Why Tax Cuts for Rich Dude Will Lead to Little Stimulus Over at Brad DeLong’s blog jonny bakho adds an interesting comment: How much stimulus did the GWBush tax cuts provide? They came during a recession followed by “jobless recovery” made somewhat better by the housing bubble, then burst big time in 2008. How different would the multiplier be if given to infrastructure repair and broadband extension, investments that create domestic jobs? In a global...

Read More »Consumption tax may not make sense

By Steve Roth (reposted from Evonomics) Consumption tax may not make sense You often hear calls out there — mostly from Right economists but also from some on the Left — for a consumption tax in the U.S. As presented, it’s a super-simple idea: tally your income, subtract your saving, and what’s left is your consumption. You pay taxes on that. We want to encourage thrifty saving and discourage profligate consumption, so what’s not to like? Lots. Before...

Read More »The Risk of Opioid Addiction

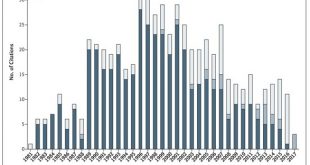

I have been writing on healthcare for a while now and started to look at various topics with regard to pharmaceuticals. In my researching other topics, I found this particular correspondence to the Editor of the New England Journal of Medicine. Illuminating, if one might call it such? “A 1980 Letter on the Risk of Opioid Addiction” The NEJM published 1980 letter: Addiction Rare in Patients Treated with Narcotics Recently, we examined our current files to...

Read More »Angry Bear 2018-02-11 21:30:09

(Dan here…another post lifted from Robert’s Stochastic Thoughts) Contra Mannheim First rules of blogging. I type as I please.I haven’t read anything by Karl Mannheim but I think he wrote the phrase “social construction of truth”. I think that is a bad phrase and all use of it or similar phrases should be criticized. My reason is simple. I think anything true which can be said including the phrase “social construction of truth” can also be said using...

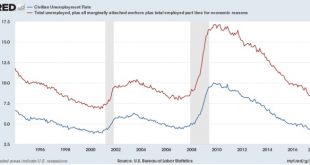

Read More »Fraying at the edges? *relative* underemployment increases

This is a post I’ve been meaning to put up all week (after all, this week was going to be very slow on data and news, right?). As the expansion gets more and more mature, the *relative* performance of certain measures of improvement become more interesting. One of those is the comparison between U3 unemployment, and the broader U6 underemployment measure. While we only have about 25 years of data, so caution is warranted, generally speaking,...

Read More »Is the “Invisible Hand” a lump of labor?

The first premise of Adam Smith’s famous metaphor about an “invisible hand” leading individuals to promote the public interest, although they intend only private gain, was that there is only so much work to go ’round. That is, Smith assumed there was a certain quantity of work to be done — a “lump of labor.” He didn’t tacitly assume it — he stated it plainly: As the number of workmen that can be kept in employment by any particular person must bear a...

Read More »Drum goes easy on Goldberg

(Dan here…Lifted from Robert’s Stochastic Thoughts) Drum goes easy on Goldberg It is progress that hack conservatives are bothsidesing now. Jonah Goldberg correctly notes that the problem isn’t just Trump but also broader extreme partizanship. He asserts that both parties are to blame. He seems to know he can’t defend this assertion and declines to try. I think he may be sincere — the extreme partisanship of Republicans means that in the Conservabubble...

Read More »Open thread Feb. 9, 2018

Stocks have gone from overvalued to fairly valued.

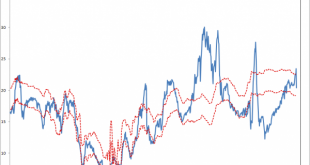

With the market falling like it did over the past week it may prove valuable to look at the PE and some other economic reports. In my PE model the market became overvalued in December and January. The last observation is at the market close on Thursday, 8 February 2018. the previous two observation are the end of December and January values. Notice that the PE did not rise until December . As of November, 2017 the market PE was still below where it was...

Read More »Jobless claims make another record low

Jobless claims make another record low One reason not to get excited about the last week’s stock market swoon is that it isn’t being confirmed by any other short term leading indicators. Most significantly, jobless claims. The 4 week moving average of new jobless claims has fallen below 225,000. This is yet another 40 year record low. In fact, with the exception of six weeks in the early 1970s, it’s a new 50 year low. And adjusted for population...

Read More » The Angry Bear

The Angry Bear