05:12 Dean's own-to-rent plan, and why it's not catching on 14:39 The MSM's crisis of accountability 19:54 Dean's deal: government payments for no patents 37:53 Does Obama really oppose a single-payer system? 44:16 Aaron frets over Obama's tenuous liberalism, massive power 53:20 Tell us: how does one beat the press? Aaron Swartz (AaronSW.com, Watchdog.Net, Open Library) and Dean Baker (Center for Economic and Policy Research, Beat the Press) Join the conversation on Bloggingheads.tv:...

Read More »US wins trade war! China goes generic big time

from Dean Baker Donald Trump has proved the skeptics wrong, it seems that the American people stand to be big winners as a result of his trade war. The Chinese government announced a major initiative to promote the manufacture and use of generic drugs. The reason this is potentially a big deal for the United States is that it could mean that China intends to push the envelope in replacing drugs protected by government-granted patent monopolies with drugs sold at free market prices. While...

Read More »Mathematical economics — an unmixed evil

from Lars Syll Balliol Croft, Cambridge 27. ii. 06 My dear Bowley, I have not been able to lay my hands on any notes as to Mathematico-economics that would be of any use to you: and I have very indistinct memories of what I used to think on the subject. I never read mathematics now: in fact I have forgotten even how to integrate a good many things. But I know I had a growing feeling in the later years of my work at the subject that a good mathematical theorem dealing with economic...

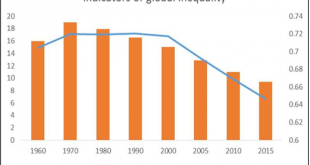

Read More »How unequal are world incomes?

from C.P. Chandrasekhar and Jayati Ghosh In discussions of global inequality, there is general agreement that, whatever else may have happened, within-country inequality has increased in most cases, even as between-country inequality has come down. But overall, because of the recent emergence of countries with large populations like China and India, there has actually been some reduction in global inequality, because of increasing incomes in the “middle” of the global distribution. Chart...

Read More »John Stuart Mill and the end of monetarism

“I apprehend that bank notes, bills, or cheques, as such, do not act on prices at all. What does act on prices is Credit, in whatever shape given, and whether it gives rise to any transferable instruments capable of passing into circulation or not.” John Stuart Mill, 1848 “The relation of changes in M (money) to Y (income) and r (the interest rate) depends, in the first instance, on the way in which changes in M come about.” John Maynard Keynes, 1936 John Cochrane has an interesting post...

Read More »Privatization of public education

from David Ruccio For the first time in American history, students in more than half of all U.S. states are paying more in tuition to attend public colleges or universities than the government contributes. The privatization of public education has been under way for decades but this inflection point was hastened by deep cuts states made to their higher-education appropriations in the midst of the Second Great Depression. For the United States as a whole, according to a new report from...

Read More »The Piketty effect

from Eli Cook A few years ago, I opened my review of Thomas Piketty’s Capital in the 21st Century in the Raritan Quarterly Review with this “bait and switch” vignette. I thought the striking similarities between George and Piketty revealed that while history does not repeat itself, the “Pikettymania” that washed over the world in 2014 might bring forth once more an era in which – much like during the “Gilded Age” of Henry George – economic inequality was at the forefront not only of...

Read More »Keynes’ beauty contest

from Lars Syll Professional investment may be likened to those newspaper competitions in which the competitors have to pick out the six prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice most nearly corresponds to the average preferences of the competitors as a whole; so that each competitor has to pick not those faces which he himself finds prettiest, but those which he thinks likeliest to catch the fancy of the other competitors, all of...

Read More »The threat of a trade war is overblown ― real war is far more likely

from Mark Weisbrot Talk of trade wars and falling skies has taken up much space in the media since Donald Trump first announced tariffs on imported steel and aluminum on March 1. But such fears are highly exaggerated, which should not be surprising in a country where the benefits of a succession of misnamed “free trade” agreements have been grossly exaggerated for decades. Within weeks of announcing the tariffs, the administration had already exempted most of the major suppliers of steel...

Read More »Why game theory never will be anything but a footnote in the history of social science

from Lars Syll Half a century ago there were widespread hopes game theory would provide a unified theory of social science. Today it has become obvious those hopes did not materialize. This ought to come as no surprise. Reductionist and atomistic models of social interaction — such as the ones mainstream economics and game theory are founded on — will never deliver sustainable building blocks for a realist and relevant social science. That is also — as yours truly argues in the latest...

Read More » Real-World Economics Review

Real-World Economics Review