Naked Keynesianism has been featured in the Top 100 Economics Blogs of 2019. I haven't been very active, and appreciate to be included in the company of much more interesting blogs. See all here.

Read More »Bernie and AOC are Functional Finance (and Socialists) but not necessarily MMT

Might not be MMT, but it isn't Socialism So there has been a lot written on Modern Money Theory lately. There is this piece by The Economist, Jerry Epstein's paper, and Lance Taylor's one, more on the Democratic Socialist ideas than MMT per se (here). There was also this op-ed by Robert Shiller in the NYTimes, and the two posts by Tom Palley, that I reposted here on the blog. Finally, Christine Lagarde also commented on MMT during the World Bank/IMF Spring Meetings.I can and I will not...

Read More »Interview on Central Bank’s exchange rate policy in Argentina

My interview with Nicolás Fiorentino and Cecilia Camarano from Led.fm yesterday (in Spanish) on the Argentinian situation and the new central bank policy. [embedded content] I basically suggest that the new policy to control exchange rates using the IMF loans (with IMF authorization) might control the exchange rate, but will finance essentially capital flight, and tries to interfere with the elections later this year.

Read More »Structural Change in China and India: External Sustainability and the Middle-Income Trap

Shouldn't listen to the IMF anyway New working paper co-authored with Suranjana Nabar-Bhaduri, and published by the Political Economy Research Institute (PERI) from UMass-Amherst. From the abstract:This paper focuses on the different development strategies of China and India, particularly regarding the role of manufacturing and services for long-run productivity growth, external competitiveness and financial fragility. The findings appear to support the argument that productivity...

Read More »Review of Keynesian Economics on the economics of negative interest rates

We are delighted to announce the publication of Volume 7, Issue 2 of the Review of Keynesian Economics. We invite you to visit the website where you can read all the article abstracts and download two free articles.Over the last several years economic recovery has led to some monetary tightening in the United States, but it is likely that a future recession will restore the issue of negative interest rates to the fore of policy debate. That is also true for Europe where there has been a...

Read More »Some unpleasant Keynesian arithmetic

By Thomas I. Palley (Guest Blogger)The last decade has witnessed a significant revival of belief in the efficacy of fiscal policy and mainstream economics is now reverting to the standard positions of mid-1970s Keynesianism. On the coattails of that revival, increased attention is being given to the doctrine of Modern Money Theory (MMT) which makes exaggerated claims about the economic costs and capability of money-financed fiscal policy. MMT proponents are now asserting society can enjoy a...

Read More »What’s Wrong With Modern Money Theory (MMT): A Critical Primer

By Thomas I. Palley (guest blogger)Recently, there has been a burst of interest in modern money theory (MMT). The essential claim of MMT is sovereign currency issuing governments do not need taxes or bonds to finance government spending and are financially unconstrained. MMT rests on a triad of arguments concerning: (i) the macroeconomics of money financed budget deficits, (ii) the employer of last resort or job guarantee program, and (iii) the history of money. This primer analyzes that...

Read More »The Mueller Report

Perhaps worth reposting what I said about Russiagate, now that the Mueller Report led to no additional indictments and validated the No Collusion slogan we're going to hear for the next year and a half. Just a brief note on the whole firing of Comey scandal that is still unfolding, and the incredible degree of anxiety on the left, which somehow thinks this means that there is a 'pee' tape and that Trump will be eventually impeached (here, for example; too many of these). This is at least...

Read More »Bretton Woods and corporate defaults

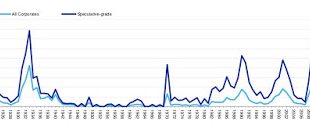

In the Eatwell and Taylor book, Global Finance at Risk, they had, I think, a graph with the percentage of corporate bonds in default in the US (I don't have the book here, it's my office). I think this is a close one, with data that is more recent (from this Moody's report). The graph shows corporate bond default rates (and also the speculative-grade bond defaults). Note that defaults fall significantly during the Bretton Woods era of capital controls and low interest rates.

Read More »Galbraith on MMT and the Hyperinflation Boogeyman

From his recent piece: "Does this mean that 'deficits don’t matter'? I know of no MMT adherent who has made such a claim. MMT acknowledges that policy can be too expansionary and push past resource constraints, causing inflation and exchange-rate depreciation – which may or may not be desirable. (Hyperinflation, on the other hand, is a bogeyman, which some MMT critics deploy as a scare tactic.)"Also, this: "And MMT is not about Congress ordering the Fed to use its “balance sheet as a cash...

Read More » Naked Keynesianism

Naked Keynesianism