from Lars Syll One of the limitations of economics is the restricted possibility to perform experiments, forcing it to mainly rely on observational studies for knowledge of real-world economies. But still — the idea of performing laboratory experiments holds a firm grip on our wish to discover (causal) relationships between economic ‘variables.’ If we only could isolate and manipulate variables in controlled environments, we would probably find ourselves in a situation where we with...

Read More »Weekend read: Ready for brain transparency? Amid the laughter of Davos, the machine is assimilating humans

from Norbert Häring A presentation on the technical monitoring of human brain functions at the annual meeting of the World Economic Forum in Davos has shined a spotlight on what ails our society: excessive faith in technology and too much efficiency without a worthwhile goal. As long as the machine runs like clockwork, it is considered irrelevant what it produces. From this diagnosis I derive recommendations on how we can change direction. Moderator Nicholas Thompson, CEO of the U.S....

Read More »The ‘Nobel Prize’ in Economics is seriously flawed

from Lars Syll People have, throughout all times, tried to form an understanding of the economic contexts using economic theories. These theories both shape and are part of society and its history. In the past century, the development of economic theories has taken place at an increasingly rapid pace. Over the last fifty years, these theories have become more mathematical and abstract in their nature. This particularly applies to the dominant economic wisdom, the so-called mainstream...

Read More »Scholarly podcasting

from Maria Alejandra Madi Podcasts, which can now be easily accessed online, have had a recent surge in popularity, which may be attributed to their convenience. These podcasts discuss a wide range of topics that are related to the professional and academic spheres. The issue that naturally emerges is what exactly makes it qualified to be regarded as a scholarship approach. To put this another way, what exactly is it about this method that qualifies it to be used as an academic...

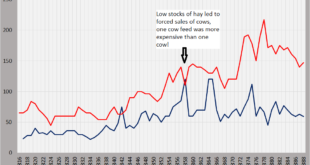

Read More »U.S. manufacturing jobs and trade: A tale of two graphs

from Dean Baker The first decade of this century was pretty awful for U.S. manufacturing workers. In December of 1999 we had 17.3 million manufacturing jobs. This number had fallen to 11.5 million by December of 2009. This amounted to a loss of 5.8 million jobs, or one-third of all the manufacturing jobs that had existed at the start of the decade. That looks like a pretty big deal. It’s also worth pointing out that most of these jobs were lost before the onset of the Great Recession. We...

Read More »On ethics and economics

from Lars Syll Justice is an ambiguous concept. We use it daily and constantly. But what is justice, really? What should be considered just? How do we measure justice? Is justice the same as equality and impartiality? And is there only one form of justice, or do different notions of justice coexist? These are important questions to try to shed light on and answer. Otherwise, the concept of justice risks becoming just one of many empty and abstract clichés we use to dress our own interests...

Read More »Notes for the beginning of: what to do?

from Peter Radford This is how I explain what has happened to myself. Nobody should begin without warning. So we ought jot down some initial observations that provide a starting point for what follows. Some will become highly relevant. Others will fade as we dig deeper into our subject and discover that they were not germane to the main theme. They are in no particular order, since imposing order suggests a level of understanding unjustified by experience. We simply do not know what...

Read More »The Chinese need to stay poor because the United States has done so much to destroy the planet

from Dean Baker That line is effectively the conventional wisdom among people in policy circles. If that seems absurd, then you need to think more about how many politicians and intellectual types are approaching climate change. Just this week, John Kerry, President Biden’s climate envoy, was in China. He was asking the Chinese government to move more quickly in reducing its greenhouse gas emissions. President Xi told Kerry that China was not going to move forward its current target,...

Read More »Summary of the Great Transformation by Polanyi

from Asad Zaman and current issue of WEA Commentaries Ever since the spectacular failure of modern economic theory became obvious to all in the Global Financial Crisis, the search for alternative ways of organizing our economic affairs has intensified. The vast majority of alternatives under consideration offer minor tweaks and patches, remaining within the methodological framework of neoclassical economics. In contrast, Polanyi offers a radical alternative, with unique insights based on...

Read More »Something about prices (III). ‘Commons prices’ which are prices fostering the reaping of the Blessing of the Commons.

As nobody else bothers, I’m tinkering with designing a (badly needed) periodic table of prices. Look here and here. Economists are fond of ex post market prices – i.e. prices paid for actual transactions. But other kinds of prices abound. Administered prices, shadow prices, cost prices and more. Each of these prices are important and are used to influence the production and distribution of goods and services. Each of these are, separately, defined on all kind of webpages. but an...

Read More » Real-World Economics Review

Real-World Economics Review