My good friend (and Patron!) Paul Gambles took advantage of my holiday in Thailand (en route to Sydney for a sister's 60th birthday party) to arrange a talk at Chulalongkorn University. I cover my usual monetary topics--why economics textbooks are wrong about money creation, and why this is extremely important for macroeconomics--and the reactionary emphasis by economists on equilibrium modeling when the rest of the world has now grown up sufficiently to model the real world as the far...

Read More »Scottish Economics Conference Glasgow: Economics of Debt (& Climate Change)

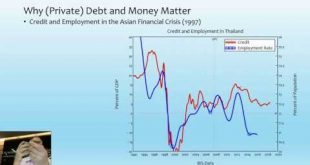

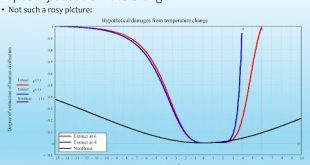

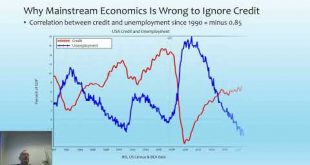

This keynote to the student-organized Scottish Economics Conference held in Glasgow in February 2019 covers the macroeconomics of private debt and credit, and in the final minutes, covers the absurdity of the "damage function" that Nordhaus uses to conclude that a 6 degree temperature rise--a level which last occurred during what's known as the "Permian Extinction" when about 80% of all then existing life forms went extincy--will cause a mere 8.5% fall in GDP.

Read More »Manchester 2019 The Magnificent Failure of Neoclassical Economics

Virtually every time Neoclassical Economists explored the stability of an equilibrium in one of their models, they found it was unstable. How did they react to this discovery? By either ignoring it, or by using elaborate workarounds to avoid it. In the process, their analysis has gone from Walras' original vision of a simple price adjustment process which could lead to all markets being in equilibrium at once, with agents knowing only their own tastes, their existing stocks of different...

Read More »Talk at the ECB on Energy and Credit

This talk at the European Central Bank covers the failure of economic theorists of all persuasions, not only Neoclassical, to properly incorporate energy into their models of production, and the failure of Neoclassical economists to properly incorporate money and credit. In both cases, I show that there is an easy way to overcome this deficiency: to treat Energy as an input into Labour and Capital, without which neither can function; and to model capitalism as a monetary system in which bank...

Read More »Keen Berlin 2019 Reality Vs Myth

This is my keynote presentation at the 1st European Modern Monetary conference. I cover the fallacies that mainstream economists believe about money and why they are wrong, how their decision to ignore banks, money, credit and private debt in their macroeconomics depends upon the false "Loanable Funds" model of bank behaviour, and how private debt and credit explain the tendency of capitalism to fall into financial crises.

Read More »Kingston University Becoming an Economist Lecture 05: Collecting and displaying data

This is a basic, introductory lecture on locating and displaying data for First Year economics students at Kingston.

Read More »Kingston Masters Political Economy 05: Neoclassical Growth theory, RBC & DSGE models

(This is an incomplete lecture due to a lack of time to prepare it: what I should have spent 2 months preparing I had to do in 2 weeks--while also moving house. Hopefully I'll find the time to complete it when writing next year's lectures.) I cover the reasons why the Neoclassical growth model--on which both RBC (Real Business Cycle) and DSGE (Dynamic Stochastic General Equilibrium) models are based--has an unstable equilibrium. Given their Neoclassical fetish for seeing stable equilibrium...

Read More »Kingston Masters Political Economy 04: From IS-LM to Rational Expectations

This lecture starts by showing that IS-LM was in fact a Walrasian General Equilibrium model, not a Keynesian model. Neoclassicals like Lucas didn't know this, but also wanted to construct a macroeconomics that was built directly from microeconomics. The first stage here was Muth's invention of the concept of "Rational Expectations" in the context of attacking the Cobweb Model of cycles in a single market.

Read More »Kingston Masters Political Economy Lecture 03: Instability of General Equilibrium

The 1870s founders of Neoclassical economics Jevons and Walras would find today's Neoclassical economics unfathomable, because it has been built of a series of failures to find the kinds of answers that Neoclassical economics wanted to find to logical questions. Not only would the answers have disappointed these Neoclassical pioneers, the way that their descendants reacted to them produced an economics that is radically different to what its founders built. For Jevons and Walras, the market...

Read More »Kingston University Becoming an Economist Lecture 05: The Ecological Blindspot in Economics

I criticise all schools of thought in economics as having a blindspot on the relationship between economics and ecology. I explain the Laws of Thermodynamics and the fact that nothing can be produced without energy, and yet theories of production in both Neoclassical and Post Keynesian economics ignore this. I show how energy could be incorporated. I cover the inevitability of reaching a maximum level of energy consumption per head, and the impact of Limits to Growth on the viability of our...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch