Successful investing is often more so about how to avoid bad ideas than it is about finding the right ideas.¹ In the last year there has been no place worse to be than cryptocurrencies with most of them down 85%+. Despite this I still see lots of optimists pushing cryptos based on narratives that are fundamentally wrong. For instance, here’s one I see all the time: “Governments are big bad terrible entities that will print money and ruin society and we can create a better form of...

Read More »3 Reasons to Hold Long Bonds as Short Rates Rise

As short rates rise the tendency for novice bond investors is to believe that the short end of the curve suddenly makes it irrational to hold any long-term bonds. While it’s true that the risk/reward of short-term bonds improves in this environment it doesn’t mean that long bonds serve no purpose in diversifying a portfolio. Here’s a very good video from Cathy Jones, Schwab’s Chief Fixed Income Strategist outlining three reasons why you shouldn’t abandon long-term bonds as short rates...

Read More »John Bogle is Wrong About Index Funds

It takes an unusually stupid person to disagree with John Bogle so I’m happy to announce that you’re reading that unusually stupid person. I’ve disagreed with Bogle on numerous occasions in recent years: 1) No, ETF’s aren’t dangerous. 2) There’s no such thing as passive investing. 3) Home bias is bad. So, I’m back for more. This time, Bogle says concentration in index fund assets is bad. Specifically: “Most observers expect that the share of corporate ownership by index funds will continue...

Read More »The Economics of Le’Veon Bell’s Gamble

The Le’Veon Bell drama has created some financial excitement in the NFL. For those who aren’t familiar with this situation, here’s the short version: Bell, who plays for the Pittsburgh Steelers, is one of the NFL’s top running backs (arguably, THE top RB). Bell was given a franchise tag in 2017 and then again in 2018. The franchise tag is a contract that the team can give to one player on their team that gives them exclusive rights to that player for one season. This guarantees their...

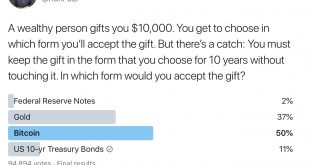

Read More »Pop Quiz, Hotshot

Okay, so you all know I am all about operational reality. And although the financial markets and the economy aren’t exactly like the physical world there are certain operational and fundamental aspects to it all. So, I was intrigued by this Tweet by Ron Paul and the lop-sided responses: Okay, so Ron Paul has a certain type of follower, but let’s go through this because it’s good practice. Federal Reserve Notes – Good ‘ol cash. Nothing gives you greater optionality. Heck, you can even buy...

Read More »Three Things I Think I Think – What In the Hell is Going On Out There?

Here are some things I think I am thinking about. 1) Has Mr. Market Finally Lost His Mind? It seems that everyone is losing their mind over politics so I’ve been rather amazed that the financial market has held it together this long. That changed a bit in October as the MSCI All World Stock Index took a 12% dive. Now, what’s interesting about the stock market downturn is that the wheels have been in motion here for almost all of 2018. The MSCI All World Index, the only true measure of “the...

Read More »The Pragmatic Voting Guide for the 2018 Mid-Terms

Many people think that the purpose of a Constitutional Republic was to protect against the tyranny of the government, but the founders of the United States also wanted to construct a system that protected against the tyranny of the majority. The USA is not a pure Democracy because the founders believed Democracy and mob rule could be just as dangerous as tyrannical rule. It’s kind of brilliant when you think about it. The problem is, we seem to be getting increasingly polarized and our...

Read More »No, The Government Didn’t Cause Unemployment

There was a big blogosphere kerfuffle in the last few weeks between some Modern Monetary Theory (MMT) people and a bunch of economics and finance people I greatly respect (Simon Wren-Lewis, Jo Michell, Steve Keen, Frances Coppola, etc). MMT was, at times, pushing an extremist and combative narrative that I found deeply misleading so I wanted to discuss this a bit as it appears that some people are being misinformed while reputable economists and finance people are being unnecessarily...

Read More »Why Does the Stock Market Rise and Fall?

Whenever the market falls people wonder why it’s happening. There are always lots of creative stories and they’re probably right to some degree, but the reality is that the stock market is like a mutating organism whose changing mutations have ever changing causes. We don’t really know what causes it to change each time and we can’t necessarily use past understandings to predict future changes. Still, we make up these narratives because they give us the illusion of control in an otherwise...

Read More »Funding in an Endogenous Money System (Nerdy)

(I come across this topic quite a bit and I think it’s hard for some people to understand so I am going to get a little nerdy here and see if I can clarify how financial instruments are created and used in the process of “funding” the economy’s needs). Endogenous money is an essential understanding for anyone who wants to better comprehend how the monetary system works. Okay, okay. Let me step back a second. First, what is endogenous money? Endogenous money refers to money that grows from...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism