As Budget Day approaches, Economists for Free Trade have taken it upon themselves to give the Chancellor some advice. They have produced a "Budget for Brexit", subtitled "An Economic Report". One might expect from this that the report would contain a comprehensive set of Budget proposals with Britain's forthcoming exit from the EU in mind, backed up by rigorous economic analysis.With this in mind, I started reading the report. There was the inevitable introduction from Patrick Minford, as usual criticising the U.K. government for disagreeing with his forecasts. Fortunately, his comments were only a little over a page in length. And remarkably, he concluded with an appeal for the Chancellor to raise public spending: It is an extraordinary thing that economists like us feel the need

Topics:

Frances Coppola considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

As Budget Day approaches, Economists for Free Trade have taken it upon themselves to give the Chancellor some advice. They have produced a "Budget for Brexit", subtitled "An Economic Report". One might expect from this that the report would contain a comprehensive set of Budget proposals with Britain's forthcoming exit from the EU in mind, backed up by rigorous economic analysis.

With this in mind, I started reading the report. There was the inevitable introduction from Patrick Minford, as usual criticising the U.K. government for disagreeing with his forecasts. Fortunately, his comments were only a little over a page in length. And remarkably, he concluded with an appeal for the Chancellor to raise public spending:

It is an extraordinary thing that economists like us feel the need to encourage politicians to spend more money and cut taxes. Usually it is our role to discourage profligacy in the name of ‘economy’. However, the mantra of austerity has truly taken hold in the UK, so long (now a decade) has it been necessary to subscribe to this policy to bring debt down to sustainable levels.How amazing. Has Minford finally seen the light about the pointlessness of austerity?

Not in the least. He has simply become aware of the threat of Jeremy Corbyn:

With popular tolerance fraying and the threat of an opposition determined on largescale socialism allied with a massive spending programme, this really is the time for Conservative politicians to show some strategic intelligence and boldness in fiscal plans.Tantalisingly, there he left it. There is no executive summary for busy people. You don't get to read the policy proposals until the end of the report.

The first section of the report proper is described as a "Commentary on the recent behaviour of the economy". It's certainly a commentary, but mostly not on the economy. Here is the opening paragraph:

The political classes are in uproar, arguing over the various forms of Brexit. Yet the economy sails on serenely, clocking up yet more record employment, with inflation coming down towards its target, interest rates finally rising, productivity recovering, the balance of payments improving and growth proceeding close to 2% (and on the latest ONS three month estimate May-July at a 2.5% annual rate). The pro-Remain media trumpet the ‘uncertainties’ and even the possible ‘terrors’ of no trade deal. But no one takes any notice apparently, outside the usual representatives of ‘industry’, such as the CBI.There then follow four paragraphs of politician-bashing and Brexit-building. For those with strong stomachs, here's a sample:

The truth is that ordinary people have got this right: they realise that, for all the posturing by politicians, trade will continue largely undisturbed by Brexit and that Brexit will bring some longer term trend changes that they have by a substantial majority approved.Eugh.

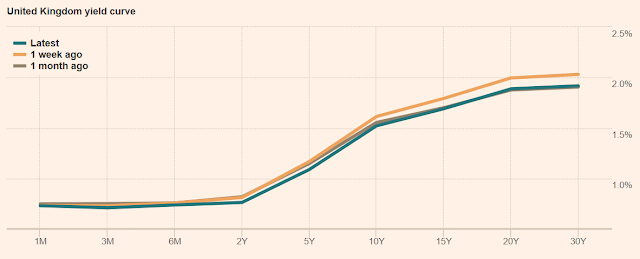

I skipped past this quickly, and read the next sub-section, which was largely about how the strength of the economy was bringing down the public sector borrowing requirement faster than expected. This is true, though I am not convinced that the economy is as buoyant as Economists for Free Trade think: the latest ONS figures show employment growth tailing off, GDP growth flat and productivity well below pre-crisis levels. And the interest rate rises shown by the yield curve predict neither normalisation nor a buoyant economy: rate expectations are falling along the curve, and the 30-year is now below 2%.

(chart from the FT)

Unsurprisingly, the Bank of England has backed off from signalling any more interest rate rises for the foreseeable future.

Disappointingly, the report repeats Minford's erroneous assertion that sterling depreciation has narrowed the current account deficit. In fact the CA deficit has widened in recent months and is now roughly back to where it was in 2015. This was the first example in this piece of substantive criticism being completely ignored. It proved to be far from the last.

It also marked the end of genuine economic commentary in this section. The remaining three pages consisted mainly of diatribes against the U.K. Treasury and complaints about the techniques used by other economic forecasters.

