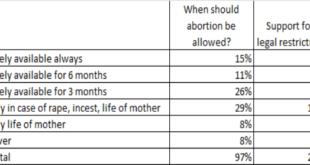

The end of Roe The era of judicial protection for abortion rights appears to ending. The Supreme Court is poised to uphold a Mississippi statute that prohibits most abortions after 15 weeks, and it is likely to do this by overruling Roe entirely. When this happens, many states will enforce draconian laws limiting access to abortion. There is a real possibility that Republicans will seek a national ban on abortion the next time they gain unified...

Read More »Outlawing Abortion, It is a costly Endeavor

Boston Public Radio May 19th episode held a discussion of the consequences for the nation when abortion is outlawed. The guest was Jonathan Gruber, the Ford Professor of Economics at MIT. He was involved with the ACA and the Mass health insurance system. Getting right to it: Based on studies: Women who wanted an abortion but could not get one are more likely to die in child birth, have worse mental health outcomes and a huge increase in...

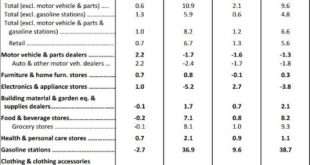

Read More »March and April’s retail sales Revised Higher

RJS, MarketWatch 666 Summary: Retail Sales Rose 0.9% in April after March Sales Revised 0.9% Higher Seasonally adjusted retail sales rose 0.9% in April, after retail sales March were revised 0.9% higher, while sales for February were revised a bit lower . . . the Advance Retail Sales Report for April (pdf) from the Census Bureau estimated that our seasonally adjusted retail and food services sales totaled a record high $677.7 billion...

Read More »Open thread May 24, 2022

Age of Warfare is Changing

Not quite star wars yet. The past and old age of warfare is changing as we watch the conflict in the Ukraine between one ill equipped small defender and the more modern equipped large attacker. It is only because of NATO and the US equipping Ukraine has the stubborn resistance held up. The lessons to be learned from watching the Ukrainians beat the Russians is something which the US should be paying attention too. While our military may not be as...

Read More »Expanding BRICS?

Expanding BRICS? Chinese paramount leader Xi Jinping has called for the BRICS group to expand to include Kazakhstan, Uzbekistan, Thailand, Indonesia, Argentina, Nigeria, Senegal, Egypt, and Saudi Arabia. The original group, suggested by the research department at Goldman Sachs in 2001 as a group to leading future world economic growth was Brazil, Russia, India, and China, who then decided to officially form a group, which then added South Africa...

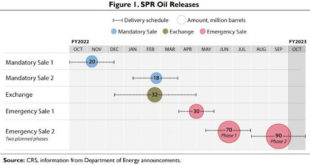

Read More »SPR and Supplies Low, Total Oil and Products the Same

RJS, Focus on Fracking Summary: Strategic Petroleum Reserve at a 34 year low, US oil supplies at a 17 year low, total oil + products inventories at a 13½ year low The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending May 13th indicated that after a jump in our oil exports, another oil withdrawal from the SPR, and an increase in demand that could not be...

Read More »LBJ, a man with gargantuan appetites and ambitions

I stole this comment from a place from I read on a regular basis. An Incredible commentary. Having grown up in that era, I felt it had merit and believe the commenter gets it right. The programs mentioned here are under attack by Republicans. SCOTUS is using nondelegation as the basis to dismantle programs. Congress did pass these programs, allocated funds to support the programs, and established the means for administration. A program can be...

Read More »Weekly Indicators for May 16 – 20

– by New Deal democrat Weekly Indicators for May 16 – 20 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The yield curve tightened some more this week (but did not invert). Meanwhile, I am seeing a fair amount of commentary suggesting that a recession is imminent. This is jumping the gun, and is mainly relying on the downturn in the stock market as well as the increase in gas prices. These are short leading indicators,...

Read More »Baby Boomers Unretiring

“Will baby boomers unretire?” (beckershospitalreview.com), Molly Gamble, Becker’s Hospital Review Me: I am seeing this phenomenon happening quite a bit myself with multiple inquiries on job status. Millions of older Americans have returned to work in recent months, with nearly 64 percent of adults between ages 55 and 64 working in April. Essentially this is matching the share working in February 2020 and marking a more complete recovery than...

Read More » The Angry Bear

The Angry Bear