Read More »

Baumol Cost Disease and Relative Prices – Part 2

Baumol Cost Disease and Relative Prices – Part 2 Many thanks to the Angrybear for reposting this as well as some excellent comments (save that absurd contention I’m a Luddite). If you check the comments over at Mark Perry’s place you will see that Paul Wynn made the same point I made and even linked to Timothy Lee: This became known as Baumol’s cost disease, and Baumol realized that it had implications far beyond the arts. It implies that in a world of...

Read More »The WaPo Gang Going After The Usual Suspects On the Budget Falls On Its Face Factually

The WaPo Gang Going After The Usual Suspects On the Budget Falls On Its Face Factually All right, all right, that is not completely fair. Yes, they dump all over Trump and the GOP-run Congress for their massive tax cut directed at the rich, as well as the hypocrisy of the Republicans in so smoothly switching from denouncing budget deficits during the Obama era to a “what? me worry?” attitude now with deficits set to soar in a period of near full...

Read More »Healthcare Notes

National Health Spending at $3.5 Trillion in 2017, CMS Says: CMS is reporting healthcare spending was $3.5 trillion in 2017. National healthcare spending grew by 4.6%, up 3 tenths of 1% from 2016. The increase was blamed on increased spending for Medicare and higher premiums for healthcare insurance. The increase in healthcare premiums can be partially attributed to Republicans blocking the Risk Corridor – Reissuances Programs which eliminated competition...

Read More »Mark Perry Has Never Heard of William Baumol

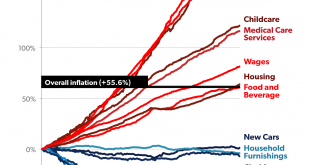

Mark Perry Has Never Heard of William Baumol Otherwise why would Mark Perry write this nonsense: The chart above (thanks to Olivier Ballou) is an update of a chart we produced last year about this time, and shows the percent changes since January 1997 in the prices of selected consumer goods and services, along with the increase in average hourly earnings in this version … Blue lines = prices subject to free market forces. Red lines = prices subject to...

Read More »Drastically Changing the Rules On Infrastructure Spending

Drastically Changing the Rules On Infrastructure Spending Most observers have figured out that the Trump infrastructure spending plan seems to be weirdly lopsided in an unrealistic way, with $200 billion in federal spending somehow supposed to inspire a total of $1.5 trillion in spending by state and local sources along with private ones. What has not been made all that clear publicly is how this plan upends decades of established practice in fiscal...

Read More »Open thread Feb. 13, 2018

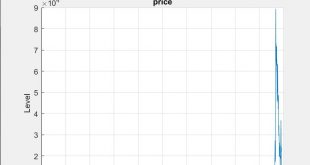

Behavioral Bitcoin

Bitcoin prices are an attractive topic for people who study behavioral finance. Behavioral means anything but rational expectations, Nash equilibrium and the Efficient Market Hypothesis. It is easy to argue that the fundamental value of Bitcoin is zero — it doesn’t yield income and there is no limit on the supply of cryptocurrency, because new cryptocurrencies can be introduced. I certainly consider the positive price of Bitcoin to be a failure of the...

Read More »Watch Out for Charlie Kirk’s Treacle Tart

“There’s many a fly got stuck in there.” Who is Charlie Kirk? He is the 24-year old executive director and founder of Turning Point USA. Jane Meyer profiled the organization in the New Yorker in December: Based outside of Chicago, Turning Point’s aim is to foment a political revolution on America’s college campuses, in part by funneling money into student government elections across the country to elect right-leaning candidates. But it is secretive about...

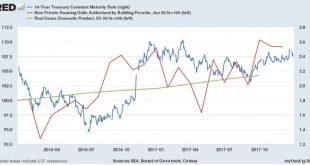

Read More »Interest rates: no shift in the economic weather yet

Interest rates: no shift in the economic weather yet I wanted to make two comments about what has been happening recently with interest rates, a short term look and a long term look. Today let’s discuss the short term. Since September, long term Treasury interest rates have risen from roughly 2.1% to 2.8%. The two year Treasury yield has risen from roughly 1.3% to 2.1% — which means that for the first time in years, the 2 year Treasury is giving you...

Read More » The Angry Bear

The Angry Bear