But buried in them were a couple of outrageous assertions. The first was this (my emphasis):

It is high time the Treasury comes round to accepting Brexit and making policy to optimise our economic prospects, building on the benefits brought by free trade including the potential deregulation Brexit can bring. In contrast to Remain efforts to defend our position within a protectionist EU, the truth has always been that free trade brings benefits in the form of lower prices and more competition.Apparently, after Brexit, the UK should discard heaps of regulations with which it has been forced to comply as an EU member. Economists for Free Trade don't say what these regulations are, though as we shall see, there are some indications later on as to what they have in mind. Leaving aside the question of whether non-tariff barriers would really be non-existent under a Canada+ trade deal (have they actually looked at CETA?), if UK regulations deviated from EU, how could non-tariff barriers possibly be "effectively non-existent"? The EU would be entirely within its rights in expecting the UK to prove that it complied with its regulations. This would not be "creating significant new non-tariff barriers", it would simply be the inevitable consequence of the UK's decision to diverge from EU standards.Furthermore, this freedom does not need to come at the expense of creating new barriers with the EU. Even with a World Trade Deal under WTO rules, such barriers will consist solely of tariffs which are in general low - ie, it will not be possible for the EU to create any significant new non-tariff barriers. Under Canada+, both tariff and non-tariff barriers will be effectively non-existent.

The second was this:

In any case - once our markets are open to the world - any barriers with the EU will have an insignificant effect on our economy.This is a fine example of sour grapes. The fact is that the UK could not quickly or easily replace lost EU trade with new trade with the rest of the world. Unilateral free trade is a non-starter (at least Economists for Free Trade admit this now), and a "web of FTAs" replicating global free trade would take years if not decades to establish. If Brexit resulted in higher trade barriers with the EU - as would almost certainly be the case - there would be a hit to the UK economy, at least in the short term.

In fact this is what the yield curve is telling us. The sharp rise in interest rates at the 2-year point indicates an inflationary shock to the economy at the end of the expected transition period. But perhaps Economists for Free Trade don't believe market indicators?

Anyway, they did say one thing I agreed with:

The Government now has a good opportunity to get away from its position of endless austerity and to grasp the growth-creating opportunities from Brexit. Improved infrastructure, reformed funding of the NHS, and tax cuts can all usher in a new environment that will build on the extra productivity coming directly from Brexit itself.Dunno about "growth-creating opportunities from Brexit," but improving infrastructure, reforming NHS funding, and judicious tax cuts (particularly aimed at the low paid) would all be economically beneficial. Bring them on.

The next section was entitled "The Brexit Negotiations and Possible Outcomes." Now if this were a genuinely independent piece of economic research, this section would have contained an evaluation of the economic effect of each of the various alternatives currently being discussed and the budget consequences arising from them. But what this section actually did was explain why Economists for Free Trade think the Chequers deal is a really bad idea, and propose a Canada+ FTA as a much better alternative, with what they call a "World Trade Deal" as a backstop.

There is, of course, no such thing as a "World Trade Deal". What they mean is exit from the EU with no trade deal, so that subsequent trade is on WTO terms only. Trying to spin this as a trade deal, and repeating discredited calculations of its benefits, shows Economists for Free Trade to be nothing but a bunch of charlatans.

By now I was on page 12 of an 18-page report, and had yet to see a robust economic forecast or a coherent Budget proposal. In their previous report, Economists for Free Trade spent a third of the piece criticising the Government. This time was even worse. More than half the piece was spent criticising the Government, decrying the competence of other forecasters, and promoting Economists for Free Trade's own preferences for Brexit. It must be one of the most polemical Budgets in history.

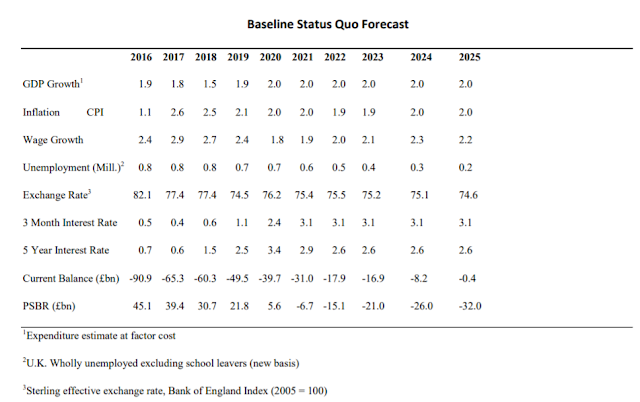

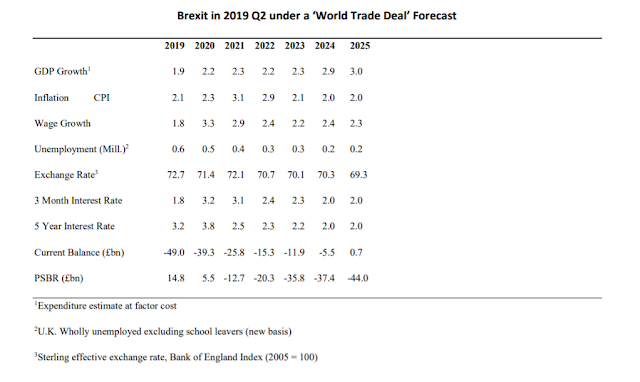

Fortunately, the third section did offer some substance. It provided "Projections of the UK economy to 2025 under three different scenarios: status quo, Canada+

from January 2021, and a World Trade Deal exit under WTO rules from April 2019." "Status quo" in this case had a rather peculiar meaning:

...we assume that some Chequers-type proposal is adopted, which leads to an indefinite postponement of BrexitEh? Chequers wouldn't postpone the UK leaving the EU.

Economists for Free Trade went on to explain that their "status quo" would mean the UK remaining in both the customs union and the Single Market. That would be Norway+, not Chequers. They are a tad confused, I think....

Anyway, they produced forecasts for all three. Here they are. First, Norway+:

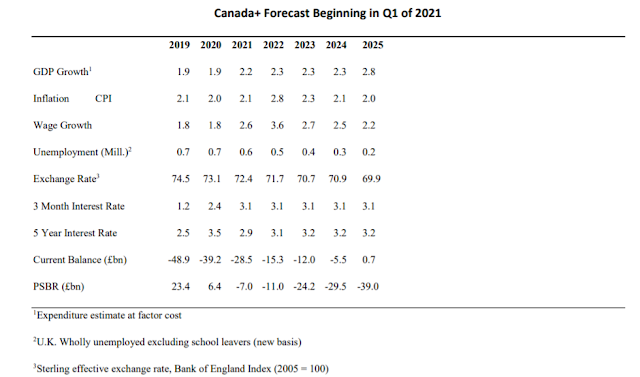

Secondly, Canada+:

Well, what a surprise. Unlike every other forecaster, Economists for Free Trade's forecasts show the Norway+ option as delivering the worst economic outcome. I have no idea how they arrived at these figures, but if I was being cynical, I might suspect that they constructed their model to deliver the results that supported their political position.

More importantly, the figures are distinctly odd. For example, all three forecasts show a flat or inverted yield curve: in the Norway+ forecast, the yield curve is considerably inverted from 2021 onwards. Since an inverted yield curve is a leading indicator of imminent recession, this is not consistent with the growth and inflation forecasts. Nor is it consistent with Economists for Free Trade's upbeat commentary. Even for the Norway+ version, they don't predict recession, only weaker growth than under the other two alternatives.

The behaviour of unemployment and inflation is also odd. All three scenarios predict unemployment of 0.2% by 2025. I know that the Phillips curve is broken and NAIRU is dead, but even so, I struggle to believe that unemployment approaching zero would not have inflationary consequences, especially if the real exchange rate is also falling (which raises the real cost of imports for domestic consumers).

In short, these figures do not make sense. In all three scenarios, very low unemployment and falling REER would mean rising inflation, which would imply higher interest rates and a steeper yield curve. This in turn would feed through into lower GDP and wage growth, particularly in scenarios 2 and 3. The Cardiff group's predictions of stronger growth under the Canada+ and WTO scenarios seem to be somewhat disconnected from reality.

This creates a problem. Section 4 discusses "how fiscal policy might best utilise the large Brexit Dividend." But if I am right about the figures, there wouldn't be a large Brexit dividend. Economic performance just wouldn't be good enough.

Nevertheless, let's look at what Economists For Free Trade think the UK Government should do with this mythical dividend.

Their top priority is tax cuts for the rich. No, I am not joking:

From the viewpoint of supply-side incentives, corporation tax and the two top rates are the highest priorities for tax cutting. If corporation tax and the top rate were both cut by 2% in 2020, and the very top rate by 7% (to equality with the top rate), the cost would be of the order of £9 billion.So, from 2020 onwards, the rich and big corporations would receive tax breaks. Then, from 2025 onwards, tax cuts could be extended:

• The standard rate could be cut by 2%, at a cost of £12 billion (raising the tax threshold is very

expensive and hardly affects any marginal rates, mainly going in the form of lower taxes to the better off, barely helping the less well-off because they lose benefits); or else VAT could

be cut by 1.5% for roughly the same cost

• Corporation tax could be cut another 3%, costing another £10 billion ; and

• The top rate could come down by 2%, costing around £3 billion.

