There’s a growing narrative that states should be allowed to default if they can’t fund their spending needs during the pandemic. Let me be very clear about this: THIS IS AN INSANELY DANGEROUS PROPOSAL Get the message? Let me explain. During the Euro crisis I explained the important difference between the European Monetary Union (EMU) and the USA. The Euro had a series of rolling crises coming out of the financial crisis and they experienced depression-like growth in many countries....

Read More »What Does The Fed Actually Do?

On today's episode Michael talks with Cullen Roche about what the federal reserve actually does, what their critics get right, and how their actions today compare with what they did during the Great Financial Crisis. Follow Cullen on Twitter: https://twitter.com/cullenroche Be sure to subscribe to our channel so you never miss an update: https://www.youtube.com/thecompoundrwm?sub_confirmation=1 Beginning Investors, check out Liftoff: http://liftoffinvest.com Follow us on Twitter:...

Read More »What Does The Fed Actually Do?

On today's episode Michael talks with Cullen Roche about what the federal reserve actually does, what their critics get right, and how their actions today compare with what they did during the Great Financial Crisis. Follow Cullen on Twitter: https://twitter.com/cullenroche Be sure to subscribe to our channel so you never miss an update: https://www.youtube.com/thecompoundrwm?sub_confirmation=1 Beginning Investors, check out Liftoff: http://liftoffinvest.com Follow us on Twitter:...

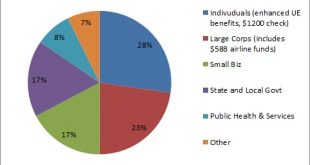

Read More »Understanding the COVID-19 Aid Package

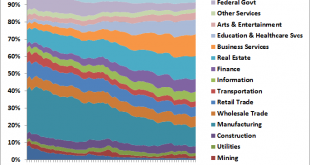

I was watching CNN the other day when a commentator, discussing the government aid package, said that individuals were only getting $1,200 checks and the rest of the money was going to “big business”. This seems to be an increasingly popular narrative and the confusion over the aid package seems widespread. The new COVID programs are much more targeted towards Main Street than the media has been reporting. I was vehemently against the bank bailouts in 2008 and thought that they didn’t help...

Read More »Three Things I Think I Think – (Mo Ron)a

Here are some things I think I am thinking about: 1) What’s up with the stock market? There was widespread outrage that the stock market didn’t go all the way to zero in the last few weeks. This image from Mad Money seemed to symbolize the outrage well: The global stock market is down 20% over the last 5 weeks. It was down 35% at one point. But then things started to look a little better on the virus front. And so the stock market recovered a little, but is still pricing in a pretty bad...

Read More »Fed Truthers Are Wrong (Again)

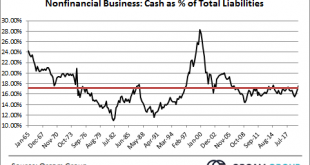

Fed Truthers spent much of the last 10 years screaming about hyperinflation. When that turned out to be wrong they pivoted and claimed the “inflation” was all in asset prices. That was also wildly misleading and based on the same underlying fundamental misunderstandings that led them to believe in the hyperinflation narrative. Unfortunately, now that a pandemic has hit the global economy they’re using the same set of misleading narratives to argue against any sort of Fed intervention in...

Read More »This Isn’t the Next Great Depression

In my recent research note on COVID I noted two potential scenarios: Short and painful. Basically, 6 months of lockdown with a modestly fast recovery (~15 months). Short-ish and painful. Basically, 12-18 months of lockdown with devastating economic pain and a much slower recovery (24+ months).¹ Case 1 happens if social distancing is working, herd immunity is building, treatments are improving, warm weather helps and we can stave off the virus long enough for a vaccine to be developed...

Read More »Pragmatic Thinking on COVID-19 – The Podcast

I joined Taylor Schulte from Define Financial to discuss the potential impact of COVID-19. We covered: The recent research paper I published. Two potential scenarios for COVID-19. Why this recession is more like a natural disaster than a standard business cycle recession. The temporal dislocation between the economy and financial markets that makes this environment difficult to navigate. What makes the government unique in times of crisis and how it creates money. I hope you enjoy it! ...

Read More »Pragmatic Thinking On…COVID-19

Given the severity of recent events I want to start writing more broadly and providing more in-depth research pieces. I’ll be starting to publish long form letters on topics of interest. The series will be called “Pragmatic Thinking On…” This will hopefully provide more detail than the blog posts and provide readers with more in-depth understandings of the topics I write about. You can find the new letters on the front of the Orcam website under “Letters From Our Founder.” I hope you...

Read More »What Do you Do When the Shit Hits the Fan?

Full blown panic has set in. And no one knows when it will end. The uncertainty is like a daily replay of the worst moments of the financial crisis. Except on warp speed. A global pandemic is the type of event that you expect to see in movies, not in reality. And there’s no precedent for how to navigate such an acute and fast economic/market downturn. So, we’re in uncharted territory. What can we do now? Match Your Liabilities Good asset management is about asset liability mismatch. What I...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism