I know that lots of you are heartily sick of the WASPI campaign, but it does have a tendency to throw up interesting issues. This time, it is the legal status of the UK's state pension.A couple of days ago, the WASPI campaign announced a crowdfunding campaign to raise funds for legal action against the Government. Their CrowdJustice page says that legal action would potentially be twofold: (this is a screen print from the CrowdJustice page. Regular readers of my blog will be aware that I do not post direct links to WASPI campaign material.)Personally, I am of the opinion that judicial review of the legality of the state pension age changes in the 1995 and 2011 Pension Acts is a non-starter. The timetables for the changes are built into the Acts themselves, so any successful challenge to them would require repeal or amendment of one or both Acts. Since the UK has no written constitution and Parliament is sovereign, judicial review cannot be used to challenge primary legislation unless EU law is violated.But I am no lawyer, and there may be an angle to this that I don't understand. As WASPI campaign has already met and exceeded its CrowdJustice target for legal advice, there will in due course be a barrister's opinion on the likelihood of the High Court granting leave for judicial review.What is far more interesting is the question that the proposed judicial review raises.

Topics:

Frances Coppola considers the following as important: benefits, law, pensions, UK, WASPI

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

Joel Eissenberg writes No Invading Allies Act

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Joel Eissenberg writes Duck and cover

I know that lots of you are heartily sick of the WASPI campaign, but it does have a tendency to throw up interesting issues. This time, it is the legal status of the UK's state pension.

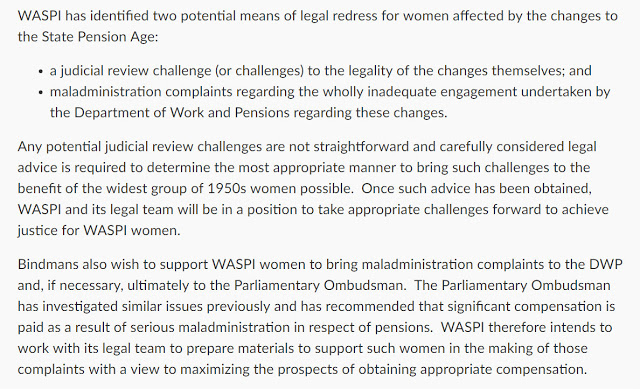

A couple of days ago, the WASPI campaign announced a crowdfunding campaign to raise funds for legal action against the Government. Their CrowdJustice page says that legal action would potentially be twofold:

(this is a screen print from the CrowdJustice page. Regular readers of my blog will be aware that I do not post direct links to WASPI campaign material.)

Personally, I am of the opinion that judicial review of the legality of the state pension age changes in the 1995 and 2011 Pension Acts is a non-starter. The timetables for the changes are built into the Acts themselves, so any successful challenge to them would require repeal or amendment of one or both Acts. Since the UK has no written constitution and Parliament is sovereign, judicial review cannot be used to challenge primary legislation unless EU law is violated.

But I am no lawyer, and there may be an angle to this that I don't understand. As WASPI campaign has already met and exceeded its CrowdJustice target for legal advice, there will in due course be a barrister's opinion on the likelihood of the High Court granting leave for judicial review.

What is far more interesting is the question that the proposed judicial review raises. Is the state pension a property right, or a state benefit?

Many in the WASPI campaign claim that the state pension is their right. They paid in during their working lives, so now the government should pay out in accordance with the terms and conditions agreed with them when they started work. Failing to do so is robbery. "We paid in - you pay out!" they screamed at their London demonstration in June this year. Twitter and Facebook are awash with posts claiming their pensions have been "stolen". It is tempting to dismiss all of this as hyperbole, but buried in all the anger is a serious point.

For women who started work before the 1995 Act came into force, the original age at which they would have qualified for a state pension was 60. If the state pension is a property right, then the state pension age rises in the 1995 and 2011 Acts could be viewed as violation of their property rights, since the total amount of pension they will receive over their lifetimes will now be substantially less than it would have been if the state pension age had not been raised. Whether or not they knew about the changes is irrelevant, though not knowing about them obviously adds to the anger and distress, and for some may have meant consequential losses for which they could seek redress through a maladministration claim against the DWP. The loss of state pension itself would be illegal, and they would be entitled to financial compensation to the equivalent of state pension from 60. I assume that this would be the ground for the proposed judicial review.

