A leftist candidate won a close election in a South American country, threatening US interests in the region. The US president asked the CIA to "make the economy scream" to undermine governance and bring regime change, even if by violent means.I am referring, of course, to Salvador Allende's election in Chile, and Richard Nixon's reaction, which eventually led to Augusto Pinochet's coup, one of the most bloody in the troubled history of the region. The reelection of Nicolas Maduro last...

Read More »Lula da Silva is a political prisoner. Free Lula!

Three hundred academics and public intellectuals joined to launch a manifesto denouncing the detention of the former Brazilian president and current Presidential candidate Lula da Silva. The petition discusses in detail the arbitrary nature of the trial conducted by Judge Sergio Moro against Lula da Silva, stating that he is nothing less than a political prisoner. The document asserts that the international community should treat him as such and demands his immediate release. Read...

Read More »Integration, spurious convergence, and financial fragility: a post-Keynesian interpretation of the Spanish crisis

Here is to another crisis like this one! Paper co-authored with Esteban Pérez that was a Levy Institute working paper is published. From the abstract: The Spanish crisis is generally portrayed as resulting from excessive spending by households associated to a housing bubble and/or an excessive welfare spending beyond the economic possibilities of the country. We put forward a different hypothesis. We argue that the Spanish crisis resulted, in the main, from a widening deficit position...

Read More »On the URPE Blog – The Video Edition

The Dynamics of Capitalism: Money and Financialization Greta Krippner – The Power of Abstraction: Marx on Money and Credit Aaron Sahr – From Pen Strokes to Keystrokes: the Production of Money in Early and Contemporary Capitalism Michael Löwy: Marxism and Romantic Anticapitalism Michael Löwy is Emeritus Research Director at the CNRS (French National Center for Scientific Research) Lecturer, École des Hautes Études en Sciences Sociales. Immanuel Wallerstein: The Contemporary Relevance of...

Read More »Fernando Cardim de Carvalho – RIP

Fernando, Cardim for most in Brazil, and Carvalho in the US and abroad, has sadly passed away. I took his macro class back in 1992 at the Federal University in Rio, before he actually moved there definitely as full professor two years later. We used his book Mr. Keynes and the Post Keynesians (still somewhere here in my bookshelf) as a textbook, even though most of the course was based on several papers.From that period I remember reading his papers on time and expectations, which were...

Read More »Top Blogs

No 'On the Blogs' section last Sunday (was traveling) and slow to react to events (at a pedagogy seminar for a couple of days, learning about teaching techniques). At any rate, the good news is that Naked Keynesianism has been featured in the Intelligent Economist's Top 100 Economics Blogs of 2018. According to them they have "made an effort to create a well-balanced list which contains blogs of all kinds political affiliations, schools of economic thought, and beliefs, in particular by...

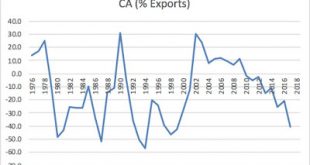

Read More »A brief comment on the Argentinian Crisis

This was faster than even I expected (for my views on what Macri meant as soon as he was elected see this and for a more recent assessment go to this post). Let me first say that I don't think is quite like the 2001/02 crisis. It is unlikely that there will be a default anytime soon. The level of reserves is at about US$ 56 billion, and the IMF is happy to finance the very Neoliberal government of Macri (because the IMF has changed a lot, remember?).The economy with Macri has not performed...

Read More »Peter Nolan on China’s Development and relation with the West

[embedded content] A bit old, from 2016, but not too old, and very apropos given the recent heightened trade disputes between the United States and China.

Read More »On the Blogs — The Video Edition

Political Economy of World Systems (PEWS) Conference 2018 Steve Keen on Alternative Foundations for Macroeconomics -- Lord Keynes posted a video by Steve Keen Bill Mitchell on the failure of economics -- Lars Syll linked to a lecture by Bill Mitchell Life and Thought - Immanuel Wallerstein -- Jan Milch sent me the link to this video about Immanuel Wallerstein (both of us depicted above in the recent PEWS conference)

Read More »Corporate Debt in Latin America and its Macroeconomic Implications

New paper by Esteban Pérez and co-authors published by the Levy Institute. From the abstract: This paper provides an empirical analysis of nonfinancial corporate debt in six large Latin American countries (Argentina, Brazil, Chile, Colombia, Mexico, and Peru), distinguishing between bond-issuing and non-bond-issuing firms, and assessing the debt’s macroeconomic implications. The paper uses a sample of 2,241 firms listed on the stock markets of their respective countries, comprising 34...

Read More » Naked Keynesianism

Naked Keynesianism