Read More »

Real wages unchanged, real money supply increases in October

With October consumer price inflation reported, let’s update a few metrics. First of all, while the YoY% growth in real wages increased: real wages were unchanged month over month, as both nominal wages and consumer inflation both increased by +0.3%: Real wages have still not even increased 1% in the last 2 1/2 years. Because, as I noted yesterday, so much of consumer inflation, and therefore real wages, depends on gas...

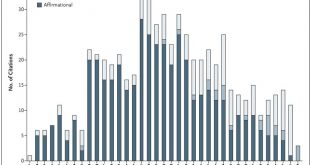

Read More »The AMA is Calling for a Relaxing of CMC Opioid Prescription Restrictions

A little history: In 1980, the Porter and Jick letter to the editor of the New England Journal of Medicine by the Boston Collaborative Drug Surveillance Program stated: “the risk of addiction was low when opioids such as oxycodone were prescribed for chronic pain.” It was a brief statement by the doctors conducting the study, taken out of context, and cited many times afterwards as justification for the use of oxycodone. In a June 1, 2017 letter to the...

Read More »Initial markers for a manufacturing slowdown now hit

I have a new article that hopefully will get posted by Seeking Alpha later today. In the meantime … Two weeks ago I wrote an article establishing a manufacturing baseline for my forecast of an economic slowdown by about the middle of next year. I concluded that by saying: the first thing I am looking for is decelerating growth which will show up in a reading below 15 in the average of Regional Fed reports, and below 60 in ISM new orders. The ISM...

Read More »Changes in labor bargaining power take up to a decade to be fully effective

Changes in labor bargaining power take up to a decade to be fully effective Sorry for the recent lack of posting on economic matters. Partly it is ennui, and partly it is a near total dearth of data in between the employment report a week ago Friday and tomorrow’s CPI report. Even a couple of quarterly series I usually report on have been inexplicably delayed. In the meantime, here is a graph from Jared Bernstein that is worth some extended comment. It...

Read More »A Serious Centennial

A Serious Centennial After failing to show up at a major American cemetery in France at least our president did not add to his shame by failing to show up for the big show with 60 or so other national leaders at the Arc de Triomphe for the official ceremony marking the centennial of the 11th hour on the 11th day of the 11th month of November, 1918, when the guns fell silent on the western front of World War I, officially ending it in the eyes of most...

Read More »Is It Not The Economy, Stupid?

Is It Not The Economy, Stupid? On many Mondays I indulge in taking Robert J. Samuelson to task after his regular Washington Post column of the day. Today he was almost right, or if you prefer, even mostly right. This one was titled “It’s Not the Economy, Stupid” about the outcome of the midterm election, as well as a delayed comment on the 2016 presidential election (although, of course, HRC did win the popular vote by three million popular votes, if...

Read More »Open post Nov. 13, 2018

The Death of Shame

The Death of Shame In any society not in a state of civil war, shame is a powerful force, perhaps the most powerful. Individuals or organizations caught cheating, lying or otherwise doing evil, when exposed and called out, are expected to be embarrassed. They should repent their sins and promise to make amends. Other than pure coercion, what else can disarm those who violate the norms of society? Evolutionary biologists tell us shame is hardwired not...

Read More »A baseline road map for the 2020 elections

A baseline road map for the 2020 elections Now that the 2018 midterm elections are behind us, let’s take a preliminary look at 2020. It occurred to me that a decent baseline for that election is to simply take the total 2018 House votes for each state, assume that the Presidential vote in 2020 in each state will be the same, and apply that to the Electoral College. Alternatively, you could use the results of the 2018 Senate races in those states where...

Read More » The Angry Bear

The Angry Bear