But there is a recent legal battle whose outcome seriously undermines the argument that the UK's state pension is a property right. This is the so-called "frozen pensions" case.

In 2002, a UK pensioner living in South Africa challenged the Government in the High Court under the Human Rights Act 1998 over its refusal to give her the same pension increments as those paid to pensioners living in the UK. She argued that her state pension was a property right, and that in refusing to pay the increments the UK government was depriving her of part of her property. And she further argued that she was being discriminated against because she lived in South Africa.

The judge disagreed, saying that "the remedy of the expatriate United Kingdom pensioners who do not receive uprated pensions is political, not judicial. The decision to pay them uprated pensions must be made by Parliament" (my emphasis). In other words, Parliament decides who should receive state pensions, and how much to pay them.

The judge went on to explain that although the claimant had a right to a pension, she could not lay claim to the increments paid to UK residents, since UK legislation did not give overseas pensioners the right to increments:

In the present case, UK legislation has never conferred a right on the Claimant to the uprating of her pension while she lived in South Africa. She does not satisfy and has never satisfied the conditions for payment of an uprated pension. She has never had a right to an uprated pension. There can therefore be no question of her having been deprived of any such right.He dismissed her discrimination claim on the grounds that the government was entitled to restrict payment:

It seems to me that a government may lawfully decide to restrict the payment of benefits of any kind to those who are within its territorial jurisdiction, leaving the care and support of those who live elsewhere to the governments of the countries in which they live. Such a restriction may be based wholly or partly on considerations of cost, but having regard to the wide margin of discretion that must be accorded to the government, I do not think it one that a Court may say is unreasonable or lacking in objective justification....And importantly, he added:

It is also difficult to criticise the position of the government if the limitation on the benefit has been published for some time, so that those who have gone to live abroad did know, or could easily have ascertained it, before deciding to live abroad. That is the case in relation to pensions.The Government had published information leaflets for those considering retiring abroad, which contained information about the effect on their UK pension. These were available on request from DWP. Clearly, the judge thought it was reasonable for people considering moving overseas to obtain information before making the decision. WASPI maladministration claims will hang on whether the DWP provided adequate information on the state pension age changes, and whether women should reasonably be expected to inform themselves. The WASPI campaign argues that the DWP should have notified women individually of the changes rather than expecting them to ask for information. The "frozen pensions" judgment does not exactly help its case.

However, the High Court's judgment appeared to undermine the principle of equal receipts for equal contributions. Age Concern, which supported the cause of people living overseas whose pensions have been "frozen", said:

People have to pay National Insurance contributions throughout their working life to be entitled to the full basic state pension, and therefore it is scandalous that they should not benefit from the annual inflationary increase that pensioners living in Britain receiveUnsurprisingly, the claimant appealed. Her appeal was heard in the Court of Appeal in March 2003 - and rejected. However, she was granted leave to appeal to the House of Lords. She duly did so. The case was heard in February 2005, and the House of Lords gave its judgment in May 2005.

The House of Lords rejected the appeal. Lord Hoffman dismissed the discrimination claim on the same grounds as the High Court judge, namely that the decision as to who should receive pension increments was a matter for Parliament not the courts.

But it is the next part of Lord Hoffman's judgment that fatally undermines the argument that state pension is a property right. Dismissing the claimant's argument that she was entitled to the same pension increments as a UK resident because she had paid in the same amount of NI contributions, he said (my emphasis):

In effect, her argument was that because contributions were a necessary condition for the retirement pension paid to UK residents, they ought to be a sufficient condition. No other matters, like whether one lived in the United Kingdom and participated in the rest of its arrangements for taxation and social security, ought to be taken into account. But that was an obvious fallacy. National Insurance contributions had no exclusive link to retirement pensions, comparable with contributions to a private pension scheme. In fact the link was a rather tenuous one.National Insurance contributions are used to fund a range of benefits. Broadly speaking, the purpose of National Insurance is to "insure" people against the risk of them being unable to work, the aim being to provide them with an income until either they are able to work or they die. The risks insured against include unemployment, sickness, maternity and bereavement, as well as old age. National Insurance also partially funds the National Health Service. In short, National Insurance is not a pension scheme and should not be regarded as in any way similar to a private or occupational pension scheme.

Following this judgment, the claimant appealed to the European Court of Human Rights, alleging that the UK government had violated Article 1 of Protocol 1 and Article 14 of the European Convention on Human Rights (ECHR). Article 1 of Protocol 1 gives protection to property rights, while Article 14 prohibits discrimination in the right to enjoy that protection. On 4 November 2008, the ECHR rejected the claim.

