Share the post "Economic Bellweather CSX on the State of the Global Economy" I’m a big fan of following macro rail trends around the world so I am fortunate to be in touch on occasion with Executives at CSX, one of the world’s largest rail firms. I reached out to Frank Lonegro, CFO at CSX to ask him about his opinion on the US and global economy. He was kind enough to let me publish his thoughts: 1) How does CSX see current trends in the US rail industry and are these trends...

Read More »Why Do We Study Macro Finance and Econ?

Share the post "Why Do We Study Macro Finance and Econ?" The study of macro is about big things. Really big things. I can only speak from personal experience, but I don’t spend most of my time thinking about money, investing and economics (for fear of death by boredom, I hope you are the same). I spend most of my time thinking about really big things. Why are we here? What is our purpose? What is the meaning of this existence? These are big questions which require big answers. And...

Read More »Three Multi-Temporal Problems within Capitalism’s Victory

Share the post "Three Multi-Temporal Problems within Capitalism’s Victory" The biggest threat to capitalism is capitalists. After all, capitalists are monopolists. And monopolists are antithetical to broader prosperity because they give the monopolist an unfair pricing power over their consumers which often leads to social unrest. We need look no further than the recent case of Martin Shkreli to see how this plays out in real-life. Anyhow, I was reading through this very good report from...

Read More »Valeant and the Gambler’s Dilemma

Share the post "Valeant and the Gambler’s Dilemma" If you’ve been paying attention to the financial media in the last few weeks you’ve probably seen the drama surrounding a company named Valeant. In case you’ve been buried in your bunker waiting for China to blow up the global economy, here’s the short version – Valeant is a pharmaceutical company that has basically acquired its way to massive growth by gobbling up smaller firms, raising prices and restructuring. They’ve become a...

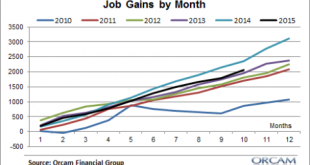

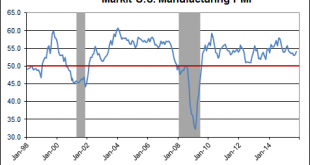

Read More »A Good Employment Report, but With Risks

Share the post "A Good Employment Report, but With Risks" Today’s Non-Farm Payrolls report was an overwhelming positive for the US economy. Total payrolls were up 271K with 268K coming from the private sector. There was considerable strength in professional and business services which is consistent with the recent strength we’ve seen in PMI Services data. The unemployment rate was down to 5% and revisions in past months did not play a significant factor. So, all in all, a pretty good...

Read More »Today in Scary Financial Media: “Apocalypse now”

Share the post "Today in Scary Financial Media: “Apocalypse now”" Here’s something to scare the pants off of you. According to what seems to be a daily article in the financial media about the next financial crisis, it’s “apocalypse now”. Go have a laugh or cry, I mean read. My thoughts: Yes, the next big crash is always right around the corner according to the financial media who is just dying to get your attention and page views however possible….They’ll be right eventually and it...

Read More »Private Sector Saving is Not Saving Net of Investment

Share the post "Private Sector Saving is Not Saving Net of Investment" I’m highly sympathetic to Post-Keynesian economic perspectives. Post Keynesians generally prefer to work from an operational perspective so there is a strong influence on how the economy works at an operational level which includes a fairly thorough understanding of stock flow consistent accounting. As I like to say, accounting is the language of economics so it’s pretty important to get the accounting right if you’re...

Read More »A Bull Market Built on Endless Financial Crisis Fears

Share the post "A Bull Market Built on Endless Financial Crisis Fears" The seven year bull market in stocks hasn’t been a story about how great things are. Let’s be honest – the economy is still pretty weak. But this bull market in stocks has been more about how wrong the bears have been. The thing is, stocks don’t rise just because the economy is getting better. They often rise just because the economy is getting better relative to expectations. And in the last few months a lot of...

Read More »Natural Nonsense – Why The Natural Rate of Interest is a Distraction

Share the post "Natural Nonsense – Why The Natural Rate of Interest is a Distraction" The “natural rate of interest” is a theoretical concept in economics that describes the interest rate at which the economy operates at full employment with stable inflation. If this price actually exists and economists can calculate it then that would be a pretty important number to know when implementing policy. Of course, it’s a totally vague concept to begin with because there isn’t just one interest...

Read More »Life Lessons From Doing a Full Ironman

Share the post "Life Lessons From Doing a Full Ironman" It’s been a week since I competed in Ironman Cabo and my body and mind are finally feeling back to normal. The Ironman is aptly named as it’s a 2.4 mile swim followed by a 112 mile bike and then a 26.2 mile run. It takes the best competitors in the world about 9 hours to complete while most people finish in 12-15 hours. It took me 16 hours thanks to my lack of endurance athleticism, a set of unfortunate race occurrences and what...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism