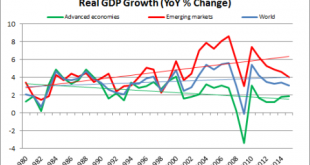

Share the post "Is Secular Stagnation Really a Thing?"Did you know that world growth rates have actually picked up since 1980? Did you know that emerging market growth rates have averaged 4.5% since 1980? You might not know it from the media’s coverage of “secular stagnation”, but global growth isn’t slowing. Secular stagnation is only a thing in the advanced economies of the world where growth has slowed. As you can see in the following chart the trend-line growth for global real GDP has...

Read More »The Three Types of Financial Forecasters

Share the post "The Three Types of Financial Forecasters"I just finished reading an excellent book called “Superforecasting: The Art and Science of Prediction” by Philip Tetlock and Dan Gardner. The authors do a wonderful job of putting our reality in the proper perspective and then helping us understand that reality so we can process potential future outcomes in a manner that will have high probability outcomes. The opening line of of the book is “We are all forecasters”. In essence,...

Read More »Macro Minute – 3 Market Thoughts

Share the post "Macro Minute – 3 Market Thoughts"After approaching all-time highs just a few weeks ago the US markets suddenly seem to be in turmoil. Maybe not a proper “Markets in Turmoil” situation, but the fear appears palpable again. Here are some random thoughts that may or may not help you navigate some of the craziness:1 – Brexit Won’t Alter the Valuation of Corporations in the Long-Term. The term Brexit is the new buzz word surrounding the market’s recent declines. This is in...

Read More »Life – The Ultimate Intertemporal Conundrum

Share the post "Life – The Ultimate Intertemporal Conundrum"This was a tough week for the human race. Between the Orlando mass shooting(s), the murder of a British lawmaker and all the usual murders (that don’t get so much attention, but are equally important) we didn’t do very well. It was all compounded for me as two people very close to me died of Cancer.Death has always been hard for me to grapple with. When I was a child it terrified me. When I was a teenager it confused me. When I was...

Read More »Winning by Playing Small Ball

Share the post "Winning by Playing Small Ball"Ichiro Suzuki is about to break Pete Rose’s all-time hits record of 4,256.¹ To understand how incredible this record is, just think that Derek Jeter is the only player in the last 20 years to come close to approaching the record. And he finished almost 800 hits shy!The admirable thing about Ichiro is his ability to play the small game. Ichiro has been known to have tremendous power. People often flock to the ballpark early to see him crush home...

Read More »John Oliver: Warning Signs of a Bad Financial Advisor

Share the post "John Oliver: Warning Signs of a Bad Financial Advisor"John Oliver had a wonderful segment last night about the deceptive and damaging practices of some financial advisors and financial firms. I’ve spent much of my career with a front row seat at this table having started in the insurance business, then moving on to the largest stock brokerage firm, managing a small private partnership and finally starting a low fee advisory and asset management firm. You could say that my...

Read More »Beware of Guru Worship

Share the post "Beware of Guru Worship"Here’s an article in the Wall Street Journal citing how bearish George Soros is. Which is strange because I feel like I’ve read that somewhere. Many times. Over many years. So I went into the Google time machine and found that this article has been written in varying forms multiple times over the last 3+ years. Here’s one from 2013, from 2014, from 2015, from January 2016 near the market lows and then again yesterday. Yes, I read way too much financial...

Read More »Successful Investing Requires a North Star

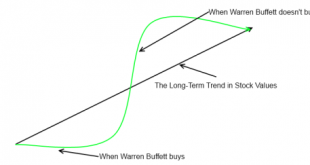

Share the post "Successful Investing Requires a North Star"The best investors in the world all have one thing in common – they have a well defined plan that they stick with through thick and thin. This plan serves as a north star regardless of where they are along the investment journey. For instance, a great value investor like Warren Buffett thinks that long-term trends will produce positive outcomes for corporate America as a whole.¹ But stock prices don’t follow long-term trends. They...

Read More »11 Signs You Own the Right Portfolio – The Annotated Version

Share the post "11 Signs You Own the Right Portfolio – The Annotated Version"This post by Jonathan Clements was so good that I thought it deserved some more detail:1. You’re so well diversified that you always own at least one disappointing investment.CR: Being well diversified means hating some part of your portfolio. This is the key building block and lesson from Modern Portfolio Theory. In essence, we want to have lots of uncorrelated assets that, by having different degrees of variance,...

Read More »The Downside of Academic Finance

Share the post "The Downside of Academic Finance" Max Planck once said that science advances one funeral at a time. In the fields of finance and economics it seems like we progress one plague at a time. That is, it usually takes decades worth of testing and evidence to prove that something really doesn’t work in the monetary world. So you can have really bad ideas that persist for no good reason other than the fact that we can’t disprove them. I got to thinking about this as I was reading...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism