The cemetery at Lampedusa were the locals and the drowned immigrants from Africa are buried.

Read More »China syndrome

from David Ruccio There are two sides to the recent China Shock literature created by David Autor and David Dorn and surveyed by Noah Smith. On one hand, Autor and Dorn (with a variety of coauthors) have challenged the free-trade nostrums of mainstream economists and economic elites—that everyone benefits from free international trade. Using China as an example, they show that increased trade hurt American workers, increased political polarization, and decreased U.S. corporate...

Read More »Trump’s infrastructure financing seems like a joke

from Dean Baker While Trump is right to emphasize the need for more and better infrastructure, his program is not the way to address the problem. There is much research showing the benefits of spending on traditional infrastructure such as roads and bridges. There are also likely to be large gains from less traditional areas like broadband, where the U.S. ranks poorly among wealthy countries, and improving the quality of public drinking water to avoid more Flint disasters. Ideally, a...

Read More »Letter of Kropotkin to Lenin, March 1920

Next year we’ll witness the hundreth anniversary of the Russian Revolution. Here a link from the Marginal Revolution blog. Below a letter by Pjotr Aleksejevitsj Prpotkin, a leading anarchist and one of the keenest scientific minds of the decades around 1900, to Vladimit Iljitsj Lenin. Note that he wrote this as early as March 1920, note also that at this time a civil war not completely unlike the present turmoil in Syria was raging in Russia. Read especially the last part. From Selected...

Read More »“Narrative Fixation in Economics”

New paperback from WEA BooksNarrative Fixation in Economics by Edward Fullbrook Here are the book’s various Amazon pages: United States $20, Brazil, Canada, France, Germany, India, Italy, Japan, Mexico, Spain, United Kingdom £15 ContentsPreface Chapter 1: The narrative pluralism of physics Chapter 2: Intersubjective reality, intrasubjective theory Chapter 3: Concealed ideology Chapter 4: From the natural to the social Chapter 5: Narrative rationality Chapter 6: What is the...

Read More »Christian Odendahl and Ferdinando Giugliano: Fail.

Oké. I’m a teacher. So, I’m primed and educated to be an arrogant nitpicker. But let’s make the best of a this dire situation and trash the work of Ferdinando Giugliano and Christian Odendahl who defile the language of scientific economics. Which is not just a mistake but a dangerous act which might cause misunderstandings and destructive economic policies. On the website of the Centre for European Reform they state about Italy: “But Italy mostly has itself to blame. The abysmal...

Read More »Where does all the surplus go?

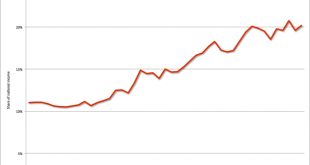

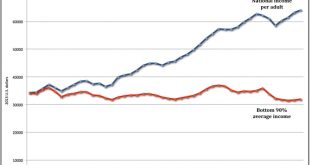

from David Ruccio Where does all the surplus in the U.S. economy go? Well, a large chunk of it is captured by the top 1 percent, whose share of national income almost doubled between 1970 and 2014—from 11 percent to 20.2 percent. Equally interesting is the composition of that growing share of national income, which we can decompose thanks to new data from Thomas Piketty, Emmanuel Saez, and Gabriel Zucman. One way of making sense of the way the top 1 percent manages to capture a...

Read More »Some problems of the neoclassical concepts of employment and unemployment

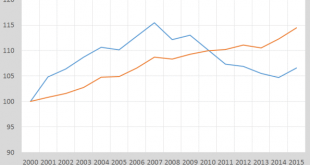

Are neoclassical macro models post-truth? It might very well be. The ‘workhorse’ neoclassical macro ‘DSGE’ models used by for instance central banks state that lower real wages will solve unemployment, largely because these lower wages will entice ‘marginal’ workers, like the elderly and women to leave the labor force (read this, by Lawrence Christiano, Mathias Trabandt and Karl Walentin (2011). Less workers, unemployment solved! But does this also happen? Ehhmmm…no (graph2). After...

Read More »You want to replace the pay working-class Americans have lost?

from David Ruccio Neil Irwin is right: “Poor and working-class Americans have fallen behind over the last generation, receiving few of the gains of an expanding economy.” So, he wants to devise a tax plan to change that. The problem is, Irwin only looks at raising the income of the bottom 20 percent of families to where they would be if they shared equally in the gains since 1979. So what would it all cost? The Tax Policy Center crunched the numbers: The policy would deplete federal...

Read More »A new orientation away from neoliberalism

According to Polanyi: [T]he victory of fascism was made practically unavoidable by the liberals’ obstruction of any reform involving planning, regulation, or control. (Polanyi 1944, p. 257) The direction and content of socioeconomic development in the EU have been essentially determined by market laissez-faire, ultimately dictated by the financial markets’ irrational, manic-depressive psychology. The institutions and the economics of the orthodoxy, which form the constitutional...

Read More » Real-World Economics Review

Real-World Economics Review