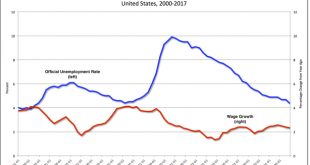

from David Ruccio They keep promising, ever since the recovery from the Great Recession started more than eight years ago, that workers’ wages will finally begin to increase. But they’re not. Sure, profits continue to rise. And so is the stock market. But not wages. And mainstream economists can’t come up with an adequate explanation of why that’s the case. We’ve all heard or read the story. According to mainstream economists, as the unemployment rate falls (the blue line in the chart...

Read More »Las Vegas

from Peter Radford So we go through it all again. We go through the constant call for payers. The incessant search for reasons; the outpouring of emotion; the interviews; the graphics; the enumeration of mayhem; the grief of families; the interviews with experts; and the silence of the voices lost. There are never, however, efforts to deal with the problem. America is obsessed with guns. It adores them It worships them. It is sick with guns. Blame it on the foolishness of the second...

Read More »Rational expectations — the triumph of ideology over science

from Lars Syll Research shows not only that individuals sometimes act differently than standard economic theories predict, but that they do so regularly, systematically, and in ways that can be understood and interpreted through alternative hypotheses, competing with those utilised by orthodox economists. To most market participants — and, indeed, ordinary observers — this does not seem like big news … In fact, this irrationality is no news to the economics profession either. John Maynard...

Read More »Mo’ better inequality blues

from David Ruccio The latest Federal Reserve Board’s triennial Survey of Consumer Finances (pdf) is out and the news is not good—at least for the majority of Americans. They’re falling further and further behind those at the top. Sure, on the surface, the results for the latest period of recovery from the Second Great Depression appear to be positive. Between 2013 and 2016, real gross domestic product in the United States grew at an annual rate of 2.2 percent, the civilian unemployment...

Read More »The Workplace — a few charts

from Peter Radford I have tried to use diagrams to explain the vast impact that the never ending search for higher shareholder value has had on the American workplace. Here is my attempt to show what the old workplace looked like in terms of the benefits to a worker … This diagram demonstrates that a traditional job brought with it a package of “compensation” far beyond a basic wage. It also helps us understand why, as the cost of parts of the package rose rapidly — healthcare costs...

Read More »The Republicans’ tax plan will impede growth

from Dean Baker Surprising no one, the Republicans outlined a tax plan that could mean huge tax cuts for the very rich with little or no tax reductions for the bulk of lower and middle income taxpayers. However in spite of their claimed “pro-growth” agenda, the plan included several provisions that will likely be a boon to the tax shelter industry and therefore an impediment to growth. The giveaways in the tax plan include the elimination of the estate tax, a great benefit to the tiny...

Read More »ECONOMIC PHILOSOPHY: COMPLEXITIES IN ECONOMICS

A conference from the World Economics Association – 2nd October to 30th November 2017 Conference leaders: John B. Davis and Wade Hands Keynote papers Strategies in relation to complexities: From neoclassical Cost-Benefit Analysis to Positional Analysis Peter Söderbaum In this essay neoclassical Cost-Benefit Analysis (CBA) is criticized as beinng too simplistic and also too specific in ideological terms. Positional Analysis (PA) is advocated as an alternative based on a definition of...

Read More »Hicks on neoclassical ‘uncertainty laundering’

from Lars Syll To understand real world ‘non-routine’ decisions and unforeseeable changes in behaviour, ergodic probability distributions are of no avail. In a world full of genuine uncertainty — where real historical time rules the roost — the probabilities that ruled the past are not necessarily those that will rule the future. When we cannot accept that the observations, along the time-series available to us, are independent … we have, in strict logic, no more than one observation, all...

Read More »Sapir in May 2008 on the Great Financial Crisis

Two days ago this blog published a blogpost by Jaques Sapir, a French economist, who stated that access to his RussEurope blog had been suspended because his posts had become to political… Interestingly, in the May 2008 issue of theReal World Economics Review, at a time when Jean-Claude Trichet, a French economists and former head of the ECB, still denied the crisis and even increased interest rates (22 July 2008: +0,25%), Sapir already had a keen insight into the nature and severity of...

Read More »Tax Fog

from Peter Radford Whenever we are told about a Trump plan we have to use the word “plan” very carefully. Thus far Trump’s various plans have been more vague suggestions, hints, clues to what’s inside his head, or varieties of “what a plan were to look like were Trump to have an actual plan, but he doesn’t”. This week’s ballyhooed tax plan is no exception. It has been introduced as a framework. A skeleton. A coat hanger upon which Congress will need to hang actual policy in order to...

Read More » Real-World Economics Review

Real-World Economics Review