Recency bias is a real sonofabitch. After someone goes through a traumatic experience they tend to be shocked into believing that the next big traumatic experience is right around the corner. But the reality is that outlier events are outlier events for a reason – they don’t happen nearly as often as we expect. For instance, I was in a car accident this past weekend. I was driving in one of these wonderful ride sharing programs when a car sideswiped us blowing through a stop sign. I was...

Read More »Did the Fed Cause the Commodity Bubble?

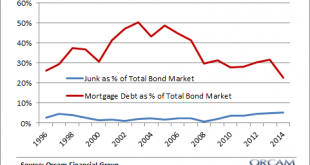

I spent an inordinate amount of time back in 2010 & 2011 talking about the potential for a commodity bubble that was Fed induced (see here, here and here). It’s now clear that the commodity collapse is rippling through many financial markets and it’s only a matter of time before the blame game starts here. I figured I’d go ahead and start pointing fingers before we even have a real crisis on our hands. The three big players in the commodity boom were clearly China, Wall Street and the...

Read More »The Cash is King Playbook

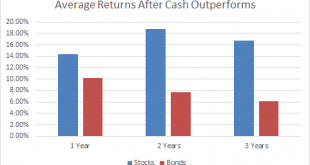

We’re seeing something really unusual in the financial markets this year. As I’ve noted recently, there’s almost nothing that’s working this year. No matter where you’ve diversified your savings you’ve likely lost money with the exception of cash. If we look at the two primary asset classes, stocks and bonds, cash has only outperformed both in the same year 10 times in the last 90 years. So this is a pretty unusual event. But there’s some potential good news on the horizon. When this...

Read More »Random Thing I Think I Think: Gambling, Investing, Luck & Skill Edition

Have you seen the commercials for fantasy sports gambling leagues like FanDuel or DraftKings? They’re everywhere. In case you’ve been in your bunker waiting for China to implode the global economy – these are basically ways of gambling on sports via the label “fantasy sports”. These firms are raking in huge amounts of money through a legal loophole that differentiates between sports gambling and gambling on fantasy sports based on the idea that fantasy sports involves “skill”. The wise...

Read More »Yellen Fears the Boom & not the Bust

Janet Yellen offered some more details behind her thinking on future Fed policy at a speech this evening. Here’s the key section: Given the highly uncertain nature of the outlook, one might ask: Why not hold off raising the federal funds rate until the economy has reached full employment and inflation is actually back at 2 percent? The difficulty with this strategy is that monetary policy affects real activity and inflation with a substantial lag. If the FOMC were to delay the start of the...

Read More »Three Things I Think I Think – Angry Old Guys and Low Risk Young People Edition

Here are some things I think I am thinking about: 1. Bill Gross is mad about short-term interest rates being so low. The latest monthly update from Bill Gross details the many reasons why the Fed is causing low returns and hurting the financial markets. I always find this view to be so strange. It’s as if some people think the Fed is some omnipotent entity steering the economy around at will. The reality is that the Fed is just one entity (yes, a powerful one) in a much bigger system and...

Read More »Are Fiscal and Monetary Policy Too Tight?

The common belief is that money is “easy” right now because interest rates are at 0% and QE^n has been in effect for 7 years. But there are many of us who have been arguing for years now that fiscal policy and/or monetary policy is too tight. That is, we actually haven’t done enough to get us back to full employment and the private sector has remained unusually fragile as a result. I know, I know. That sounds ludicrous. But it’s more logical than you might think. For instance, we know...

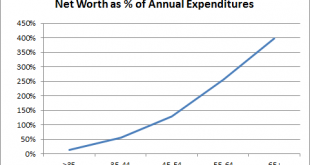

Read More »No, Young People Don’t Have a Higher Tolerance for Risk

2015 is introducing a lot of young people to the idea of a bear market. And article after article is telling us that the downturn is no problem and that young people absolutely shouldn’t sell. This thinking is based on the vastly oversimplified concept of long run returns. That is, the stock market tends to generate positive returns in the long-term so a young investor should always remain overweight stocks and remain aggressive. Then, as they get older their risk profile should change...

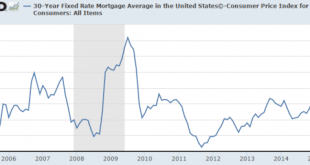

Read More »The Misguided Interest Rate Obsession

Prices are very important in economics and finance for obvious reasons. And in modern economic models the price that is always most important is the price of money also known as the interest rate. The discussion over this price has really flared up in the last few months as the debate about the Federal Reserve and raising rates has picked up momentum. But what if it’s all misguided? What if interest rates are the wrong policy tool to focus on? From an operational perspective the Federal...

Read More »Did The Fed Make a Mistake Leaving Rates Unchanged?

Today’s market declines have a lot of people wondering if the Fed didn’t make a mistake yesterday by leaving rates unchanged. Here are some good thoughts from a trader in Asia who I really respect. He says the Fed made a mistake yesterday with their policy decision and delivery: Their message was that some improvement in the US economy would elicit a hike. We got the improvement but they moved NAIRU and more tellingly emphasized the risks that are building in the emerging economies. ...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism