Record Income Taxes? I should read more posts from Kevin Drum: The Yahoo News reporter comes close to explaining what happened by noting that there were more returns in 2018 than 2017. As you might guess, this happens every year as the US population increases. So let’s take a look at personal income tax receipts adjusted for inflation and population growth … In reality, income tax receipts were down 2.6 percent in 2018 compared to 2017. What this means,...

Read More »Why the revised Q2 GDP report next week may be the most important release in 10 years

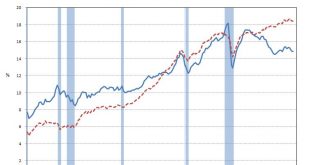

by New Deal democrat Why the revised Q2 GDP report next week may be the most important release in 10 years Last Thursday there were major backward revisions to unit labor costs. Since corporate profits deflated by unit labor costs are a long leading indicator, this had a big negative effect on the forecast for the next six months or so. Corporate profits for Q2 of this year will be released next week as part of the first revision of the GDP report, and...

Read More »Cheerleading for Austerity

Cheerleading for Austerity Not content to follow a news strategy that maximizes Trump’s prospects for re-election, the New York Times leads today with a story that combines economic illiteracy and reactionary scaremongering in a preview of what we’re likely to see in the 2020 presidential race. “Budget Deficit Is Set to Surge Past $1 Trillion” screams the headline, and the article throws around a mix of dollar estimates and vague statements about...

Read More »The Truckers are not happy

I’ll just post this link and let it speak for itself. Truckers voted for Trump in droves. Now they say his trade war is ‘killing’ their ability to make a living. Its starts wtih: Morris Coffman has been a truck driver for 35 years. And he’s been a conservative for even longer than that — his whole life. “That said,” Coffman told Business Insider, “[Trump] is absolutely a moron. His idiotic ideas will tank the economy even further.” Truckers, like...

Read More »“Tougher On Trade Than Trump”?

“Tougher On Trade Than Trump”? This is how the NY Times has presented things day before yesterday, apparently lamenting that the Dem candidates are going to have a tough time presenting themselves as “tougher on trade than Trump.” This somehow presumes that this is what they must do to win the election, and at least one has been making virtually this claim: good old Bernie. A few have mumbled vaguely about Trump hurting farmers in the Midwest, but not...

Read More »Importance of Imports

It is standard analysis to see real and nominal imports as a share of GDP quoted to estimate the importance of imports in the economy. Currently that shows nominal imports are about 15% of GDP and real imports are some 18% of real GDP. But I suspect that this comparison understates the role of imports in the economy because services are some 45% of GDP but only about 16% of imports. As my high school algebra teacher was fond of saying, you are adding...

Read More »Open thread August 21, 2019

Denmark Offers to Buy the US

Andy Borowitz, The Borowitz Report, COPENHAGEN: After rebuffing Donald J. Trump’s hypothetical proposal to purchase Greenland, the government of Denmark has announced that it would be interested in buying the United States instead. “As we have stated, Greenland is not for sale,” a spokesperson for the Danish government said on Friday. “We have noted, however, that during the Trump regime pretty much everything in the United States, including its...

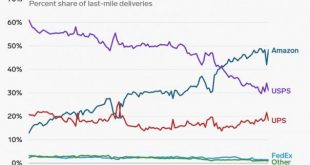

Read More »Amazon, FedEx and the Post Office

Both Amazon and Fed ex have embarked on plans to deliver their own “last mile” package delivery previously contracted with the US Post Office. Here is a link to run75441 (postmaster Mark Jamison’s) piece on this process Fake News, Flawed Analysis, and Bogus Tweets from 2018 for a much more complete description. I have pulled a quote from the more recent Business Insider post on “last mile” delivery. According to the US Postal Service Inspector...

Read More »Sunday Morning Commentary

What is going on lately in the nation. Maybe you do not read it, but these authors/cartoonists can depict each of today’s issues in one image. Immigration, CEO Pay, Guns, and Retirement Click on each image to enlarge.

Read More » The Angry Bear

The Angry Bear