So the general public would get either a small cut to the standard rate of income tax or an even smaller cut to VAT, while the rich and corporations were given even more tax breaks. The Cardiff group express concern about the fact that raising tax thresholds doesn't help the poor, while allocating almost none of the Brexit dividend to the poor. Priceless.

And what about that infrastructure investment, and reforming NHS funding? There would be perhaps £15 billion for this, but not until 2025. And of course if the Brexit dividend disappointed, it wouldn't happen at all. Because, you see, tax breaks for the rich are so much more important.

I thought trickle-down economics had been consigned to the dust heap of history. But in these days of shamanism and sacrifice, discredited ideologies seem to be coming back to life. Voodoo is back in fashion.

Reinforcing the voodoo, here is the Appendix from Economists for Free Trade's report:

Assumptions Used in the Liverpool Model to Reflect the Impact of Brexit with a Canada+ FTA

• We assume the gain in consumer living standards from leaving the EU customs union is 3.2 per cent due to the fall in tariff-equivalents (which we treat as a fall in the UK expenditure tax) and 0.8 per cent due to an improvement in the terms of trade (whereby the prices of UK imports from the EU fall, partially offset by a fall in the prices of UK exports to the EU, which are some 8 per cent of GDP smaller than the imports).

• The net EU budget contribution, 0.6 per cent of GDP, plus the 0.2 per cent of GDP paid to EU unskilled immigrants is returned to UK consumers in the form of an income tax cut

• The reduction of the regulative burden is modelled as a fall in the employer rate of national insurance by 2 per cent

• There is no direct effect on the public sector borrowing requirement (PSBR) since none of these changes affect the net public revenues

• The 0.8 per cent terms of trade gain plus the 0.6 per cent return of the net EU budget contribution are received as direct improvements of the current accountFor me, the most obvious howler is the claimed 3.2% improvement in consumer living standards from the Canada+ deal. There is no way that tariff equivalents versus the EU could fall in this scenario; even Economists for Free Trade admit that there would at best be no change. And as I have explained above, it would take years or even decades for non-EU trade to deliver that sort of improvement. In short, it is fiction.

There is another problem, too. I have explained previously why the consumer living standards and terms of trade improvements envisaged here take insufficient account of exchange rate effects. In my view, Economists for Free Trade's inadequate understanding of the interaction of trade tariffs with exchange rates and interest rates are a principal cause of the anomalous figures I discussed above.

And there are some more gems. Firstly, it is completely inconsistent to model the return of the EU budget as an income tax cut while claiming that it makes no difference to the PSBR. Income tax cuts are a policy choice. If the administration chose not to cut income tax in response to reduced government spending due to the repatriation of the EU budget contribution, the PSBR would fall. Similarly, it is inconsistent to model the return of the EU budget as a current account balance improvement while simultaneously modelling it as an income tax cut. An improvement in net financial income doesn't necessarily mean lower taxes.

Secondly, the claim that there would be a fiscal saving from ending EU unskilled migration is decidedly questionable. The evidence is that migrants contribute more to the economy than they take from it, so if anything there would be a loss. But even if there were a saving, there is no guarantee that it would go into tax cuts. It might simply reduce the PSBR, or go into government spending.

Thirdly, modelling reduced regulatory burden for businesses as a 2% cut in employer NI clearly indicates that the regulation that Economists for Free Trade think should be dismantled is worker protections. That is not what the people of Britain voted for!

Finally, there is no guarantee that the current account would close as shown. FTAs generally tend to worsen trade imbalances - after all, this is why the US is busy renegotiating FTAs all over the world, including with Canada. The UK is a services-led economy, not a manufacturing powerhouse. My prediction would be that in all three scenarios, interest rates would be higher than Economists for Free Trade expect, sterling would be stronger, and the current account would remain in deficit.

I said I would take this piece apart, and I'm glad that I did. But I fear that my comments will fall on deaf ears. Those who want to believe this stuff will believe it, and nothing I or anyone else can say will change their minds. And too many of those who believe it are close to power. In the end, it is not being factual that matters, or professional, or even honest. It is being able to influence those in power. And it seems that power would rather listen to rogues and charlatans.

Related reading:

A Budget for Brexit - Economists for Free Trade

An Alternative Brexit Polemic

Tariffs, trade and money illusion

Patrick Minford's holidays

Image at head of post is from Live News Malta.