http://www2.warwick.ac.uk/fac/soc/economics/research/centres/cage/

Read More »Libor and the Bank

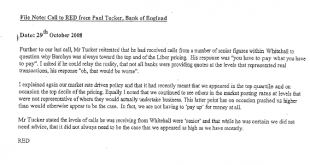

Nearly five years ago, the former CEO of Barclays Bank, Bob Diamond, defended himself against accusations that on his watch, Barclays had deliberately falsified Libor submissions. To no avail: after widespread adverse press coverage, Diamond resigned.Was this at the instigation of the Governor of the Bank of England and the head of the FSA? We will probably never know. But events yesterday make not only Diamond's resignation, but also the prosecution and jailing of traders and Libor...

Read More »A dangerous Eden

I have been going to the gym. Seriously. For about a couple of months now. I'm doing weight training for the first time in my life, and cardio exercises, including - wonder of wonders - short bursts of running. I'm even paying for a personal trainer. It's a shocking extravagance, but I'm likely to find any excuse under the sun not to do my workouts unless I have someone telling me what to do and shouting at me if I don't do it. As one of my school reports said, "Frances does not enjoy...

Read More »Barnier and the Tantalus game

The EU has laid out its negotiating strategy for Brexit. Well, not officially yet, of course - the letter triggering Article 50 won't be delivered until tomorrow, 29th March. But as is its wont, it has made its intentions clear in the press.In an op-ed in the FT, Michel Barnier, the EU's chief negotiator, has stated in no uncertain terms how he expects the negotiations to proceed. He identifies three crucial issues that must be resolved before there can be any discussion of future trading...

Read More »Frances Coppola on endogenous money.

Frances Coppola on endogenous money. Source: https://youtu.be/g-9CggGqong

Read More »Frances Coppola on endogenous money.

Frances Coppola on endogenous money. Source: https://youtu.be/g-9CggGqong

Read More »Of cars and tariffs, and Brexit fantasies

"The Germans won't want tariffs on their car exports to the UK", said my father the other day.I have to agree. No-one likes tariffs, especially when they are used to having none. But it was his next comment that made me pause. My father's idea is that the EU will allow the UK to have tariff-free access to the EU's markets after Brexit in order to placate the powerful German car manufacturing lobby. He's not alone in this view: it has been repeatedly stated by Brexit promoters, both during...

Read More »Game theory in Brexitland

"No deal for Britain is better than a bad deal", says Theresa May. Her Brexit sidekick David Davis appeals to MPs not to "tie her hands". And that master of flannel, trade secretary Liam Fox, says that leaving without a deal would be "not just bad for the UK, it's bad for Europe as a whole".These three statements sum up the hopes of the Brexiteers. The idea seems to be that if the UK adopts a really strong stance in its forthcoming negotiations with the EU, the Europeans will be so...

Read More »Adam Smith’s Destructive Hand

Adam Smith's "invisible hand" is perhaps one of the most misunderstood concepts in economics. It is usually interpreted to mean that when individuals all operate according to their own self-interest, their actions somehow combine to create a well-ordered, well-functioning society "as if guided by an invisible hand".To be fair, this statement about the "invisible hand" (from the Wealth of Nations) does seem to mean exactly that: [The rich] consume little more than the poor, and in spite of...

Read More »UK inflation and the oil price

Inflation is back.Here is the change in the consumer price index (CPI) for January 2017, according to ONS: Well, this doesn't look too serious. CPI is barely reaching the Bank of England's target of 2%. It has been much higher for most of the last decade, and yet the Bank of England has kept interest rates at historic lows.But consumer price inflation - the prices that people pay for goods in the shops - is only one side of the equation. On the other side is producer price inflation (PPI),...

Read More » Francis Coppola

Francis Coppola