I missed this. CEPR blog posted on Thomas Edsall's column and quoted this nugget from Daron Acemoglu (and this guy might get a "Nobel"): As long as the Democratic Party shakes off its hard-core anti-market, pro-union stance, there is a huge constituency of well-educated, socially conscious Americans that will join in. I don't agree with all of the CEPR proposals. I always found the free trade on professionals a peculiar idea. At any rate, that would alienate a constituency of the Democratic...

Read More »What caused the great inflation moderation in the US? A post-Keynesian view

New paper by Nate Cline and Perry. From the abstract: Several explanations of the ‘great inflation moderation’ (1982–2006) have been put forth, the most popular being that inflation was tamed due to good monetary policy, good luck (exogenous shocks such as oil prices), or structural changes such as inventory management techniques. Drawing from post-Keynesian and structuralist theories of inflation, this paper uses a vector autoregression with a post-Keynesian identification strategy to show...

Read More »Self Driving Trucks

[embedded content] I don't normally post about this stuff, but the possible implications of this technological change are far reaching, not just in terms of safety as implied in the video (somewhat promotional; hey, it's WIRED), but also in terms of employment. Jimmy Hoffa is turning on his grave, wherever that is. The original WIRED piece here.

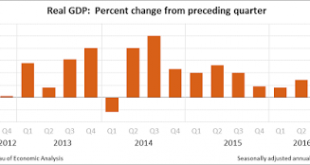

Read More »GDP recovers a bit in the third quarter

According to the BEA, the advance estimate of GDP growth in the third quarter is 2.9%, which is a significant improvement on the second quarter (1.4%). So maybe there is no recession in the near future (Neil Irwin might be right about that), which does not mean Yellen should hike the Fed rate in December anyway.

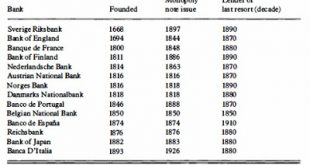

Read More »History of Central Banks tutorial

Next semester I'll be teaching a senior seminar on the history of central banks. The idea is to blend economic history, history of economics ideas and monetary theory in equal parts. And I decided to post on some of the topics I'll discuss in the class, very much like Robert Paul Wolff's tutorials in his blog The Philosopher's Stone, but probably in a less instructive and interesting way than the ones he posts (see this multi-part tutorial on Marx that starts here, and continues here and...

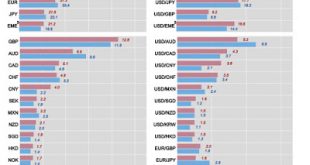

Read More »Foreign Exchange Trading and the Dollar

The new Bank for International Settlements (BIS) Triennial Central Bank Survey was published last month. The Foreign exchange turnover is down for the first time since they started in 1996. As the press release says: "Trading in FX markets averaged $5.1 trillion per day in April 2016. This is down from $5.4 trillion in April 2013." The figure below shows the main results. Not surprisingly the dollar remained the key vehicle currency, being on one side of around 88% of all trades, while...

Read More »On Volcker and Peterson’s debt problem

In their recent NYTimes op-ed Paul Volcker and Peter Peterson say: Yes, this country can handle the nearly $600 billion federal deficit estimated for 2016. But the deficit has grown sharply this year, and will keep the national debt at about 75 percent of the gross domestic product, a ratio not seen since 1950, after the budget ballooned during World War II. The practical consequence of large deficits and debts, according to them is that: Our current debt may be manageable at a time of...

Read More »A Theory of Economic Policy Lock-in and Lock-out via Hysterisis

Locked out By Thomas PalleyThis paper explores lock-in and lock-out via economic policy. It argues policy decisions may near-irrevocably change the economy’s structure, thereby changing its performance. That causes changed economic outcomes concerning distribution of wealth, income and power, which in turn induces locked-in changes in political outcomes. That is a different way of thinking about policy compared to conventional macroeconomic stabilization theory. The latter treats...

Read More »On manufacturing output and jobs at the Rick Smith Show

[embedded content]

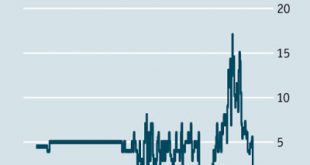

Read More »Nominal and Real Interest Rates

The persistence of low interest rates has dominated the news. In general related to whether the Fed will or will not increase the interest rate by the end of the year. The Economist tried a few weeks ago to put things in perspective, and suggested not only that the current nominal rates close to zero are unprecedented, but it sort of indicated that the negative real rates are also to some extent a new phenomenon. The explanations for low rates can be found here, and the consequences,...

Read More » Naked Keynesianism

Naked Keynesianism