Those excellent researchers at the House of Commons Library have produced a briefing paper on the Carillion collapse. It is clear, succinct and well-researched. And extremely grim.The researchers seem to have gone back through the reports & accounts to about 2009. And they conclude that Carillion was a basket case not just in the last year of its life, but from about 2011 onwards. I've now done the same exercise, and I agree with them. Carillion's cupboards were virtually bare, and the little that was in them stank.This chart summarises the mess that Carillion got itself into: We need to be a little careful with this chart, of course, since it is comparing stocks and flows. But what it shows is that a large uplift in loans in 2010-12 generated absolutely no additional net cash revenue

Topics:

Frances Coppola considers the following as important: audit, cash, loss, profit

This could be interesting, too:

Frances Coppola writes Proof of reserves is proof of nothing

Stavros Mavroudeas writes ‘Marxism and its contemporary relevance’ – Stavros Mavroudeas, FARAK International Conference

Mike Norman writes Zero Hedge — Hundreds Of Billions In Gold And Cash Are Quietly Disappearing

Frances Coppola writes The blind Federal Reserve

Those excellent researchers at the House of Commons Library have produced a briefing paper on the Carillion collapse. It is clear, succinct and well-researched. And extremely grim.

The researchers seem to have gone back through the reports & accounts to about 2009. And they conclude that Carillion was a basket case not just in the last year of its life, but from about 2011 onwards. I've now done the same exercise, and I agree with them. Carillion's cupboards were virtually bare, and the little that was in them stank.

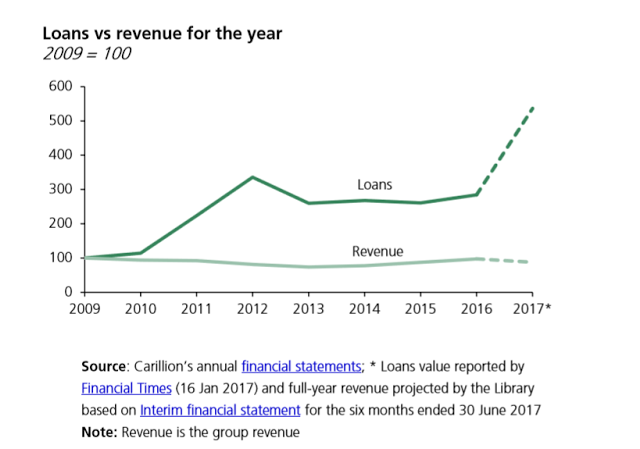

This chart summarises the mess that Carillion got itself into:

We need to be a little careful with this chart, of course, since it is comparing stocks and flows. But what it shows is that a large uplift in loans in 2010-12 generated absolutely no additional net cash revenue - in fact cash revenue actually fell between 2009 and 2016. For a company whose entire business model relies on increasing net cash flow, this is disastrous. The distressed uptick in borrowing in 2016-17 is very evident, of course, but for me the real issue here is the steady excess of loans over cash revenue from 2013 onwards. The company was simply not generating enough money to reduce its indebtedness.

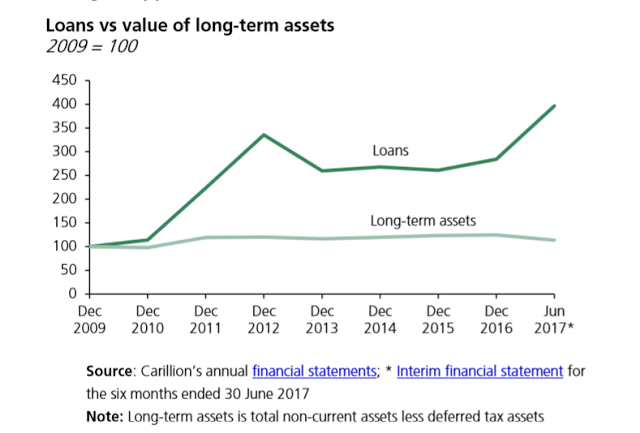

Of course, if the loans are used for productive investment, the company can eventually grow its way out of indebtedness. But Carillion didn't manage to do that. All that borrowing delivered almost no asset growth:

In Carillion's case, the shock to income occurred in 2017, when the company was forced to write down net cash flows on several contracts in the UK and the Middle East:

- Deterioration in cash flows on a select number of construction contracts led the Board to undertake an enhanced review of all of the Group’s material contracts, with the support of KPMG and its contracts specialists, as part of the new Group Finance Director’s wider balance sheet review.