The ECHR's judgment defined the UK's state pension as state benefits intended primarily for UK residents, not property rights enforceable from anywhere in the world:

....the Court noted that the Contracting State’s social security system was intended to provide a minimum standard of living for those resident within its territory. Insofar as concerned the operation of pension or social security systems, individuals ordinarily resident within the Contracting State were not therefore in a relevantly analogous situation to those residing outside the territory.And it endorsed the view of Lord Hoffman that there is no exclusive link between National Insurance and the state pension (my emphasis):

National Insurance Contributions were only one part of the United Kingdom’s complex system of taxation and the National Insurance Fund was just one of a number of sources of revenue used to pay for the United Kingdom’s Social Security and National Health systems. The applicants’ payment of National Insurance Contributions during their working lives in the United Kingdom was not therefore any more significant than the fact that they might have paid income tax or other taxes while domiciled there.But it didn't end there. The case was referred to the Grand Chamber of the ECHR and was heard on 2nd September 2009.

The Grand Chamber dismissed the case on 8th March 2010. Its summary is a clear and unequivocal statement that the UK state pension is a social security benefit, not a pension scheme (my emphasis):

The Court did not consider that it sufficed for the applicants to have paid National Insurance contributions in the United Kingdom to place them in a relevantly similar position to all other pensioners, regardless of their country of residence. Claiming the contrary would be based on a misconception of the relationship between National Insurance contributions and the State pension. Unlike private pension schemes, National Insurance contributions had no exclusive link to retirement pensions. Instead, they formed a part of the revenue which paid for a whole range of social security benefits, including incapacity benefits, maternity allowances, widow’s benefits, bereavement benefits and the National Health Service. The complex and interlocking system of the benefits and taxation systems made it impossible to isolate the payment of National Insurance contributions as a sufficient ground for equating the position of pensioners who received uprating and those, like the applicants, who did not.The "frozen pensions" case has now hit a wall. It can go no further. Pensioners still grumble, of course: but unless the UK government relents, which it shows no signs of doing, their choice is either to accept that their pensions are frozen or to return to the UK.

The unfortunate precedent that this sets for WASPI should be evident by now. The WASPI campaign's claim for financial restitution rests on the belief that woman are "owed" their pensions. Although women are also pursuing maladministration claims, maladministration claims alone will not restore them to the position that they would have been in had they been excluded from the state pension age rises in the 1995 Act - which was the original WASPI "ask". Admittedly, the "ask" published on the WASPI website has now been changed to "fair transitional arrangements", with an explanatory paragraph as follows:

This translates into a 'bridging' pension to cover the gap from age 60 until State Pension Age - not means-tested and with compensation for losses for those women who have already reached their SPA.But this appears to imply that the WASPI campaign believes women are entitled to some or all of the pension that they have "lost" due to the changes in the state pension age. Sadly, the outcome of the "frozen pensions" case suggests that this is not the case. Parliament can change the terms and conditions of the state pension as it sees fit, just as it can any other contributory benefit.

However, there is possibly a loophole. The High Court judge dismissed the claim of the overseas pensioner to an uprated pension on the grounds that UK legislation has never conferred the right to uprated pensions on overseas pensioners. Since she had never had those rights, therefore she could not have been deprived of them. Could WASPI claim that women DID have the right to state pension at 60, and have now been deprived of that right?

We shall have to wait and see what m'learned friend says. But myself, I doubt that this is a flier. The WASPI case that women have been deprived of property rights is fatally undermined in my view by the finding of both the House of Lords and the ECHR that the state pension is a benefit, not a pension scheme. You can't have property rights to a benefit.

The precedent set by the "frozen pensions" case would seem to indicate that the WASPI campaign has little hope of winning the thousands of pounds in "lost" pensions that it has promised its supporters. The wording of the CrowdJustice campaign suggests that the pressure for judicial review comes from the WASPI campaign leadership, not from its lawyer: Bindmans LLP appear much more interested in helping women to pursue individual maladministration claims against the DWP, even though you don't need a lawyer to pursue these. And as I noted above, maladministration claims alone cannot restore the "lost" pensions (I shall explain why in a later post).

I fear this will not end well.

Related reading:

An introduction to judicial review - Public Law Project