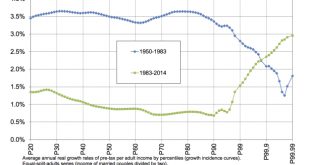

from David Ruccio On the eve of their presidential election, the French people and politicians continue to debate how they should respond to the end of “Les Trente Glorieuses,” a period that appears to receding into ancient history. Except, as it turns out, for those at the very top, for whom the last thirty years have been quite glorious. According to new research by Bertrand Garbinti, Jonathan Goupille-Lebret, and Thomas Piketty, between 1983 and 2014, average per adult national income...

Read More »We cannot understand social theories (like economics) outside the historical context.

from Assad Zaman Based on ideas derived from my study of the methodology of Polanyi’s Great Transformation, I have come to the conclusion that history and social theories are entangled — they co-evolve in time. We cannot understand social theories (like economics) outside the historical context, just as we cannot understand history without understanding the social theories in use by different groups to try to interpret events in ways that would lead to policy actions in their favor. It is...

Read More »David Ricardo and comparative advantage — a bicentennial assessment

from Lars Syll Two hundred years ago, on 19 April 1817, David Ricardo’s Principles was published. In it he presented a theory that was meant to explain why countries trade and, based on the concept of opportunity cost, how the pattern of export and import is ruled by countries exporting goods in which they have comparative advantage and importing goods in which they have a comparative disadvantage. Although a great accomplishment per se, Ricardo’s theory of comparative advantage, however,...

Read More »Exacerbation of the contradiction between democracy and capitalism

from Alicia Puyana While the 2008 crisis called into question the fundamentals of economic theory over which the model of global growth had been sustained for the last three and a half decades, today we witness the crisis of liberal democracy and neo-liberal economics (Bauman, 2016), of the Social Democracy doctrine, the New Labor and waning The Third Way, as well as the fading out of the unrestricted support of globalization (Rodrik, 2017). Some foresee it as the end of the Pax...

Read More »Nailed to its perch

from PeterRadford I always use some famous Chicago School economist as my representative fool when I am describing mainstream economics to my uninitiated friends. How does one, after all, defend such a ludicrous body of thought? By reference to Monty Python? Here is Gary Becker explaining why mainstream theory is so ridiculous: “The combined assumptions of maximizing behavior, market equilibrium, and stable preferences, used relentlessly and consistently, form the heart of the economic...

Read More »Income and wealth—the top and the very top

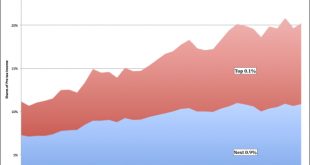

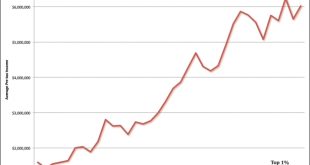

from David Ruccio Skellington is right: in my post on Tuesday, I did not separate out people at the very top from the rest of those at the top. That’s because, in the data I presented, those in the top 0.1 percent were included in the top 1 percent. Unfortunately, I don’t have the same kind of breakdown in the composition of incomes as I used in those charts. What I do have are data on the shares of income and wealth for the top 0.1 percent versus the remainder of the top 1 percent (so,...

Read More »Is having infinitely many models really a sign of progress in economics?

from Lars Syll In Dani Rodrik’s Economics Rules it is argud that ‘the multiplicity of models is economics’ strength,’ and that a science that has a different model for everything is non-problematic, since economic models are cases that come with explicit user’s guides — teaching notes on how to apply them. That’s because they are transparent about their critical assumptions and behavioral mechanisms. Hmm … That is at odds with yours truly’s experience from studying mainstream economic...

Read More »The top and the very top

from David Ruccio Who’s running away with the surplus, those at the top or those at the very top? In a new study on “income inequality in the 21st century,” Fatih Guvenen and Greg Kaplan note that recent increases in inequality in the United States need to be understood in terms of trends of and, especially, within the top 1 percent. That’s particularly true when, instead of using Social Security data (which capture labor income), they turn to Internal Revenue data (which capture all...

Read More »Could a leftist bring growth back to France?

from Mark Weisbrot If the first round of the French presidential election on Sunday is now too close to call, that’s partly because of Jean-Luc Mélenchon’s last-minute surge in the polls. The media describe him as a populist from the far Left, and as he has risen, attacks on him have intensified. One common criticism is that his economic proposal to jump-start growth in France while reducing mass unemployment and inequality is pie in the sky. Is it, though? Mr. Mélenchon would certainly...

Read More »Trumponomics: Neocon neoliberalism camouflaged with anti-globalization circus

from Thomas Palley A key element of Trump’s political success has been his masquerade of being pro-worker, which includes posturing as anti-globalization. However, his true economic interest is the exact opposite. That creates conflict between Trump’s political and economic interests. Understanding the calculus of that conflict is critical for understanding and predicting Trump’s economic policy, especially his international economic policy. As part of maintaining his pro-worker...

Read More » Real-World Economics Review

Real-World Economics Review