In August 2014, I wrote this post arguing that harsh austerity during the Depression caused Hitler's rise to power. At the time, my argument seemed controversial, at least in Germany. There, it is not the austerity of 1930-32 that is blamed, but the debt-driven hyperinflation of a decade earlier. Germans remain terrified of both inflation and debt to this day.I am certainly not the only person to identify a causative link between austerity and Hitler. Here is Paul Krugman slapping down...

Read More »Thirty-three flawed Theses

Five hundred years ago, so legend has it, a dissident priest called Martin Luther nailed a list of 95 "theses" to the door of the Castle Church in Wittenburg. His action launched the Protestant Reformation. Last week, the dissident economist Steve Keen "nailed" a list of 33 Theses to the door of the London School of Economics. His aim was to launch a Reformation in economics as significant as the religious Reformation that Luther started. It was a bold gesture.But for such a movement...

Read More »Demolishing a straw man

This is David Hencke's response to my comment on his blog. You can find the Coppola Comment version of my comment here.For the record while not replying to all your points. 1. I cover a wide range of topics on my blog – child sex abuse, domestic violence, bad treatment of the disabled, the rise of Jeremy Corbyn, dodgy privatisations, institutional racism etc. 2. Given the government has to write to everyone telling them when their pension is due, it is not beyond the wit of man or woman to...

Read More »Never mind WASPI, just look at Back to 60

The Back to 60 Campaign is attracting the attention of some high-profile people. Michael Mansfield QC has publicly endorsed it, although he has backed off from providing legal representation in their claim for state pension at 60. And now the journalist David Hencke has written a blogpost about the campaign.The sole source of Hencke's information about the campaign appears to be this video, in which a number of women complain about the effect that not receiving state pension at 60 has had...

Read More »Trade and currency, a Brexiter’s delusion

If there is one industry Brexit has stimulated, it is the production of daft ideas for regenerating the UK economy after its exit from the EU. Many of the offerings have been from people who really like the idea of Britain becoming a European version of Singapore. But the left wing is not short of silly schemes either. This one, from businessman and self-styled economist John Mills, is one of the silliest I have seen.John Mills is chairman of John Mills Limited (JML). On his biography,...

Read More »Productivity and Employment: A Cautionary Tale

Ah, productivity. Who knew that our whole prosperity was totally dependent on a concept as nebulous as this?To be sure, it doesn't sound nebulous. It is output per worker per hour. What is so difficult about that?The problem is how you define "output". Usually, we take this to mean GDP (gross domestic product), though we might use GNP (gross national product) or GVA (gross value added). In this post, I shall use GDP.As Diane Coyle has engagingly written, GDP is a deeply flawed measure....

Read More »The Amazing Conversion of Sir James Dyson

“Will you tell me how long you have loved him?” asks Jane Bennet, on receiving the astonishing news that her sister Elizabeth is to marry Darcy, the rich aristocrat she used to hate. “It has been coming on so gradually, that I hardly know when it began,” replies Elizabeth. “But I believe I must date it from my first seeing his beautiful grounds at Pemberley.” This is from the end of Jane Austen’s Pride and Prejudice. Austen is lampooning the British 19th century marriage market, in which...

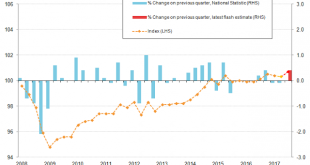

Read More »More on productivity

The ONS's latest flash productivity estimate is rather good. Productivity in Quarter 3 2017 was up by 0.9% on the previous quarter. Here's what ONS has to say about it: Output per hour growth in Quarter 3 2017 was the result of a 0.4% increase in gross value added (GVA) (using the preliminary gross domestic product (GDP) estimate) accompanied by a 0.5% fall in total hours worked (using the latest Labour Force Survey data). This fall in total hours was driven primarily by a 0.5% fall in...

Read More »Money creation in a post-crisis world

As many of you know, I have spent much of the last seven years explaining to anyone who will listen that banks do not "lend out" deposits or reserves. Rather, they create both loan assets and matching deposit liabilities "from nothing" by means of double entry accounting entries. Creating money with a stroke of the pen (or a few taps on a computer keyboard) is what banks do.But this does not mean that the money that banks create comes from nowhere. It doesn't. It is only created when they...

Read More »Beyond disappointment

I'm sitting in a coffee shop opposite Haymarket Station in Edinburgh. Just up the road, the Institute for New Economic Thinking (INET) is holding its conference. I'm supposed to be there, as I was yesterday and the day before. But I am not at all sure I want to go. The last two days have left a very bitter taste.This conference, grandly entitled "Reawakening", is supposed to be a showcase for the "new economic thinking" of INET's name. I hoped to hear new voices and exciting ideas. At...

Read More » Francis Coppola

Francis Coppola