The Fed left interest rates unchanged at 0-0.25%. Here’s the key part of the statement: Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term. Nonetheless, the Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual...

Read More »Three Things I Think I Think – Stupid Markets Edition

Here are some things I Think I am thinking about: 1. The fact that markets are hard to “beat” does not make them smart. I noticed this comment on a recent Scott Sumner post claiming that markets must be smart because they make it difficult to become wealthy. He says: Markets are just amazingly wise. But that shouldn’t be surprising, because they must be smarter than us in order to make it tough to get rich. I see this a lot in academic circles. People often say the Efficient Market...

Read More »Nowhere to Hide…

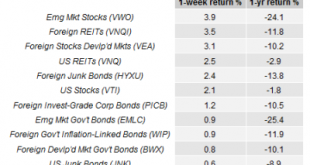

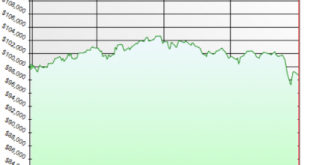

How weird has 2015 been so far? This weird – every major asset class is negative on a one year basis (via Capital Spectator): I don’t have the exact data, but I would venture to guess that this just about never happens. Heck, even a long-term bond is barely positive on a 1 year basis. If you had told me that China might be falling apart in 2015, emerging markets were falling 25%+ and we’d have a flash crash I’d have guessed that long-term bonds were up 10%+ in that period. But no, even...

Read More »Are We on the Precipice of Another 2008?

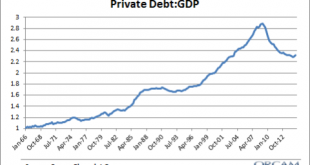

When it comes to the recent market turmoil people are quick to make two comparisons – 1998 or 2008. Both were “crisis” type events that led to big stock market declines and substantial economic turmoil, but 2008 was far more traumatic. There are some important distinctions between the two environments so let’s look at the macro picture and see if we can’t better understand where we are and where we might be headed. I should start by pointing out that the only reason this website even...

Read More »Learning to Love Tax Cuts

Paul Krugman really hates tax cuts which is something that I find pretty weird for a Keynesian. Here’s his latest post showing that the 2013 Obama tax hike coincided with more private sector job creation than the 2003 Bush tax cut. He concludes that this “didn’t work” for Bush and that Jeb isn’t learning from big bro’s mistakes with his latest tax plan. I don’t see the correlation though. There is obviously a lot more to the economy than tax policy. And in 2003 we had a deficit that was...

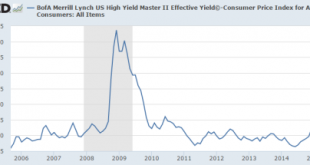

Read More »Have Savers Been “Punished” in the Low Interest Rate Environment?

There’s usually two forms of ideological rhetoric that accompany low interest rates. The first is that the Fed has “manipulated” interest rates lower. And the second is that the Fed is “punishing savers”. Let’s take a look at each of these ideas because I find them misleading at best and hypocritical at worst. The first misunderstanding has to do with Fed policy and its setting of interest rates. We should be very clear about the Fed’s role in the overnight market where they set interest...

Read More »Are Low Yielding Bonds Still a Good Stock Market Hedge?

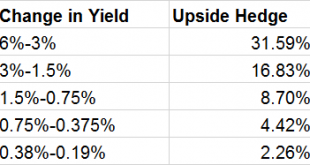

One thing that’s stood out during the most recent stock market turmoil is that bonds aren’t performing all that well either. US Treasury Bonds are up just 3.5% since stocks peaked and the aggregate bond index is up less than 1%. The concern here is that ultra low yielding bonds can’t decline sustainably below 0% and are therefore unlikely to provide much downside protection in the future whereas environments like the 2008 financial crisis and before offered investors far more protection...

Read More »There is no Defensible Argument for Raising Rates at Present

I am a little stunned by the Fed’s insistence on leaving a rate hike on the table in September. What is the purpose of this? Worse, I have yet to hear a strong argument justifying this view. So far the “logic” appears to amount to “we’ve been at 0% for too long”, “the Fed wants to raise rates so they can lower them later”, “we need to fend off financial instability” or “we just need to get that first hike out of the way”. These arguments display a total lack of risk/reward analysis....

Read More »Three Things I Think I Think – Crashing Up & Down Edition

Here are some things I think I am thinking about recently: 1) What a boring year! The Global Financial Asset Portfolio is down about 1.2% year to date. This might come as a shock to people who are glued to financial TV all day and think of the “market” as the stock market. Yes, some stock markets are down quite a bit, but the aggregate “markets” really haven’t budged much. And this goes to show how damaging it can be to constantly be obsessing over the daily moves of your investments....

Read More »There Are no Holy Grails

When the markets get volatile many strategies will start performing poorly. Even your most basic diversified low fee indexing strategy will start to look weak even though it likely beats most professional fund managers. And when these strategies start to weaken many investors will start getting impatient. You probably know that nothing works 100% of the time, but that still doesn’t stop the allure of the green grass elsewhere. I know, the gold strategy looks so good in the short-run. That...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism