from David Ruccio There are plenty of reasons to be interested in—and, even more, concerned about—Facebook. Many of them are raised in the recent review of Facebook-related books by John Lanchester [ht: db]: the fragmentation of the polity (via the targeting of posts), the dissemination of “fake news” (which played an important role in the 2016 U.S. presidential election), the undermining of other livelihoods (such as journalism and music), the level of surveillance of users (much more...

Read More »Time for critics of economics critics to move on!

from David Orrell and WEA Commentaries There is a growing trend for economists to write articles criticising the critics of economics. These articles follow a similar pattern. They start by saying that the criticisms are “both repetitive and increasingly misdirected” as economist Diane Coyle wrote, and might complain that they don’t want to hear one more time Queen Elizabeth’s question, on a 2008 visit to the London School of Economics: “Why did nobody see it coming?” Economist Noah Smith...

Read More »Modern society

from Lars Syll

Read More »Everyone can create money

from Merijn Knibbe “Everyone can create money; the problem is to get it accepted.“ Hyman Minsky Summary. Central banks the world over publish sophisticated Flow of Funds data which shows who and how and, to an extent, why all kinds of money are created and used and if stocks and flows of debt and money are becoming a threat to stability. Institutional analysis of these data, which looks at different kinds of credit as well as at different kinds of money and using a grid which enables the...

Read More »Beyond the trinity formula

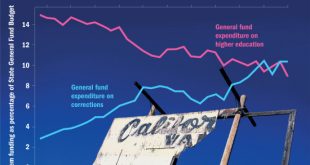

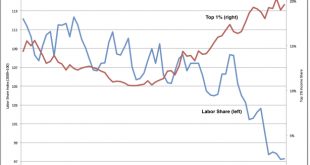

from David Ruccio John Hatgioannides, Marika Karanassou, and Hector Sala are absolutely right: mainstream macroeconomists and policymakers never venture beyond the “holy trinity” of economic growth, inflation, and unemployment.* Everything else, including the distribution of income and wealth, is relegated to the fringes. This problem, while always serious, has been magnified in recent decades as inequality has grown to obscene levels, particularly in the United States. The labor share...

Read More »The history of ‘New Keynesianism’

from Lars Syll Stage 0. Late 1960’s. The Phelps volume, and Milton Friedman’s paper (pdf), both thinking about the microfoundations of the Phillips Curve, the difference between actual and expected inflation, and the role of monetary policy. This was the ancestral homeland of both New Keynesian and New Classical macroeconomics, which could not be distinguished at this stage … Stage 1. Mid 1970’s. Now we see the difference. A distinct New Keynesian approach emerges. New Keynesians assume...

Read More »Stocks and wages

from David Ruccio The new jobs report is out and, once again, little has changed—including wage growth (the blue line in the chart above), which for production and nonsupervisory workers was only 2.3 percent. That may not be good for workers but their employers and stock-market investors couldn’t be happier. The Dow Jones Industrial Average (the red line in the chart above) continues to soar, on the expectation of higher future profits. Just in the first couple of hours of trading, the...

Read More »Two forthcoming online WEA Conferences

1. Economic Philosophy: complexities in economics, 2nd October – 30th November 2017 2. Monetary Policy After The Global Crisis:How Important Are Economic (Divisia) Monetary Aggregates for Economic Policy? 15th January – 15th February 2018 Deadline for submissions: 15th DecemberOPEN CALL FOR PAPERS

Read More »Revealed preference theory — much fuss about ‘not very much’

from Lars Syll We must learn WHY the argument for revealed preference, which deceived Samuelson, is wrong. As per standard positivist ideas, preferences are internal to the heart and unobservable; hence they cannot be used in scientific theories. So Samuelson came up with the idea of using the observable Choices – unobservable preferences are revealed by observable choices … Yet the basic argument is wrong; one cannot eliminate the unobservable preference from economic theories....

Read More »New issue of WEA Commentaries

The August issue of WEA Commentaries is now available at: https://www.worldeconomicsassociation.org/files/2017/09/Issue7-4.pdf Content is as follows: Eveybody can create money Merijn Knibbe 2 html Adam Smith and Altruism 5 Time for critics of economics critics to move on David Orrell 6 html Two forthcoming WEA conferences 7 Going rogue: Economic practice and hitting the orthodox wall Andrew Vonnegutt 8 html Why economics needs pluralism Edward Fullbrook 9...

Read More » Real-World Economics Review

Real-World Economics Review