Johnny Harris is no friend of Putin, but this video is mainly non political and shows how and why Russia became so big. The original Russia had weak borders with no mountains or sea, and with one border being a grass flatland, it was under constant attack until it expanded outwards, and then outwards, and so on, not knowing when to stop. Most of the time they took over other countries peacefully, but not always.[embedded content]Johnny Harris - Why is Russia so DAMN BIG?

Read More »Only Fools and Horses – Rodney Pretends to be a Bad Boy to Impress His Date

[embedded content]Only Fools and Horses - Rodney Pretends to be a Bad Boy to Impress His Date

Read More »Record bank reserves will push bond yields down

Record bank reserves are like gravity pulling bond yields down.

Read More »Glenn Greenwald — Strengthening Substack Journalism With Video at Rumble: the Free Speech, Anti-YouTube Platform

Along with a group of heterodox writers, this move is designed to expand the reach of our journalism, support free speech platforms, and enable more reader interaction.…Alternative video venue. Glenn GreenwaldStrengthening Substack Journalism With Video at Rumble: the Free Speech, Anti-YouTube Platform

Read More »A Saigon moment looms in Kabul — Pepe Escobar

Backgrounder.The Vineyard of the SakerA Saigon moment looms in KabulPepe Escobar

Read More »Moon of Alabama — Afghanistan – This Is The End …

Vietnam redux. Same policy and strategy. Same result. Although b does not make the connection.Moon of AlabamaAfghanistan - This Is The End ...

Read More »PPP exchange rates are riddled with problems — Jayati Ghosh

In other words, current estimates of per workers productivity across countries are poor indicators of the reality, because the conceptualisation and empirical estimation of both numerator and denominator are riddled with problems. How do we solve this? It’s not clear what can be done within existing national accounts and statistical systems to make these problems go away: maybe the point is to search for a more reliable and valid indicator of human progress.... Real-World Economics Review...

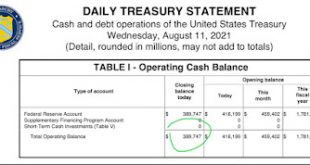

Read More »TGA $389b

Down to 300 handle in the TGA under debt ceiling… that was the previous low on March 23, 2020 before Mnooch proceeded to run TGA up by 1.5T over next few months creating a massive bank reserve reduction that sparked the moonshot recovery rally…

Read More »There’s no such thing as "monetizing the debt."

The "debt" is money. It's already monetized.

Read More »The Latest Front in China’s Campaign Against Big Tech? Entertainment. — Wang Shuaishuai

On August 2, state-run news agency Xinhua published two major reports on China’s “unhealthy” fan culture. The first detailed the powerful Cyberspace Administration of China’s recent crackdown on unruly fan groups, which has so far resulted in the removal or closure of 814 hashtags and more than 1,300 groups engaged in channeling traffic to celebrities. The second article covered new guidelines meant to push content platforms away from a reliance on online traffic — and the algorithms that...

Read More » Mike Norman Economics

Mike Norman Economics