 to 218,750. Continuing claims also rose slightly, by 6,000, to 1,493,000: This is right in the middle of where claims have been for the last 6 months. If anything, there might be a slight rising trend in the last month. The jobs market remains very tight. Aside from...

Read More »Open thread Nov. 11, 2022

“Open thread Nov. 8, 2022 Election Day,” Angry Bear, angry bear blog.

Read More »Coronavirus dashboard for November 8, 2022

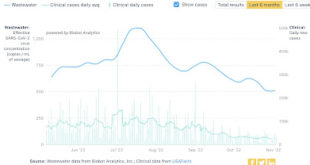

Coronavirus dashboard for November 8: the new alphabet soup of variants fails to generate a new wave (so far) – by New Deal democrat Biobot has not updated since late last week, showing COVID particles at or near 6 month lows both nationwide: and in all 4 Census regions: As expected, the CDC’s variant update last Friday showed that BA.5 was down to 40% of all cases, with the alphabet soup of new variants descended from BA.2 and BA.5...

Read More »Promoting the 2022 Election – Michigan Signs

“U.S.A. the Envy of World After Ten Billion Dollars in Campaign Ads Changes Almost Nothing,” The New Yorker, Andy Borowitz. Three questions in a row commentary. Were you convinced? Did you wonder about who was trying to influence the election the most? Which ones, Republicans, Democrats, Polling firms, TV News, Magazines, News Papers, the masked militia at the polling boxes, trump??? UNITED STATES OF AMERICA (The Borowitz Report) – The...

Read More »Letters from an American – November 9, 2022

“November 9, 2022,” Letters from an American, Prof. Heather Cox Richardson, (substack.com) Yesterday was a good day for democracy. Americans turned out to defend our principles from those who denied our right to choose our own leaders. There was little violence, the election appears to have gone smoothly, and there are few claims of “fraud.” As I write tonight, control of the House and Senate is still not clear, but some outlines are now...

Read More »Some Big Picture comments on the 2022 midterm elections

Some Big Picture comments on the 2022 midterm elections – by New Deal democrat No economic news today while we await tomorrow’s big inflation report (Hint: shelter inflation is going to continue to be the big driver); and I think maybe we had a little political event yesterday, so let me make a few brief comments. 1. From the beginning of this year, I told everybody who would listen that (1) the Supreme Court was really and truly going to...

Read More »Scenes from the October jobs report

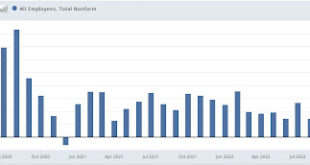

Deceleration and deterioration, but no downturn signaled – by New Deal democrat No economic news of note today or tomorrow, except the (very late) Q3 Senior Loan Officers Report this afternoon, which will tell us about the state of credit, but is anticipated in much more timely – i.e., weekly – fashion by the Chicago Fed’s Financial Conditions Index. So let’s take a look at some noteworthy items from last Friday’s jobs report. As I...

Read More » The Angry Bear

The Angry Bear