One of the key aspects of the crypto boom that keeps bothering me is the inherent conflict between centralized entities and decentralized entities.¹ For instance, let’s think about Bitcoin. Bitcoin is a supposedly useful form of money because it’s decentralized and no one can manipulate it. Then again, I’ve argued that Bitcoin’s biggest weakness is its decentralized nature because: It cannot act as a stable form of money (because money that settles at par does so because a trustworthy...

Read More »Please Millennials, No Do Not Save in Bitcoin

Alright Millennials, listen up – I am older than you and that means I am smarter than you so take a few minutes and soak up this old man’s knowledge bomb or I will put you into a choke hold and noogie you until you scream mercy.¹ Here’s an article by a millennial telling other millennials to “save” in Bitcoin. It’s an intriguing bit of advice that can be boiled down to this: Fiat money is bad and is designed to hurt your purchasing power.² Stocks, bonds and real estate are all super...

Read More »Waiting for The Market to Boom is a Terrible Strategy

Sam Lee wrote a very awesome piece last year titled “Waiting for the Market to Crash is a Terrible Strategy“. The basic gist of the post was that you shouldn’t wait around for market crashes trying to time when you will invest in the markets. That summary is a disservice to Sam’s thoughtful post so go give it a full read. As the stock market booms and Donald Trump touts the market’s record highs every day there is a palpable feeling of missing out. Many people are now jumping in and...

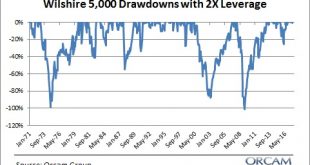

Read More »Why I Hate Leveraged ETFs

Here’s a new filing for leveraged Bitcoin ETFs: Boom–> NYSE files to list leveraged Bitcoin ETFs, many flavors incl 2x and -2x, here’s full list, h/t @fintechfrank pic.twitter.com/XGiX1mzq0O — Eric Balchunas (@EricBalchunas) January 6, 2018 Yikes. Now, some people might be inclined to say “who cares, if people want to gamble and buy crazy speculative assets then so be it!” I understand that mentality, but I loathe so much of what I see on the product development side of ETF products....

Read More »Let the Paramedics Sort Them Out

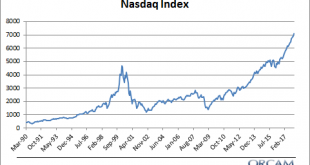

So, Bitcoin is soaring and very few people understand how this will all end and whether these cryptocurrencies will even be viable economic variables. We’re in that early part of a mania when there is a very serious risk that the price of the asset is disconnected from its actual utility. I call this a price compression. Basically, it means that investors price-in lots of future cash flows into the present and this creates a serious behavioral risk in the asset in the case that those cash...

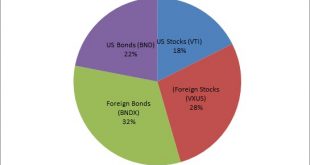

Read More »The 2018 Global Financial Asset Portfolio

The Global Financial Asset Portfolio¹ is a simple approximation of the world’s current financial asset allocation. It is, in my opinion, the logical starting point for anyone trying to build a diversified portfolio because it is the closest reflection of “the market portfolio”. In other words, if you were a true adherent of the Efficient Market Hypothesis this portfolio would be a good reflection of the current market capitalization of the world’s financial assets. One of the nice things...

Read More »The Best of Pragcap in 2017

2017 was another year of learning and trying to spread that education to the readers here. I am so grateful for all the people who find the content here useful and provide feedback. With all the amazing sources of financial content out there I know most of you don’t have the time to keep up with everything I write so if I had to narrow this year’s content down to just 5 posts these would be the ones: The Biggest Myths in Investing – This was actually a series of 10 posts on big issues that...

Read More »My Favorite Financial Content of 2017

2017 was another year of incredible content distribution across an ever growing number of platforms. Here is a list of just a few of the things I enjoyed most. If you have an addition please use the forum to add your own content.

Read More »2017 Fixed Income Review – Bond Permabears Wrong Again

2017 is coming to a close and the largest, but least talked about market in the world had another outstanding year. Despite the never-ending predictions about rising rates and a bond bear market the bond market experienced another solid year of performance. Here are some performance figures for some of the more broadly held instruments: iShares Core US Aggregate Bond ETF (AGG) + 3.4% iShares Investment Grade Corp Bond ETF (LQD) +6.7% iShares 20+ Year Treasury Bond ETF (TLT) + 8.8% iShares...

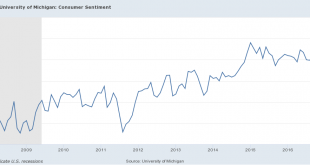

Read More »The State of the Trump Bubble

When all is said and done with the Trump Presidency I suspect we’ll remember the era as “The Trump Bubble”. As I outlined earlier this year and on election night last year, it just makes too much sense – big talking business man comes in and implements a bunch of business friendly policies all the while exaggerating the impacts and stoking a sense of (relatively) false positivity in the economy. Investors, already sitting on a massive 8 year bull market soak it all in, bid up prices more,...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism