from Mark Weisbrot Republican nominee Donald Trump’s embarrassments and scandals keep piling up, from his Twitter meltdown last Friday night to The New York Times revelations that he could have gotten away without paying income taxes for the past 18 years. These may have some impact on the race, although it’s tough to guess how much. But a recent piece in the Times about Trump’s potential influence on the stock market could really take some votes away from him, if it happens to go...

Read More »Whiplash effects of NIRP (Thomas Palley)

The potential future costs of financial fragility and asset price bubbles raise the prospect of policy whiplash effects due to contradictions between current and future policy actions. The economy currently suffers from shortage of AD owing to systemic failings related to income inequality and trade deficit leakages. That demand shortage was papered over by a thirty-year credit bubble plus successive asset price bubbles, which eventually burst with the financial crisis of 2008. Now,...

Read More »Negative interest rates or 100% reserves: alchemy vs chemistry – Herman Daly

Negative interest rates or 100% reserves: alchemy vs chemistry Herman Daly [University of Maryland, USA] The close connection of fractional reserve banking with alchemy was recently emphasized by Mervyn King, former head of the Bank of England, in the very title of his recent book, The End of Alchemy: Money, Banking, and the Failure of the Global Economy. He refers to the more thorough development of this connection by Swiss ecological economist H. C. Binswanger in his brilliant study,...

Read More »Lengthening shadows

from David Ruccio While Wells Fargo (whose CEO blamed employees for his bank’s failings) has put traditional banks in the news lately, the resurgence of the so-called shadow banking sector has largely gone unnoticed. Until now. The Dallas Fed (pdf) has issued an alarming report concerning the growth of financial activities that, while connected to traditional banks, remains largely unregulated—even under Dodd-Frank. “Shadow banking,” an almost sinister-sounding term that originated in...

Read More »“the economics profession is under profound pressure” (Financial Times)

For a group that has helped change the way economics is taught at universities up and down Britain, the Post-Crash Economics Society had a less than momentous start. It was November 2012 when seven undergraduates met in a cramped room on the top floor of Manchester university’s student union. Chairs drawn into a semi-circle, they listened as the two founding members went through a brief PowerPoint presentation explaining what they thought was wrong with the economics curriculum. A polite...

Read More »Links. Females and values edition.

Stamps are money. And as such often adorned with the heads of presidents. A sign of the times: nowadays also with the heads of super models (Anton Corbijn meets Doutzen Kroes edition, both live up to their reputation). The core neoliberal value: companies and markets first, families second. Which explains the absence of involuntary unemployment from neoclassical macro models. But this value is also bad for the health of young children The core free choice value of western society (maybe...

Read More »issue no. 76 of the Real-World Economics Review

download the whole issue Negative interest rates or 100% reserves: alchemy vs chemistry 2Herman Daly download pdf Why negative interest rate policy is ineffective and dangerous 5Thomas I. Palley download pdf Japan’s liquidity trap 15Tanweer Akram download pdf Paul Romer’s assault on ‘post-real’ macroeconomics 43Lars Pålsson Syll download pdf ...

Read More »Economists keep getting it wrong because the media coverup their mistakes

from Dean Baker Most workers suffer serious consequences when they mess up on their jobs. Custodians get fired if the toilet is not clean. Dishwashers lose their job when they break too many dishes, but not all workers are held accountable for the quality of their work. At the top of the list of people who need not be competent to keep their job are economists. Unlike workers in most occupations, when large groups of economists mess up they can count on the media covering up their...

Read More »Harvard’s incorrectly political ignorant gay-bashing bloviating right-wing infotainment war-crimes-apologist historian finally gets one right

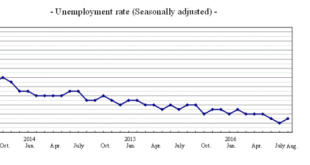

from David Ruccio source Niall Ferguson, Harvard’s incorrectly political ignorant gay-bashing bloviating right-wing infotainment war-crimes-apologist historian, finally gets something right. In explaining the “fight isn’t going as planned” for Hillary Clinton, Ferguson writes: Last week, Clinton’s supporters seized on new economic data from the Census Bureau showing that median household income rose by more than 5 percent in real terms last year. Poverty is down. So is the number of...

Read More » Real-World Economics Review

Real-World Economics Review