Share the post "QE: “Printing Money” To Tax Your Own Citizens" The Federal Reserve reported a massive $97.7B in net income for the year 2015 thanks primarily to the income the Fed earned on its asset holdings via QE. And while the media will likely report this as a windfall profit the reality is that this is a huge drag on the aggregate economy. You see, the Fed doesn’t retain these profits and spend them back into the real economy like most corporations do. Instead, the US Treasury...

Read More »2008 Has Already Happened in the Energy Sector

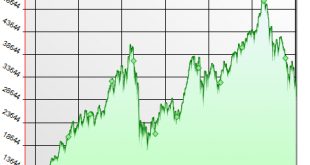

Share the post "2008 Has Already Happened in the Energy Sector" We’re approaching a level of truly horrific returns in the energy space as the price of oil continues to crumble in the early days of 2016. There are quite a few people predicting a repeat of 2008, but the reality is that the energy space has already experienced its 2008. To put things in perspective, here’s a chart of the energy sector’s performance over the course of the last two booms and busts. During the 2003-2008 bull...

Read More »Powerball Fever!

Share the post "Powerball Fever!" Tonight’s Powerball is expected to total $900MM. But you won’t really get $900MM. Most winners choose the lump sum payout option which, in this case, will amount to $558MM. This is probably the smart move for a savvy saver in a low interest rate environment who will wisely allocate the cash in a diversified portfolio expecting to beat the rate of return that the winner would otherwise earn with the 30 year annuity option. But since most winners aren’t...

Read More »There’s Nothing “Natural” About the Economy and the Financial Markets

Share the post "There’s Nothing “Natural” About the Economy and the Financial Markets" At the most basic level, the entire economy and financial system is highly unnatural. It is entirely made up out of thin air. Stocks, bonds, cash, money – all of it is just a figment of the human imagination conjured up from nothing to try to reflect the state of what is. In some ways the financial system and the monetary system is real as it reflects things in the real world that we transfer from one...

Read More »Three Things I Think I Think – Lose Money With Friends Edition

Share the post "Three Things I Think I Think – Lose Money With Friends Edition" Here are some things I think I am thinking about: 1) MARKETS IN TURMOIL! You just have to love the financial media. Every time there is a small hiccup in the global economy they latch onto it to drive up viewership. Fear is, by far, the most powerful emotion and the media has mastered the art of selling it. I suspect this is one reason why markets have become more volatile over the last 20 years. The 24 hour...

Read More »China, China, China….

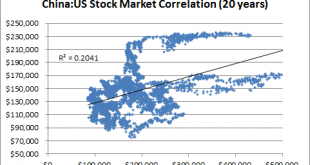

Share the post "China, China, China…." The year of China appears to have started. At least that’s what the headlines would have us all think. I feel like I can’t read anything in the financial news in 2016 without stumbling on how awful the Chinese stock market is. But let’s pan way out here and put things in perspective again because we’ve been through this movie already….just 6 months ago! Three things I am tired of: 1) China 2) China 3) China — Cullen Roche (@cullenroche) January 7,...

Read More »Why Hedge Funds Are Sucking Wind

Share the post "Why Hedge Funds Are Sucking Wind" The basic arithmetic of the financial markets is very simple. At the aggregate level there is just one portfolio of all outstanding financial assets. These financial assets generate “the market” return. This means that the holders of these financial assets must, by definition, generate the post-tax and post-fee return. That is, the aggregate of investors will generate the top line return from all outstanding financial assets MINUS any taxes...

Read More »10 Useless Predictions for 2016

Share the post "10 Useless Predictions for 2016" I’ve discussed in detail why annual predictions are relatively useless. In short, a 12 month period is too brief to establish a reliable data set for market predictions. There is simply too much noise inside of this time frame for us to establish high probability predictions. But hey, let’s not rain on the parade here. And yes, there will be a parade of these predictions….I am not going to disappoint you by not contributing to this slew...

Read More »Shorting The Big Short

Share the post "Shorting The Big Short" The Big Short is getting rave reviews from both critics and audiences. While I enjoyed the movie I did feel as though it played up to two very powerful biases that overshadowed the quality of the film making. Specifically, the movie played up survivorship and political bias. As a result I came away from the film thinking that it gave the viewer what the viewer thinks they want to hear as opposed to the truth about the financial crisis....

Read More »The Best Econ and Finance Research of 2015

Share the post "The Best Econ and Finance Research of 2015" SSRN published their top 10 papers of 2015 and my paper Understanding the Modern Monetary System came in at #6. I’m incredibly humbled to be on a list like this where the names Fama, French, Asness and Faber are listed. Of course, many of these papers are old and so they end up on a list like this because they’re legacy papers that have stood the test of time. My paper was originally written in 2011 and has gone through a...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism