How close are we to “full employment”? As I pointed out Friday, there was a lot of good news underneath the headline jobs gain — primarily in labor force participation and underemployment. So, how close are we to “full employment,” based on the last few expansions? Let’s start with the simple, straightforward unemployment rate of 3.9%. This is already considerably below the best reading of the 2000s expansion, and only 0.1% above the best reading of the...

Read More »Real Wages Decline

Real Wages Decline Trump and his allies have been loudly bragging about the second quarterly GDP growth rate of 4.1%. It is quite possible that a growth rate of this sort may be maintained for another quarter or so, given the large fiscal stimulus put in place at the beginning of the year. How curious it is that that coincided with the peak of the US stock market, at least as measured by the Dow. However, this is seriously overblown for the simplest of...

Read More »July jobs report: booming jobs market, and a surge in participation continues to depress wage growth

July jobs report: booming jobs market, and a surge in participation continues to depress wage growth HEADLINES: +157,000 jobs added U3 unemployment rate down -0.1% from 4.0% to 3.9% U6 underemployment rate down -0.3% from 7.8% to 7.5% (new expansion low) Here are the headlines on wages and the broader measures of underemployment: Wages and participation rates Not in Labor Force, but Want a Job Now: down -95,000 from 5.258 million to 5.163 million...

Read More »Mid Week Clips

Sleepers in Hong Kong McDonalds I have eaten at the McDonalds in Hong Kong over the years. Just smaller portions and only after I grew tired of fish and veggies. I think I told the story of coming off The Wall, making my way down a road with my Chinese associates towards a Chinese restaurant, and turning the corner to eat at a KFC (their choice). It back upped to The Wall. They loved it. According to a survey, in just five years there has been a six-fold...

Read More »Trump’s Illegal Economic Sanctions Against Iran Start Up

Trump’s Illegal Economic Sanctions Against Iran Start Up Today, President Trump’s promised abjuration of President Obama’s hard-negotiated nuclear deal with Iran,the JCPOA, jointly agreed with Russia, China, UK, France, Germany, the EU, and the Security Council of the United Nations. All parties agree that Iran has held to the agreement, so Trump’s move is completely internationally illegal. His move is supported by exactly four other nations on the...

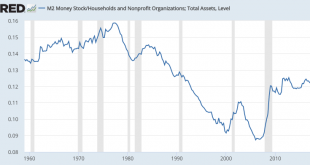

Read More »Four Definitions of Money. All Correct

By Steve Roth (originally published at Evonomics) Four Definitions of Money. All Correct Money makes the world go round. That may well be true, but money certainly makes the economics world go round. It’s the discipline’s special purview, the numeric linchpin that gives economics its dominant role and voice in our affairs. It’s what makes economics seem so “objective” compared to other social sciences. Given that, it’s remarkable that economists don’t...

Read More »Open thread August 7, 2018

The Birth of a Bomb and the Rebirth of a City

1945 and 2018 On August 6, 1945; The US dropped an atomic bomb (Little Boy) on Hiroshima destroying much of the city and instantly killing 80,000 of its citizens. 60,000 more would die later On August 6, 1945; The Enola Gay dropped the first atomic bomb ever used in military combat on Hiroshima. A second atomic bomb was dropped on Nagasaki August 9, 1945. On August 6, 2018; On the 73rd anniversary of dropping of the first atomic bomb, the residents of...

Read More »Sunday Political News Funnies

Enjoy!

Read More »Mortgage rates probably have to top 5% to tip housing into a recession-leading downturn

Mortgage rates probably have to top 5% to tip housing into a recession-leading downturn I’ve pointed out many times that, generally speaking, mortgage rates lead home sales. It’s not the only thing — demographics certainly plays an important role — but over the long term interest rates have been very important. I have run the graph comparing mortgage rates to housing permits many times. In the graph below, I’m using a slightly different housing metric —...

Read More » The Angry Bear

The Angry Bear