Brexit supporters have been severely critical of the OBR for its grim outlook for the UK post Brexit. The OBR is by no means the most negative of the professional forecasting bodies, and historically its forecasts have tended to err on the side of optimism, as Duncan Weldon observes. But it struggles to find anything good to say about post-Brexit Britain. In particular, it is distinctly negative about the future for Britain's external trade.Brexit is above all a shock to trade, since its primary impact will be on Britain's trading relationships, not only with the EU but with other countries too. At present, we have no real idea what these will look like once the UK has left the EU. The OBR is therefore forecasting under extreme uncertainty. If there is one thing we can be sure of when forecasting under extreme uncertainty, it is that the forecasts are even more likely than usual to be wrong. This does not indicate that the forecasters are biased. It just means they have little reliable information.

Topics:

Frances Coppola considers the following as important: Brexit, GDP, inflation, trade

This could be interesting, too:

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Angry Bear writes Voters Blame Biden and Harris for Inflation

Angry Bear writes GDP Grows 2.3 Percent

Lars Pålsson Syll writes How inequality causes financial crises

Brexit supporters have been severely critical of the OBR for its grim outlook for the UK post Brexit. The OBR is by no means the most negative of the professional forecasting bodies, and historically its forecasts have tended to err on the side of optimism, as Duncan Weldon observes. But it struggles to find anything good to say about post-Brexit Britain. In particular, it is distinctly negative about the future for Britain's external trade.

Brexit is above all a shock to trade, since its primary impact will be on Britain's trading relationships, not only with the EU but with other countries too. At present, we have no real idea what these will look like once the UK has left the EU. The OBR is therefore forecasting under extreme uncertainty. If there is one thing we can be sure of when forecasting under extreme uncertainty, it is that the forecasts are even more likely than usual to be wrong. This does not indicate that the forecasters are biased. It just means they have little reliable information.

Because of the lack of clarity about the future, the OBR has applied three conditioning assumptions to its forecasts:

• the UK leaves the EU in April 2019 – two years after the date by which the Prime Minister has stated that Article 50 will be invoked

• the negotiation of new trading arrangements with the EU and others slows the pace of import and export growth for the next 10 years

• the UK adopts a tighter migration regime than that currently in place, but not sufficiently tight to reduce net inward migration to the desired ‘tens of thousands’.

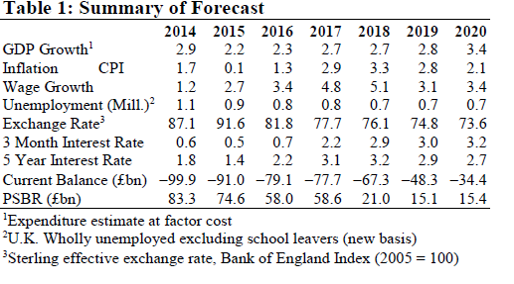

For the purposes of this post, the second of these is the most significant. It is also the most controversial. The pro-Brexit group "Economists for Brexit" disagree with it. They think that when the UK leaves the EU - assuming that the government adopts their preferred unilateral free trade model - there will be a substantial boost to trade which will flow through to higher incomes and sustained GDP growth:

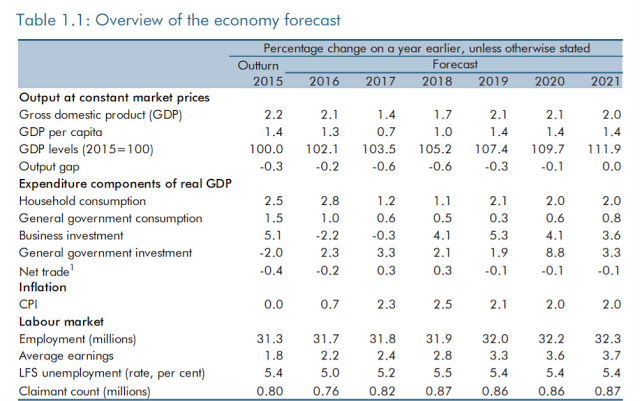

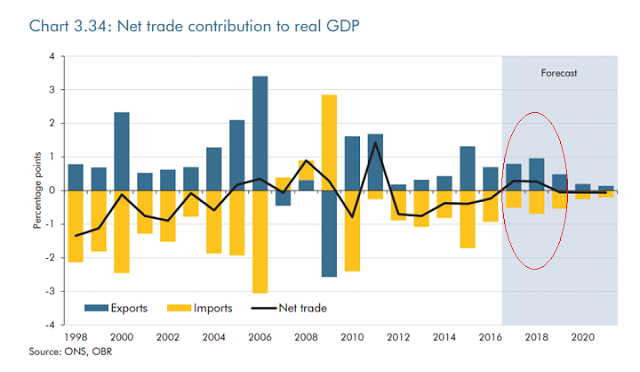

The OBR's forecast is substantially more gloomy:The difference primarily arises from the fact that the OBR doesn't assume a consumer demand boost from unilateral abandonment of trade tariffs. In fact its underlying assumption is that trade tariffs rise, as leaving the EU exposes the UK to higher trade barriers in Europe, free trade deals take time to establish, and the UK is likely to apply (at least) WTO MFN tariffs to trade that was previously free. This is the primary cause of the contraction in gross trade evident in the greyed area of this chart: However, it is not the only cause. Brexit will be implemented against the background of contracting global trade and rising protectionism. This is likely to hamper the UK's quest for new export markets considerably. The OBR forecasts that by 2020, gross trade will be lower than it was in the 2007-8 financial crisis.

The worsening global trade outlook also seriously calls into question the assumptions made by Economists for Brexit regarding the economic effect of unilaterally abandoning trade tariffs. Positioning the UK as a beacon of free trade for the rest of the world is hardly likely to be an effective strategy for growth if the rest of the world is sticking two fingers up to free trade. When everyone wants to export and no-one wants to import, the country that unilaterally opens its doors to imports is inevitably flooded and its own supply side is crowded out. So UK businesses would face stiff competition from imports in addition to tariffs and other trade barriers for their exports. Economists for Brexit heroically assume that this would be entirely offset by improved export competitiveness from sustained sterling depreciation. But when a consumer boom from cheap imports is combined with challenging supply-side conditions which are resistant to the stimulus of a lower exchange rate (as I shall explain shortly), sustained currency depreciation can have only one outcome. Inflation, here we come.

To be fair, that is what Economists for Brexit forecast. Their medium-term estimates for CPI inflation are significantly above those of the OBR. Even so, I think they are not high enough, given the difficulties UK businesses face due to the worsening trade outlook. Economists for Brexit also appear to predict a wage-price spiral, since their forecast shows much higher wage growth than the OBR's. Unsurprisingly, they forecast higher interest rates. We haven't seen this combination of inflation, wage growth, falling sterling and rising interest rates since.....well, since the Volcker Shock. In fact Economists for Brexit's forecasts could be entitled "Back to the 1970s", apart from their amazing optimism about unemployment. Maybe I am scarred by my memories of the 1970s, but I don't regard their forecast as rosy.

Sterling depreciation is a double-edged sword. It would boost exports to some extent: the OBR's chart shows a small boost to exports from this year's fall in sterling. But it would also squeeze household incomes and business profits because of inflation in essential goods, notably energy and fuel. In the oil price shock of 2011-12, households cut back discretionary spending sharply, derailing a promising recovery. They would be likely to respond in the same way to energy and fuel price rises due to sterling depreciation: they might also defer or cancel spending on other imported goods. Consequently, OBR forecasts that imports will fall.

The OBR says that the combination of falling imports and increased exports will mean net trade turns positive in 2017-18 (I have circled this on the chart). However, the implied fall in domestic demand means lower, not higher, GDP growth than would have been the case without the Brexit shock. Fortunately, the shock is short-term and the OBR says the UK will return to growth of around 2% per annum thereafter, which is consistent with the views of other professional forecasters (though not, of course, Economists for Brexit).

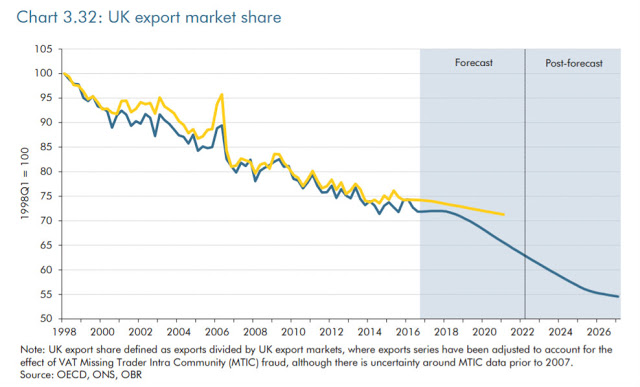

The UK's share of world trade has been declining for the last two decades, and this trend is unlikely to reverse. This is due to the changing structure of the world economy, and in particular the rise of China. The OBR's longer view of the UK's export market share shows that the depreciation of sterling after the Brexit vote makes little difference:

In short, there isn't going to be an "explosion of international trade", as some Brexit supporters have suggested - at least, not enough to reverse the UK's secular decline as a major trading power. The boost to net trade from sterling depreciation will be short-lived if the OBR's assumptions hold. If the UK government adopted Economists for Brexit's unilateral free trade policy, there would be a boost to imports as trade barriers were lifted, but this would also be short-lived. After that, worsening inflation, tighter monetary conditions and a difficult external trading environment would cause both imports and exports to fall, just as they do in the OBR's model. Whichever forecast you look at, the outlook for trade is indeed grim. I don't know what planet Jacob Rees-Mogg inhabits, but it isn't one I recognise.

