For those in the New York City area, I'll give a talk at my alma mater on Modern Monetary Theory in the Tropics. Meaning really developing countries (including some in temperate areas).The seminar will take place on Tuesday, September 17, from 4 to 6 pm, at the New School campus close to Union Square (6E 16th St #1009). The department goal, I've been told, is to bring together graduate students and faculty, but, if tradition is worth something, others will be also welcome. About the New...

Read More »Larry Summers on the necessity of fiscal expansions

As noted before, Larry Summers argues that Post Keynesians and original Keynesians (arguably Keynes and those close to him) did not think in terms of imperfections. The op-ed version of the Tweets here. He says, on the topic of secular stagnation and the lower zero bound that: This formulation of the secular stagnation view is closely related to the economist Thomas Palley’s recent critique of “zero lower bound economics”: negative interest rates may not remedy Keynesian unemployment....

Read More »Economic Terrorism

My interview on the Argentinean crisis with Javier Lewkowicz from Página/12 is available here. In Spanish, though.

Read More »Larry Summers on Effective Demand

On of the issues between more mainstream Keynesians and their more heterodox counterparts is whether frictions are central for Keynesian results or not. Since the Neoclassical Synthesis the conventional view is that some rigidity or friction was behind the problems of unemployment, be that the liquidity trap (the Keynesian case with the flat LM, since Hicks 1937), the rigidity of wages (since Modigliani 1944), or some other coordination problem (mostly in the New Keynesian literature).In...

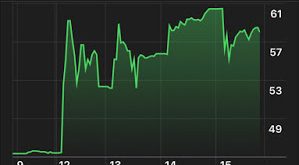

Read More »The inverted yield curve and the recession

The inverted yield curve, as it is well-known, indicates a forthcoming recession. I used it last year to suggest that the recession was not in the near horizon. The conventional explanation follows Wicksellian ideas (see this old post). In the Wicksellian story, one can think of the 10 year bond rate as a proxy for the natural rate of interest, and the Fed Funds for the monetary or banking rate. Hence, whenever the short-term rate (Fed Funds) is above the long-term one, it would be...

Read More »ICAPE call for papers

Geoff Schneider sent a reminder that the deadline (9/4) for the ICAPE call for papers, for the San Diego conference next January 5 and 6, is just a couple of weeks away. See details for submitting a paper, panel or workshop proposal. in the following link. The main topic is Policy, Politics and Pluralism: Pluralistic economics for the post-Trump era. As we approach the 2020 elections, it is an opportune time for heterodox economists to articulate their vision for modern economic...

Read More »Thirlwall’s law at 40

Table of contents of the next issue of the Review of Keynesian EconomicsThirlwall’s law at 40 Esteban Pérez Caldentey and Matías VernengoWhy Thirlwall’s law is not a tautology: more on the debate over the law J.S.L. McCombie Endogenous growth, capital accumulation and Thirlwall’s dynamics: the case of Latin America Ignacio Perrotini-Hernández and Juan Alberto Vázquez-MuñozThirlwall’s law and the terms of trade: a parsimonious extension of the balance-of-payments-constrained growth...

Read More »The return of populism or Argentina on the verge of collapse

The Argentinean primary elections, which are very peculiar and take place all at once with all parties, were last Sunday. The primaries made some sense when the Peronist party was all divided and that allowed the main candidate to proceed, but with the move of Cristina Kirchner to the vice-presidential spot next to Alberto Fernández, and the unification of a good part of Peronism (in particular Sergio Massa), the primaries become essentially an anticipated election. And Peronism won...

Read More »Class conflict, Economic Development and the Brazilian Crisis

Last summer readings The issue of class conflict and its relation to accumulation of capital was central for classical political economists of the surplus approach. That tradition has survived in political science mostly through the work of Marxist authors. And in many recent discussions of the Brazilian crisis, that started with the 2013 protests, the 2015 turn in economic policy (the so-called New Economic Matrix), the 2016 mediatic/parliamentary coup against Dilma, and the 2018...

Read More »The IMF Program in Ecuador: A New Report by Mark Weisbrot

Thirty pieces of silver As they discuss the new candidate for the International Monetary Fund (IMF), and it seems that the lead candidate for Lagarde's position is the former Dutch finance minister Jeroen Dijsselbloem, a pro-austerity member of the Labor Party (which I guess is at least nominally on the left), it is worth reading the new CEPR report on the possible effects of IMF programs in Latin America, more specifically the one in Ecuador, now that the country has been brought back...

Read More » Naked Keynesianism

Naked Keynesianism