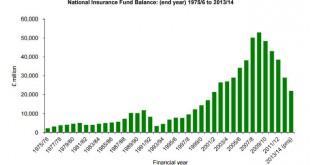

There is a great deal of confusion over National Insurance - what it is, how it works and what it funds. I have attempted to clear up some of the muddle elsewhere. But partly, it stems from the existence of something called the NI Fund. If there is a Fund, surely this implies that National Insurance contributions are invested? If so, those (like me) who insist that state pensions are unfunded are talking gibberish.There is indeed a NI Fund. But it is badly named. It would be more accurate to...

Read More »The building society broken by its own accountants

The Manchester Building Society is sinking. It has reported a post-tax loss of £4.9m and a fall in reserves of £5.4m. This is not a one-off disaster due to an external shock. No, these results are symptomatic of a deep underlying malaise. The Manchester is in terminal decline, broken not by the financial crisis, nor by regulators, but by its own accountants.The Manchester's problems started in 2012, when it discovered that its accounting violated IAS 39 (IFRS 9) hedge accounting rules. For...

Read More »Germany’s negative-rates trap

Germany's Finance Minister Wolfgang Schaueble has long been critical of ECB monetary policy,. But now, as Reuters says, the gloves are off. In a speech at a prizegiving for an ordoliberal economics foundation last Friday, Dr. Schaeuble demanded that the ECB raise interest rates.The justification? Very low interest rates hurt Germany's savers, which are the bedrock of its economy.There is a political dimension to this. Dr. Schaueble's party, the CDU, is losing popularity and desperate for...

Read More »The illusion of value

I have been looking through my diary for the next couple of months. It is pretty crowded. Meetings, lectures, conferences, TV and radio appearances.....it is almost 7 days a week. It's nice to be busy, isn't it?But as I look at this ridiculous schedule, I wonder why, if I am so busy, I am so broke. When I say "broke", I mean that I do not currently have enough money to pay my mortgage this month. I am hoping that those who owe me money for work I have already done (some of it dating back to...

Read More »Bond yields and helicopters

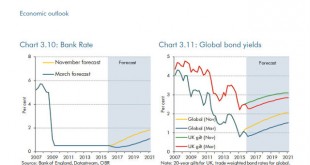

The ever-optimistic OBR has some encouraging forecasts for interest rates and global government bond yields: Well, ok, they were rather more encouraging in November than they are now. The uplift was supposed to start ANY DAY NOW, but there has been an interruption to normal service. Leaves on the line, perhaps. Or the wrong sort of snow.The trouble is, the OBR has a long record of hockey-stick forecasting. Not that it is unique in having a noticeable bias to the upside: If ever there were...

Read More »A plan to turn the Euro from zero to hero

Guest post by Ari Andricopoulos It is difficult to read the history of inter-war Europe and the US without feeling a deep sense of foreboding about the future of the Eurozone. What is the Eurozone if not a new gold standard, lacking even the flexibility to readjust the peg? For the war reparations demanded at Versailles, or the war debts owed by France and the UK to the US, we see the huge debts owed by the South of Europe to the North, particularly Germany. The growth model of the...

Read More »The unaffordable George

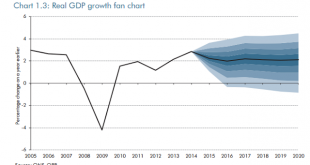

On March 16th, George Osborne unveiled his shiny new Budget. Full of populist tax giveaways to help "hard working people", it was the sort of budget that we might expect from a Chancellor riding the crest of an economic recovery. UK plc is growing well, profits are rising and the Board can afford to increase the dividend.But this is not the current economic situation. Far from an economic recovery gathering pace, the latest figures from the OBR show that UK plc is slowing. In its March 2016...

Read More »Understanding balance of payments crises in a fiat currency system

It's weird. Whenever I say that floating exchange rates can't absorb all shocks and that balance of payments crises can happen even in fiat currency systems, I am accused of gold standard thinking. Gold standard? Me? Perish the thought. I am the world's biggest fan of fiat currencies. And of floating exchange rates, too. But that doesn't mean I regard them as a panacea.Firstly, about gold standards. Under a strict gold standard, the quantity of money circulating in the economy is...

Read More »A German spring

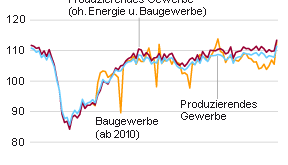

The sun is shining, the daffodils are flowering. Blossom is on the trees. The dark days of winter are behind us: in front of us lies a bright, glowing spring. Black zeros reap golden rewards, it seems.What is all this about? German industrial production has suddenly bounced back from recent falls, rising by 3.3% month-on-month in January 2016. The German statistical agency DEStatis reports that there are particularly strong performances in construction, capital and consumer goods production:...

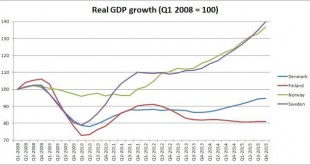

Read More »The Great Scandinavian Divergence

From @MineforNothing on Twitter comes this chart: Now, we know Finland is in a bit of a mess. A series of nasty supply-side shocks has devastated the economy. When Nokia collapsed in the wake of the 2007-8 financial crisis, ripping a huge hole in the country's GDP, the government responded with substantial fiscal support. This wrecked its formerly virtuous fiscal position: it switched from a 6% budget surplus to a 4% deficit in one year, and although its deficit has improved slightly since,...

Read More » Francis Coppola

Francis Coppola