from Michael Joffe This perspective contrasts with standard neoclassical theory in several respects. That theory puts forward models relating to the decision making of (potential) workers, and of firms – respectively the supply of and the demand for labor. Workers choose whether or not to accept employment, based on a comparison of the offered wage with their reservation wage. Firms’ decision making is seen as a comparison between employing one more or one fewer worker with the difference...

Read More »Game theory, Larry Samuelson and one of the most widespread myths in economics

from Bernard Guerrien One of the most widespread myths in economics, but also in sociology and political science, is that game theory provides “tools” that can help solve concrete problems in these branches – especially in economics. Introductory and advanced textbooks thus often speak of the “applications” of game theory that are being made, giving the impression that they are revolutionizing the social sciences. But, looking more closely, we see that the few examples given concern...

Read More »Modeling economic risk

from Lars Syll Model builders face a constant temptation to make things more complicated than necessary because this makes them appear more capable than they really are. Remember that a model is not the truth. It is a lie to help you get your point across. And in the case of modeling economic risk, your model is a lie about others, who are probably lying themselves. And what’s worse than a simple lie? A complicated lie.

Read More »The wisdom of crowds

from Lars Syll A classic demonstration of group intelligence is the jelly-beans-in-the-jar experiment, in which invariably the group’s estimate is superior to the vast majority of the individual guesses. When finance professor Jack Treynor ran the experiment in his class with a jar that held 850 beans, the group estimate was 871. Only one of the fifty-six people in the class made a better guess. There are two lessons to draw from these experiments. First, in most of them the members of...

Read More »Ryan, deficits and hypocrisy

from Peter Radford Paul Ryan is leaving Congress. Before he had finished announcing his upcoming retirement the airwaves were awash with commentary about his legacy. Count me as one of those who have a particularly strong perspective on this. Paul Ryan was, and presumably still is, a supremely hypocritical human being. Recall how he sprang into public consciousness. He quickly established himself as a severe right winger, but one with the smarts to back it all up. He promoted himself as a...

Read More »More evidence of the skills shortage in top management

from Dean Baker We all know about the skills shortage Harvard has to pay investment managers millions to lose the school a fortune on its endowment, Facebook can’t find a CEO who can avoid compromising its customers’ privacy, and restaurant managers apparently don’t understand that the way to get more workers is to offer higher pay. The NYT gives us yet another article complaining about labor shortages. The complaint is that restaurants have small profit margins and therefore can’t afford...

Read More »ET1%: blindfolds created by economics

from Asad Zaman In my paper on “The Empirical Evidence Against Neoclassical Utility Theory: A Survey of the Literature”, I have argued that economic theories act as a blindfold, preventing economists from seeing basic facts about human behavior, obvious to all others. For instance, economists consider cooperation, generosity, integrity (commitments), and socially responsible behavior, as anomalies requiring explanation, while all others consider these as natural aspects of human...

Read More »Keynesian uncertainty

from Lars Syll In “modern” macroeconomics — Dynamic Stochastic General Equilibrium, New Synthesis, New Classical and New ‘Keynesian’ — variables are treated as if drawn from a known “data-generating process” that unfolds over time and on which we therefore have access to heaps of historical time-series. If we do not assume that we know the “data-generating process” – if we do not have the “true” model – the whole edifice collapses. And of course, it has to. Who really honestly believes...

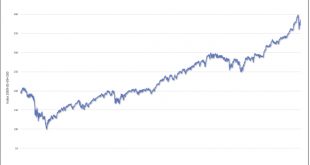

Read More »Ten years after the crash (8 charts)

from David Ruccio “. . . ten years on, U.S. capitalism has created the conditions for renewed instability and another, dramatic crash.” The economic crises that came to a head in 2008 and the massive response—by the U.S. government and corporations themselves—reshaped the world we live in.* Although sectors of the U.S. economy are still in one of their longest expansions, most people recognize that the recovery has been profoundly uneven and the economic gains have not been fairly...

Read More »Gary Dean Baker Funeral Service video

Gary Dean Baker Celebration of Life Video Dec 7, 1940 - March 12, 2018

Read More » Real-World Economics Review

Real-World Economics Review