Mike Beggs wrote an interesting Review of the book In the Long Run We Are All Dead (which I started, but have not finished yet). Beggs argues that: "Marx lived long enough to declare himself 'not a Marxist.' Keynes was not so lucky. Followers would make the distinction between 'Keynesian economics' and 'the economics of Keynes.' But by then the word had well and truly transcended the man." That's not altogether correct. Dave Colander retells the Abba Lerner story of Keynes' famous...

Read More »Talk of military intervention in Venezuela is absurd

In early February, US Secretary of State Rex Tillerson embarked on a Latin America tour aimed at promoting "democratic security". But just before he set off on his trip, he speculated on the possibility of a military coup in Venezuela. "In the history of Venezuela and South American countries, it is often times that the military is the agent of change when things are so bad and the leadership can no longer serve the people," he said at an event at the University of Texas at Austin....

Read More »Cohen and DeLong on Hamilton’s Report on Manufactures

Hamilton's Reports, posthumous 1821 edition Stephen Cohen* and Brad DeLong, in their highly readable book Concrete Economics: The Hamilton Approach to Economic Growth and Policy (if you haven't, go buy a copy now), argue that “Alexander Hamilton [was a] major economic theorist. His theory of economic development, first set out in his famous Report on Manufactures (1791), not only reshaped America’s economy but was channeled by Frederich List half a century later to play a central role...

Read More »What About the New Tax Law?

New Event from the Susquehanna Progressives. Drop by if you're around the area. Info below. "As activists we need to understand the history of US tax policies, how they have changed since the 50's and why, the affect on our social fabric and what the new tax bill will mean for the health of our nation (Presentation followed by Q&A)."Presenter: Matías Vernengo, Professor of Economics, Bucknell UniversityThursday, February 22 | 7:00 - 8:30 PM Community Zone, Market Street in...

Read More »Keynes’ intellectual influence: the theorist vs the pamphleteer

Keynes' 1933 and 1929 pamphlets, respectively One of the many unfair criticisms of Keynes' General Theory (GT) is that is badly written or somewhat incomprehensible. Note that Keynes started to write it in 1932, four years into the Depression, and two years after publishing the Treatise, which he probably thought was going to be his Magnus Opus. In other words, by the time he started to write the GT the worst part of the Depression was coming to an end (the UK had abandoned gold in 1931, and...

Read More »Alan Blinder on Fiscal Adjustment

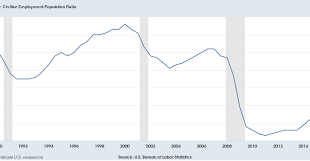

Alan Blinder published recently two columns on the WSJ (here and here) on the need to exercise fiscal restraint. In both cases he complains that the fiscal deficit is too large. Note that he is not saying that this is always the case, he emphasizes that in the second and most recent piece. The reason, as always, is that we are close to full employment. In his words:"... today we are back at full employment, or perhaps beyond it, ad economic growth kooks solid. The economy doesn't need...

Read More »Investment Rate, Growth and Accelerator Effect in the Supermultiplier Model: the case of Brazil

A new paper by Julia Braga, that she will present at the next Eastern Association Economic Meeting in Boston. From the abstract: "This paper investigates the role of demand in the productive investment evolution in the Brazilian economy. First, it assesses the long-run relationship between investment rate and GDP growth, taking annual data since 1962 until 2015. We then construct a “Final Demand” index and estimate its impact on productive investment growth rate, taking quarterly data...

Read More »Demand Drives Growth all the Way

New paper by Lance Taylor, Duncan Foley and Armon Rezai. From the abstract: "A demand-driven alternative to the conventional Solow-Swan growth model is analyzed. Its medium run is built around Marx-Goodwin cycles of demand and distribution. Long-run income and wealth distributions follow rules of accumulation stated by Pasinetti in combination with a technical progress function for labor productivity growth incorporating a Kaldor effect and induced innovation. An explicit steady state...

Read More »Godley-Tobin Lecture at the EEA in Boston

James k. Galbraith on inequality at the EEA in Boston. Don't miss it!

Read More »International Workshop on Demand-led Growth, Conflict Inflation, and Macro Policy

At my alma mater the Federal University of Rio de Janeiro (UFRJ), to be co-sponsored by the Review of Keynesian Economics (ROKE). Call for papers to come soon in this channel. Stay tuned.

Read More » Naked Keynesianism

Naked Keynesianism