from David Ruccio The world economy only grew by 3.1 percent in 2015. But the world’s billionaires did much better. As David Barks, associate director of custom research for Wealth-X, understands, “Wealth helps accumulate more wealth.” According to the latest Wealth-X report on the global billionaire population, the world’s billionaire population grew by 6.4 percent, to 2,473, last year. And their combined wealth increased by 5.4 percent, to a record $7.7 trillion. Needless to say, the...

Read More »Trump, denial and the end of normal

from Peter Radford Shocking is an understatement. Donald Trump is unfit for public office, be it town clerk or president of the US. He’s an unbalanced egomaniac. He’s a racist. He’s an immature misogynist. He’s many other awful things. Presidential, he is not. How did we get here? Failure. But a particular kind of failure. Failure dressed as success. A success so sweeping and deep that we hardly recognize the extent of the change that it wrought. Naturally I am speaking of the victory of...

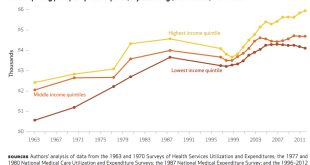

Read More »Trickle-up healthcare

from David Ruccio We’re all familiar with the usual indictment of the U.S. healthcare system: we pay much more and we get much less. For example, according to the Commonwealth Fund: Data from the OECD show that the U.S. spent 17.1 percent of its gross domestic product (GDP) on health care in 2013. This was almost 50 percent more than the next-highest spender (France, 11.6% of GDP) and almost double what was spent in the U.K. (8.8%). Since 2009, health care spending growth has...

Read More »Getting the story straight

from Robert Locke In the Collapse of the American Management Mystique, Oxford UP 1996, I wrote about the rapid decline in American staple industries, “in automobiles and in the related industries of steel, glass, and tires. The total number of workers in the automobile industry declined from 802,800 in December 1978 to 478,000 in January 1983. By 1980 Japan had become the world’s major automobile producing nation. As Japanese replaced American, American automakers world market share...

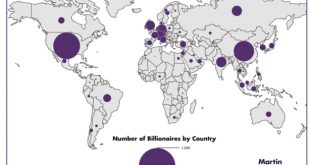

Read More »Map of the Billionairs – 1,826

from David Ruccio According to a new study, The Geography of the Global Super-Rich, by Richard Florida, Charlotta Mellander, and Isabel Ritchie, the United States is home to the world’s largest number of billionaires, with 541, 30 percent of the total. China is second with 223 or 12 percent. Next in line are India and Russia, with 82 billionaires (4.5 percent) each. Germany is fifth with 78 billionaires (4.3 percent). The United Kingdom is sixth with 71 (3.9 percent). Switzerland has 58...

Read More »Voters aren’t buying what mainstream economists are selling

from David Ruccio Mainstream economists, such as Harvard’s Gregory Mankiw, celebrate international trade (including outsourcing, which they argue is just another form of international trade) at every opportunity. But right now, voters—especially in the United States and the United Kingdom—aren’t buying what mainstream economists are selling. They are (as I’ve argued here, here, and here) ignoring the so-called experts. That rejection clearly disturbs Mankiw, who just adds fuel to the fire...

Read More »Is the CORE e-Book – Part Two: The basic background ideology

from Mouvement des étudiants pour la réforme de l’enseignement en économie (MEPREE) France and RWER #75 The basic background ideology: free individuals, free markets and “invisible hand” The e-Book overtly proclaims that it adheres to “methodological individualism”. That is, individuals are society’s point of departure. They are “free to choose”, between consumption and leisure for “Angela the farmer” and “Mary the employee”, e-Book’s typical consumer, and between leisure and...

Read More »Is the CORE e-Book a possible solution to our problems? – Part One

from Mouvement des étudiants pour la réforme de l’enseignement en économie (MEPREE) France and RWER #75 “Students in economics all over the world were asking, just as I had asked a few years previously: why has the subject of economics become detached from our experience of real life?” (Camila Cea, Member of the CORE project, University of Chile.) AbstractThe CORE project is a response to students’ protests against teaching in economics. It wants “to make economics accessible and relevant...

Read More »“On economics as a science” – Paul Spicker

Much of social science has come to rely on a set of analytical approaches intended to identify specific influences within a range of confounding factors. The object of analysis is to separate the strands, to distinguish different influences, to attribute influence to particular variables. This has to be done in the face of multiple, competing influences. As a discipline, economics goes about this in different ways. The traditional approach of classical economics is theoretical and...

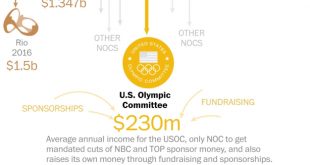

Read More »“I will row through shit for you, America.”

rom David Ruccio U.S. Olympic rower Megan Kalmoe doesn’t want to talk about water quality anymore. As she explained on her blog, journalists are ruining the 2016 Olympic games by being “fixated on shit in the water.” We are American, and we are going to Rio to represent you in this potentially flawed and imperfect setting that you are trying so desperately to get the public to love to hate. We are going to compete for medals to bring them home to you, and for you so that the US...

Read More » Real-World Economics Review

Real-World Economics Review