On the rise of German militarism The long-term rise of Japanese militarism that culminated in the Pacific War in World War 2 was painstakingly documented in Meirion and Susie Harries’ excellent “Soldiers of the Sun,” a template that ought to give pause to Americans today. Briefly, the Meigi consitution required that there be a military cabinet secretary. If that secretary resigned, the government fell. Once the military realized the leverage they had,...

Read More »The Political Economy of the Working Class

The Political Economy of the Working Class The political economy of the working class is pluralist. The political economy of the working class is pragmatic. The political economy of the working class is critical. Karl Marx chronicled and contributed to the political economy of the working class. He did not invent, conclude or supersede it. In his Inaugural Address to the International Working Men’s Association, Marx celebrated the first victory of the...

Read More »Housing’s most difficult comparisons in years begin next Wednesday

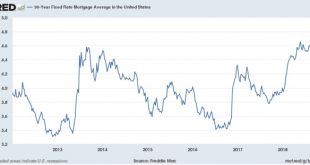

Housing’s most difficult comparisons in years begin next Wednesday After a real quiet week for news, next week we get retail sales, industrial production, the JOLTS report, existing home sales … and housing permits and starts. The week after, real residential fixed investment will be reported as part of Q3 GDP. Permits and residential fixed investments will have some of the most challenging comparisons in a long time. Here’s why. First, here’s a graph...

Read More »Senate Dems put Republicans on the Spot Over Junk Healthcare Plans

Last March, U.S. Senator Tammy Baldwin of Wisconsin sponsored a bill (Fair Care Act) to block President Trump’s plan to allow insurers to sell short term or what is frequently called junk plans. Senator Baldwin bill would reverse all of what the Republicans attempted to do with short term plans by reinstating protections for pre-exiting conditions, maintaining the community benefit costing of the plans, blocking life-time cost limits, etc. Senator Tammy...

Read More »Tracking Trump’s trade wars: inventories and intermodal traffic

Tracking Trump’s trade wars: inventories and intermodal traffic Here’s something I thought I would start to track: looking for evidence of the effects of Trump’s trade wars on manufacturing and distribution. Producers and distributors aren’t simply going to sit back and wait to absorb new tariff expenses: we should expect them to engage in as much “front-running” as possible, importing the goods and commodities likely to be affected by the tariffs early,...

Read More »U.S. Saudi Trade

U.S. Saudi Trade Donald Trump appears to be reluctant to investigate the murder of Jamal Khashoggibecause of an alleged trade deal? Donald Trump has said US investigators are looking into how Jamal Khashoggi vanished at the Saudi consulate in Istanbul, but made clear that whatever the outcome, the US would not forgo lucrative arms deals with Riyadh. The president’s announcement raised concerns of a cover-up of evidence implicating Saudi Arabia’s powerful...

Read More »Kevin Drum discusses single parent households

(Dan here…lifted from Robert’s Stochastic Thoughts) Kevin Drum discusses single parent households Disqus won’t let me comment, so I post my comment on this post hereI am honestly impressed that you didn’t mention lead. So I will. The single parent household peak came later than the murder peak — as one would expect. Single parent households last (until another marriage & good luck with that Ms single mom). You graph a stock (OK 3 stocks) each...

Read More »Open thread October 12, 2018

Is the taboo against raising wages beginning to break?

Is the taboo against raising wages beginning to break? It’s a *really* slow news week for economic data — just producer and consumer prices tomorrow and Thursday. Even JOLTS doesn’t come out until next week. But there was one little nugget of good news this morning: the NFIB, which represents small businesses, came out with their September report, and there was some good news about wages: more small businesses — 37% — said they *actually* raised wages in...

Read More »How To Succeed in Business Without Really Trying

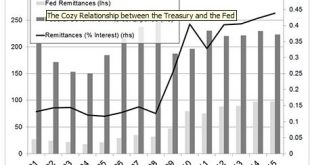

This is a somewhat late 10th anniversary of the Lehman failure post. I am not going to write much that is new, but will restate an argument I have been making for years (following John Quiggin and Miles Kimball). It is trivially easy for the US Treasury (and other treasuries) to make huge profits on the carry trade. These huge profits are, I claim, actual wealth created by the operation. In general, the argument is that, over all recorded long time...

Read More » The Angry Bear

The Angry Bear