[embedded content] EPS Symposium: Policy Challenges for the New US President: Global Security: Russia, China, Europe and Latin America from Thea Harvey on Vimeo.

Read More »CROWDFUNDING CAMPAIGN FOR THE JMK WRITINGS PROJECT

From Rod O'DonnellDECEMBER 8, 2016. THE CLOSING DATE FOR THE CROWDFUNDING CAMPAIGN FOR THE JMK WRITINGS PROJECT. I thank, from the bottom of my heart, all those who have backed the campaign, with donations ranging from USD5 to USD1,000. Almost everyone has said complimentary things about the proposed edition (‘great idea’, ‘wonderful project’, ‘best of luck’ etc), but far fewer have followed up with contributions. The bottom line is this. Funds are essential if the edition is to be...

Read More »Global Security: Russia, China, Europe and Latin America

Economists for Peace and Security will conduct its 9th annual policy symposium at the Hyatt Regency Capitol Hill in Washington DC today to discuss the economic dimensions of the most pressing global security issues and those facing the domestic economy. Following one of the most unusual presidential and congressional elections in US history, panelists will present ideas for improving prospects for peace, and growth with fairness for all Americans. Program starts at 9am. Watch the...

Read More »On the blogs — Election edition

The Rust Party Belt The High Price of the Trans-Pacific Partnership -- Dean Baker on the role of free trade deals in the electionIs globalization to blame? -- Chris Dillow on, well, whether it was globalizationThe long haul -- Paul Krugman, right that is going to be a disaster, but not very perceptive on how (it's not about the bad things that will happen and Drumpf will be unprepared to deal with; it's all about the predatory behavior of the GOP and the president elect cronies, that...

Read More »The working class joins the cocktail party

The working class elephant in the room Upton Sinclair famously said that "it is difficult to get a man to understand something, when his salary depends on his not understanding it." Not understanding the results of this election is what the Democratic establishment is trying very hard to do. Many will continues to say that at the heart of the loss are the misogyny, racism and xenophobia of Trump and his supporters, which is real and problematic, but deny the truth that it was the...

Read More »CALL FOR PAPERS: Special issue of ROKE on ‘Monetary policy and negative nominal interest rates’

In light of increased unemployment, the absence of strong economic growth and the threat of deflation in many countries, the recent financial crisis led many to expect a shift in monetary policy. Central banks were at the forefront of these changes, by shunning ‘conventional’ policies in favor of so-called unconventional ones. After experimenting with Quantitative Easing, a number of countries have recently officially adopted negative interest rates in the hope of reviving their moribund...

Read More »The Rust Belt and the Election

It's Manufacturing Stupid! There will be a lot to say about the election from all kinds of pundits. On the left, many will blame the coverage of emailgate, Comey, the FBI, third party candidates, Bernie and Bernie bros, racism, xenophobia, misogyny, the electoral college and God knows what else. And certainly all of these things did play a role. But it was minor. The election was lost in the old Rust Belt, the decadent manufacturing center that has been hit hard by trade deals (as...

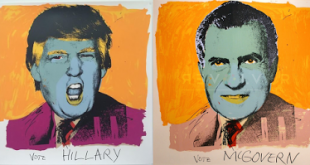

Read More »In the face

"The facts are looking you in the face. What more do you need? This is Nixon. Vote McGovern." Andy Warhol

Read More »Latin America at a Crossroads

New paper by Carlos Medeiros, with Nicholas Trebat, at the Centro Sraffa (h/t Alejandro Fiorito, and Revista Circus). From the abstract: This paper discusses the connections established in recent non–neoclassical literature between growth, structural change and income distribution in large developing economies. We argue that though many analyses have the merit of reintroducing income distribution as a factor in economic growth, they rely almost exclusively on macroeconomic theory, and thus...

Read More »Jobs Report and more at the Rick Smith Show

[embedded content]

Read More » Naked Keynesianism

Naked Keynesianism