Here are some things I Think I am thinking about: 1. Hillary Clinton has a plan to stop the next crash. Here’s an op-ed over on Bloomberg View by Hillary Clinton about reforming Wall Street. It’s titled “My Plan to Prevent the Next Crash”. It’s basically a whole bunch of reforms that Hillary wants to slap on Wall Street. Some of it makes a lot of sense (like the part about ensuring that executives can’t leave an imploding firm with a golden parachute) and some of it is excessive (like...

Read More »Who Cares if Economics is a “Science”?

It’s silly season again. The Nobel Prize in economics is being announced in a few hours and we’re already seeing the uproar over the award. This annual tradition usually amounts to: Economics isn’t a science. The Nobel in Economics is fake. Let’s just stop with all the silliness here. There are Nobel prizes for peace and literature in addition to the hard sciences. I don’t see anyone in an uproar over how “scientific” they are. And while I love peace and literature, I don’t know think...

Read More »Do Markets and Economies Move in Cycles?

Someone emailed the other day asking for my opinion on theories of wave cycles such as Kondratiev cycles. There are numerous different versions of this idea utilized by various market pundits and investors including Robert Precher’s Elliot Wave Theory, Harry Dent’s long wave theories and Ray Dalio’s debt cycle theories. These theories usually assume three key characteristics: The economy and the markets exist in a state of disequilibrium as opposed to an equilibrium or an environment in...

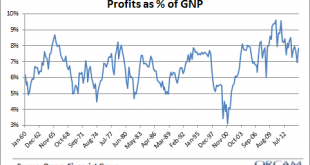

Read More »Why Are Corporate Profit Margins So High?

There’s a lot of scary chatter in the last few years about profit margins. The basic thinking usually goes something like this: “Profit margins are mean reverting and since profit margins are high then that means stocks are risky because they’ll crash when profit margins mean revert” This reminds me a lot of the scary “high valuation” discussions about Tobin’s Q and Shiller’s CAPE which usually go something like this: “Stock valuations are mean reverting and since stock valuations are...

Read More »What If Everyone Indexed?

I see this question more and more as indexing grows in popularity. People generally think that more indexing will make the markets function less efficiently . I don’t think this is true at all. Unfortunately, the question and its answers are usually shrouded in misunderstandings about how assets are priced and myths about what it means to invest “passively”. So, let’s think about this from an operational perspective. An index fund is not really an “index”. They are portfolios managed...

Read More »“Price is a Liar”

This is a very good lecture by John Burbank of Passport Capital. I particularly like his explanation of prices: “Price is all the information that exists in the market…it’s just what people think….price means nothing other than the equilibrium of liquidity…It doesn’t mean it’s good or bad, it’s just where people agree.” That’s really clean thinking. And it’s very different from something like the efficient market hypothesis which says that all available information is reflected in...

Read More »Thinking About Net Financial Assets (Nerdy)

Steve Waldman has a very good post over on his site about the concept of “net financial assets” and the way it is used by some economists (mainly MMT economists). Several of us covered this in excruciating detail several years ago when we had our big disagreements with the MMT people, but it’s always worth going over again because it’s an important concept in financial accounting. For those who aren’t familiar, “net financial assets” refers to private sector assets issued by the public...

Read More »So Long, Rate Hikes!

The emerging market turmoil that developed this year was a total game changer for Fed policy. Even though the US economy looked relatively strong (I’d argue it has been muddling through all along) the argument in favor of rate hikes shifted once the foreign economy started to falter. Especially when we started hearing about how much turmoil the rising dollar was causing in commodity markets and economies that had borrowed in dollar denominated instruments. The risk of raising rates in...

Read More »Three Things I Think I Think: Trumponomics Edition

Here are some things I think I am thinking about: 1) Trumponomics – a bi-partisan dream come true? Donald Trump has only just started to offer details on his economic plan and I have to admit that I am intrigued. He’s essentially calling for across the board income tax cuts, closing the carried interest loophole, taxing importers and boosting spending on infrastructure and the military. There haven’t been a lot of details here, but so far it sounds like the spending cuts would be wildly...

Read More »How Long Can You Stick With Failing Factor Investing?

Someone asked me the other day why I reject factor investing. My answer was simple. I said that factor investing is usually just a good marketing pitch to charge higher fees for something that will give you most of the correlation of a market cap weighted portfolio. For the uninitiated, factor investing is one of the hot buzz words in portfolio construction these days. Researchers found that “risk” doesn’t properly describe what drives returns over the long-term and several other factors...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism