from David Ruccio Lots of folks have been asking me about the significance of the so-called Nobel Prize in economics that was awarded yesterday to Richard Thaler. They’re interested because they’ve read or heard about the large catalog of exceptions to the usual neoclassical rule of rational decision-making that has been compiled by Thaler and other behavioral economists. One of my favorites is the “ultimatum game,” in which a player proposes an allocation of an endowment (say $5) and the...

Read More »Microeconomics: an Islamic approach

from Asad Zaman At the heart of modern economic theory is the micro-economic model of homo economicus, who is cold, calculating and callous. This picture of humans as heartless rational robots is what leads to “Poisoning the Well: How Economic Theory damages our moral imagination” (Julie Nelson). I have provided a thorough critique of neoclassical utility theory in my paper: The Empirical Evidence Against Neoclassical Utility Theory: A Review of the Literature,” International Journal of...

Read More »Nudges, individual behavior and neoliberalism

from Maria Alejandra Madi The concept of nudge became popular after the publication of the 2008 book Nudge: Improving decisions about health, wealth, and happiness, written by Cass Sunstein and the most recent Nobel Laureate, Richard Thaler. According to the authors, nudge refers to “any aspect of the choice architecture that alters people’s behavior in a predictable way without forbidding any options or significantly changing their economic incentives. To count as a mere nudge, the...

Read More »Nobel Committee making a colossal fool of itself

from Lars Syll In its ‘scientific background’ description on the 2017 ‘Nobel prize’ in economics, The Royal Swedish Academy of Sciences writes (emphasis added): In order to build useful models, economists make simplifying assumptions. A common and fruitful simplification is to assume that agents are perfectly rational. This simplification has enabled economists to build powerful models to analyze a multitude of different economic issues and markets. What absolute nonsense! Writing this...

Read More »Richard Thaler gets the 2017 ‘Nobel prize’

from Lars Syll Today The Royal Swedish Academy of Sciences announced that it has decided to award The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel for 2017 to Richard Thaler. A good choice for once! To yours truly Thaler’s main contribution has been to show that one of the main building blocks of modern mainstream economics — expected utility theory — is fundamentally wrong. If a friend of yours offered you a gamble on the toss of a coin where you could lose...

Read More »Modern macro-economics and the sad truth about decoupling

Decoupling is the idea that when societies get richer, additional units of GDP will require less physical resources and will produce less carbon dioxide. This seems true when we look at national rich country production data. But it is not true when we look at rich country consumption data – as we outsourced energy and material intensive parts of producing our consumption goods to developing countries. We really have to blame our consumption pattern… Look here for an article of Mir and...

Read More »Inequality and immiseration (4 graphs)

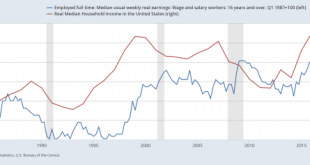

from David Ruccio It’s clear that, for decades now, American workers have been falling further and further behind. And there’s simply no justification for this sorry state of affairs—nothing that can rationalize or excuse the growing gap between the majority of people who work for a living and the tiny group at the top. But that doesn’t stop mainstream economists from trying. Look, they say, American workers are clearly better off than they were before. Both real weekly earnings (the...

Read More »Yes, economics has a problem with women

from Julie Nelson Yes, economics has a problem with women. In the news recently we’ve heard about the study of the Economics Job Market Rumors (EJMR) on-line forum. Student researcher Alice H. Wu found that posts about women were far more likely to contain words about their personal and physical issues (including “hot,” “lesbian,” “cute,” and “raped” ) than posts about men, which tended to focus more on academic and professional topics. As a woman who has been in the profession for over...

Read More »Geography as an Example

from Peter Radford Let me be very quick: Geography is not taught [if it is taught at all] as if there are no rivers, mountains, plains, valleys, coasts, seas, or oceans. Cities, towns, villages and the networks that connect them exist in even the most elementary geography lesson. Geographers don’t begin their lessons by ignoring reality. They dive right in and use the real world as the backdrop for teaching the processes and forces that result in what we actually see. So why does...

Read More »Why game theory will be nothing but a footnote in the history of social science

from Lars Syll Nash equilibrium has since it was introduced back in the 50’s come to be the standard solution concept used by game theorists. The justification for its use has mainly built on dubious and contentious assumptions like ‘common knowledge’ and individuals exclusively identified as instrumentally rational. And as if that wasn’t enough, one actually, to ‘save’ the Holy Equilibrium Grail, has had to further make the ridiculously unreal assumption that those individuals have...

Read More » Real-World Economics Review

Real-World Economics Review