from Lars Syll How selfish soever man may be supposed, there are evidently some principles in his nature, which interest him in the fortune of others, and render their happiness necessary to him, though he derives nothing from it except the pleasure of seeing it. Of this kind is pity or compassion, the emotion which we feel for the misery of others, when we either see it, or are made to conceive it in a very lively manner. That we often derive sorrow from the sorrow of others, is a...

Read More »Time to dethrone economists

from David Ruccio The election and administration of Donald Trump have focused attention on the many symbols of racism and white supremacy that still exist across the United States. They’re a national disgrace. Fortunately, we’re also witnessing renewed efforts to dethrone Confederate monuments and other such symbols as part of a long-overdue campaign to rethink Americans’ history as a nation. In economics, the problem is not monuments but the discipline itself. It’s the most disgraceful...

Read More »Social Security: still the most efficient way to provide retirement income

from Dean Baker Last week marked the 82nd anniversary of Franklin Roosevelt’s signing the bill that created Social Security. The program has stood the test of time well. It accounts for more than half of the income for 60 percent of senior households and more than 90 percent for almost one third. It has reduced poverty rates among the elderly from more than one-third to roughly the same as the rest of the adult population. In addition, it provides disability insurance, as well as life...

Read More »150 years of ‘Das Kapital’: How relevant is Marx today?

from Jayati Ghosh It is quite amazing that Karl Marx’s Capital has survived and been continuously in print for the past century and a half. After all, this big, unwieldy book (more than 2000 pages of small print in three fat volumes) still has sections that are evidently incomplete. Even in the best translations, the writing is dense and difficult, constantly veering off into tangential points and pedantic debates with now unknown writers. The ideas are complex and cannot be understood...

Read More »Condition of the workplace in the United States

from David Ruccio Last fall, just before the presidential election, I posted a report on the perilous condition of the American working-class. Now, thanks to the Rand Corporation [ht: ja], we have a report on how terrible working conditions are in the United States. Most Americans between the ages of 25 and 71 spend most of their available time in a given day, week, or year forced to have the freedom to sell their ability to work to a small group of employers. Thus, as the authors of the...

Read More »Modern macroeconomics — totally messed up

from Lars Syll Until a few years ago, economists of all persuasions confidently proclaimed that the Great Depression would never recur. In a way, they were right. After the financial crisis of 2008 erupted, we got the Great Recession instead. Governments managed to limit the damage by pumping huge amounts of money into the global economy and slashing interest rates to near zero. But, having cut off the downward slide of 2008-2009, they ran out of intellectual and political ammunition....

Read More »Ultra sexism on online economics forum

from The Daily Californian (Berkeley) A recent study on gender stereotypes in the anonymous online forum Economics Job Market Rumors, or EJMR, revealed what appears to be a hostile environment toward women in some circles of the economics field. Recent campus graduate Alice Wu conducted the study as part of her senior thesis, using EJMR posts from 2014 to 2016. The focus of the study, according to Wu, was to “examine whether people in academia portray and judge women and men differently...

Read More »An explanation for weak wage growth that fails the simple logic test

from Dean Baker When workers are doing badly you can always count on a large number of economists to come forward with ways to argue it really ain’t so. For example, we have heard endless stories about how our price indices hugely overstate inflation — we’re actually way better off than we think we are. Or, they point to the growth in non-wage benefits. One problem with that story is that non-wage benefits have been shrinking as a share of total compensation in recent years, not growing,...

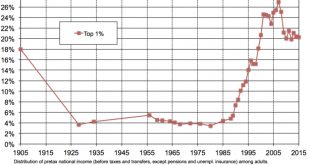

Read More »From oligarchs to Soviets—and back again

from David Ruccio Russia is back in the news again in the United States, with the ongoing investigation of Russian interference in the U.S. presidential election as well as a growing set of links between a variety of figures (including Cabinet and family members) associated with Donald Trump and the regime of Vladimir Putin. This year is also the hundredth anniversary of the October Revolution, which sought to create the conditions for a transition to communism in the midst of a society...

Read More »Economists — people being paid for telling stories justifying inequality

from Lars Syll If economics was an honest profession, economists would focus their efforts on documenting the waste associated with protectionist barriers for professionals. They devoted endless research studies to estimating the cost to consumers of tariffs on products like shoes and tires. It speaks to the incredible corruption of the economics profession that there are not hundreds of studies showing the loss to consumers from the barriers to trade in physicians’ services. If trade...

Read More » Real-World Economics Review

Real-World Economics Review