The announcement, and backtracking, on a 20% tax on Mexican imports caused a lot of confusion yesterday. I assumed like most that this was a proposal for a tariff, which would both ditch NAFTA rules and run afoul of the WTO rules. The wall and the tariff led to a cancellation of the Mexican president's trip, and a souring of the diplomatic relations. But in all fairness, it seems that this had little to do with Mexico.The Republican Tax Plan basically is to eliminate the corporate income...

Read More »Adam Smith on the origins of first generation public banks

I discussed in a previous post the reasons why the Bank of England is considered a central bank, but not its precursors. I did not pay enough attention in that post to the reasons for which the early public banks were created. Adam Smith discussed that in his magnum opus. From the Wealth of Nations: “The currency of a great state, such as France or England, generally consists almost entirely of its own coin. Should this currency, therefore, be at any time worn, clipt, or otherwise...

Read More »Are Negative Interest Rates Dangerous? A debate on negative interest rates

A debate between Tom Palley and Adam Posen. From Tom's argument: A negative interest rate policy (NIRP) appears revolutionary, but its justification rests on failed, pre-Keynesian “clas- sical” economics. This claims that lower interest rates can al- ways solve aggregate demand shortages and lead to full employment. Keynes discredited classical economics by showing that saving and investment might not respond, as assumed, to lower interest rates. Read the debate here.

Read More »The Global Political Economy of Raúl Prebisch

New book edited by Matías Margulis. We have a chapter with Esteban Pérez, a new updated version of this paper really. Many interesting contributions from Eric Helleiner, Peter Ho and Robert Wade to cite three well-known scholars of development. From the blurb: The Global Political Economy of Raúl Prebisch offers an original analysis of global political economy by examining it through the ideas, agency and influence of one of its most important thinkers, leaders and personalities....

Read More »Electoral quakes and the establishment: A new world approaching?

By Denis Melnik and Andrés Lazzarini (Guest bloggers) As the first days of Donald Trump’s presidency unfold, the prevalent attitude to his surprising victory among the various breed of the liberal intelligentsia all over the globe is pretty much the same as it was on the morning of November 9, 2016 — that of a profound shock. Apart of purely emotional reactions (ranging from desperate ‘Bernie could have won’ to hopeful ‘Trump will be impeached almost immediately’), this shock reveals...

Read More »Top 20 most productive departments of the top 100 national liberal arts colleges

So Bucknell is on that list, according to Chen Qian, Steven B. Caudill and Franklin G. Mixon, Jr. (2016) “Engaged in teaching, and scholarship too: economics faculty productivity at national liberal arts colleges,” International Journal of Pluralism and Economics Education, 7, 360-372 (subscription required). Not sure how useful this kind of data is. Very much like the data on journal rankings discussed before, this should be taken with a grain of salt. But the schools with heterodox, or...

Read More »President Trump and Fiscal Policy: Austerity Big Time?

I can already see some of the cuts ;) The Hill suggests that we should expect a huge decrease in government spending. According to them: Overall, the blueprint being used by Trump’s team would reduce federal spending by $10.5 trillion over 10 years. The proposed cuts hew closely to a blueprint published last year by the conservative Heritage Foundation, a think tank that has helped staff the Trump transition. In all fairness, I am not, or at least was not until now, expecting big...

Read More »The “Natural” Interest Rate and Secular Stagnation

New paper by Lance Taylor in Challenge Magazine. From the blurb: Can America recover ideal rates of growth through interest-rate policies? This important analysis suggests that most economists misunderstand the issue. Updating Keynes, the analysis suggests that fiscal stimulus, labor union bargaining power, and more progressive income taxes are needed to support growth. (The article includes some algebra, which some readers may choose to skip.) Read full paper here.

Read More »On Trumponomics at the Rick Smith Show

[embedded content]

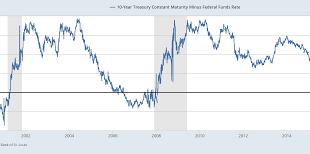

Read More »Bill Gross and the Yield Curve

Tyler Durden at ZeroHedge, and others, are discussing Bill Gross's recent rant on his monthly letter to investors about the yield curve and the possibility of a Trump recession. Bill Gross sees in the decline of the 10-year bond rate since the early 1980s a secular (like Summers and his secular stagnation, it seems everything is secular now) trend, and concludes that the long term rate cannot go above 2.6% or so. In his words: "So for 10-year Treasuries, a multiple of influences obscure a...

Read More » Naked Keynesianism

Naked Keynesianism