A response to David Laidler’s review of Macroeconomics and the Phillips curve myth-- James Forder on the arguments of his book on the Phillips CurveWhat to Watch on Jobs Day: Putting wage growth in perspective-- Elise Gould on a paper on wage stagnation Outburst of conventional wisdom on trade merits caution-- Greg Hannsgen on the recent steel tariffs

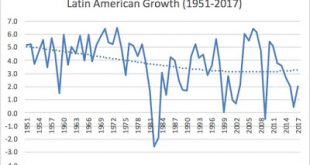

Read More »GDP growth in Latin America

Writing a paper on Latin America. Nothing particularly relevant to report. I was just checking the date. Many sources to get the data. I suggest both the World Bank Development Indicators and the Conference Board Total Economic Database. At any rate, below GDP growth from the Golden Age (after the Korean War and up to Debt crisis) to the Neoliberal Era (starting in the 1990s). Clearly growth has been more volatile and at lower rates. So much for the notion that Neoliberalism works.

Read More »Classical Political Economics and the History of Central Banks

As promised not long ago, here a short paper on the history of central banks presented at ASSA meeting in Philadelphia. The paper is short, given the submission policy. It discusses the growing literature on the origins of central banks, and essentially disagrees with Charles Goodhart, who is the authority on the topic.The conventional argument is that central banks only become effectively central banks in the late 19th century when a concern with financial stability was developed and...

Read More »On the blogs

Trying to resurrect my brief look at blogs during weekends. So here are three post/entries/op-ped pieces worth reading (look at this space for three or four of these every Sunday):Will bourgeoisie ever rule the Chinese state?-- Branko Milanovic on Arrighi's question. Funny thing is this weekend I was re-reading Adam Smith in Beijing, since I'm giving one of the keynote speeches at the Political Economy of World Systems (PEWS) meeting in April at Fairfield University (the other being...

Read More »Basil Moore (1933-2018)

Basil Moore I first met Basil in 2000 or 2001, which was quite late, since I've read his work as an undergraduate back in the late 1980s. I was Assistant Director of the Center for Economic Policy Analysis (CEPA, now the Schwartz Center) at the New School, and we invited him for a talk, which was about his forthcoming (at that time) book Shaking the Invisible Hand: Complexity, Endogenous Money and Exogenous Interest Rates which was published considerably later (my review here).Basil...

Read More »Andrea Ginzburg and Anthony Brewer

These were two great economists, that I never met, and that sadly have passed away. I would recommend this paper by Andrea Ginzburg, with Annamaria Simonazzi, on foreign debt cycles, and this paper by Anthony Brewer on the effects of capital mobility on the Ricardian comparative advantage model. Their contributions are certainly much more relevant than these two papers, but I think this provide a good example.

Read More »The left and the return of protectionism

So if you believe a simplified version of conservative views on the economy, Trumponomics is pretty contradictory (and yes they are contradictory, even if one may doubts about why). Tax cuts should lead to growth, via supply side economics, and the recently proposed tariffs on steel and aluminum do exactly the opposite. Protectionism (not a very good name, I prefer managed trade, as I discussed here before) has made a come back, but while many heterodox economists have suggested that 'free...

Read More »The Godley-Tobin Lecture by James K. Galbraith

Presenting the Lecture Here is the audio file of Jamie Galbraith inaugural Godley-Tobin Lecture. Due to the weather he recorded the lecture before hand. The paper will appear in the Review of Keynesian Economics (ROKE) soon. Jamie presents a macro discussion of income distribution, which he correctly points out has been absent from most discussion of inequality in recent times.Further, he connects his concern with the data (the UNIDO data that his team at UTIP has worked on for years...

Read More »Theotônio dos Santos (1936-2018)

Theotônio dos Santos, one of the main authors of the Latin American Dependency School, has passed away. I had some minimal contact with him, seeing some of his talks as an undergraduate, and then at a few conferences were we could talk a bit more, including after I had published this paper.When I was a student, I might add, I was basically taught that there were two dependency school traditions, and often the Marxist one, in which Theotônio and André Gunder Frank were the key figures,...

Read More »The inaugural Godley – Tobin Memorial Lecture

The inaugural Godley – Tobin Memorial Lecture at the Eastern Economic Association meetings in Boston on Saturday March 3, 11.30am – 12.50pm. The lecture pays tribute to both Godley and Tobin's emphasis on being non-hyphenated Keynesians (more on that for a later post).The lecture is sponsored by the Review of Keynesian Economics (ROKE) and will be delivered by Professor James K. Galbraith, whose talk is titled “A global macroeconomics – Yes, macroeconomics damn it – of inequality and...

Read More » Naked Keynesianism

Naked Keynesianism