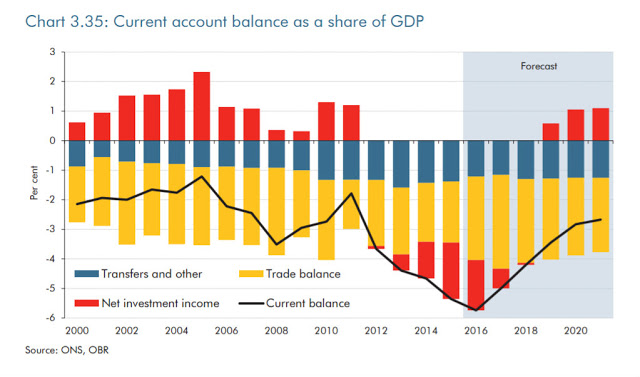

However, the outlook for the UK's external balance is not quite so grim. The current account deficit has been in the headlines recently because of its (considerable) size. This worries some economists because of the risk of a "sudden stop", and annoys the economic illiterates who think the UK should "pay its way" in the world. But as I have explained before, the current account deficit doesn't necessarily say anything about UK competitiveness. You have to look at the component parts to understand what is going on.

The headline current account deficit is set to shrink, as investment income switches from deficit to surplus. The current investment income deficit arises mainly from sterling's appreciation versus the Euro due to the ongoing Eurozone depression and the ECB's negative interest rate policy and QE. This chart clearly shows the switch of investment income from surplus to deficit in 2012, when the Eurocrisis hit:

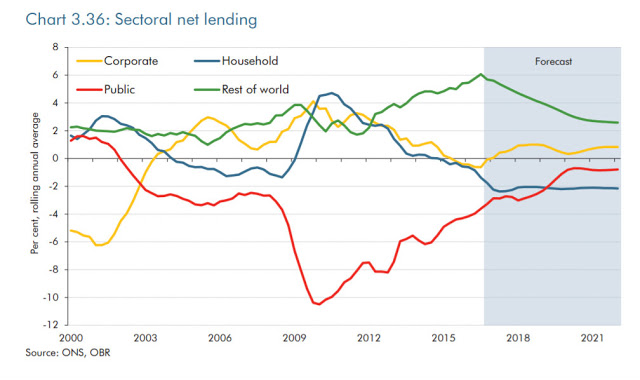

This improvement in the UK's current account balance is reflected in my favourite chart - the sectoral lending chart:

Despite the improvement in the external position, this looks awful. The OBR forecasts a sustained 2% deficit for the household sector. That means rising debt. As the household deficit is partnered by a surplus for the corporate sector and closure of the fiscal deficit, the increased debt is likely to take the form of borrowing to fund consumption. This is anything but desirable.

The OBR says that a sustained household deficit of that size is unprecedented and probably unsustainable:

The persistence of a household deficit of this size would be unprecedented in the latest available historical data, which extend back to 1987. Other datasets extending back to 1963 also suggest little evidence of a large, persistent household deficit, with the household surplus moving into negative territory in only one year between 1963 and 1987. A household deficit of the size and persistence we expect over the forecast period might be considered consistent with the unprecedented scale of the fiscal consolidation and the extremely accommodative monetary policy upon which our forecast is conditioned. It nevertheless demonstrates that the adjustment to the fiscal consolidation is subject to very significant uncertainty, and alternative adjustment paths are quite possible.

- households choose to cut spending rather than taking on more debt, causing imports to fall more than forecast and sharply reducing the external deficit. This would be likely to be associated with a sudden slowdown in GDP growth, possibly amounting to a recession (the OBR's fan chart shows recession as an outside possibility)

- sterling continues to fall, maintaining the improvement to exports beyond 2018 and increasing the net investment income surplus, thus reducing the external deficit

- business investment increases, pushing the corporate sector into deficit (this could be "pump-primed" by government investment)

- the government fails to close the fiscal deficit (or decides not to)

Though of course, a miracle could still happen. For if there is one thing we can be certain of, it is that forecasts made under extreme uncertainty are unusually likely to be wrong.

Some unpleasant trade realities

The currency effects of Brexit

The dominance of Brexit

Image is a Stewart McCrae cartoon from the 1970s satirising the Australian government's struggle to manage the economy. Gough Whitlam, Jim Cairns and Frank Crean are pictured on a raft called 'Economy'. Source: ABC News