- This review has resulted in an expected contract provision of £845m at 30 June 2017, of which £375m relates to the UK (majority three PPP projects) and £470m to overseas markets, the majority of which relates to exiting markets in the Middle East and Canada. The associated future net cash outflows in respect of these contracts is £100m-£150m (primarily in 2017 and 2018).

- As a result of the enhanced contracts review and the strategic actions below, reflecting difficult markets and exits from certain territories, Carillion is issuing revised full-year guidance, with revenue now expected to be between £4.8bn and £5.0bn and overall performance expected to be below management's previous expectations.

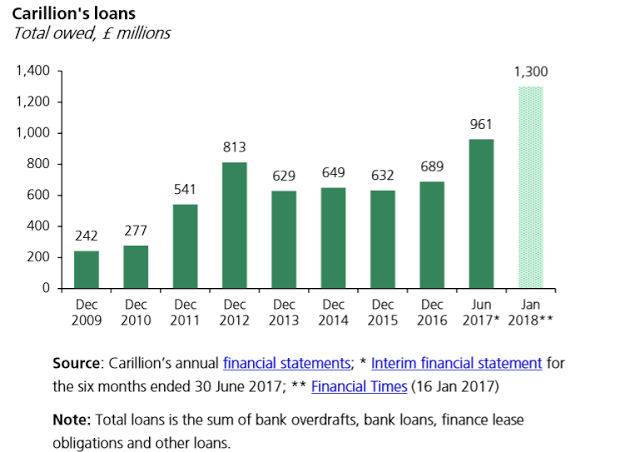

As Carillion's cash flow deteriorated during 2017, it was forced to borrow more and more cash simply to meet its obligations. Carillion's borrowing doubled:

Most of this borrowing was from banks, since repeated profit warnings make issuing commercial paper all but impossible. Banks will lend to distressed borrowers - at a price. I hate to think what Carillion's short-term interest rates were by the end of 2017. Even in 2016, Carillion's debt service cost it £30m. The cost for 2017 will be far higher.

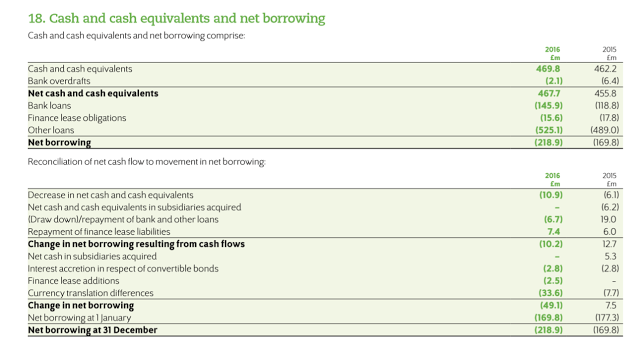

But how did Carillion's cash position deteriorate so much, so quickly? After all, the 2016 full-year accounts show cash of £469.8m, slightly better than the position at the end of 2015. A provision of £845m in mid-2017 shouldn't have caused the massive borrowing spike evident from the chart above. What was going on?

The simple answer is that the cash declared in the 2017 accounts did not belong to Carillion. Note 18 to the 2016 accounts shows that Carillion's cash position was in fact negative:

In reality, Carillion had no "free cash" at all. Its cash was entirely borrowed from its banks and its suppliers. If this isn't clear, consider this:- If I borrow money from a bank, I have money in my bank account. It looks like "free cash", but it is actually encumbered by the bank's claim on my future cash flows.

- If I don't pay my suppliers for 4 months, I have money in my bank account. It looks like "free cash", but it is actually their money.

But if Carillion's cash position was so dire at the end of 2016, how did it manage to declare profits and pay a dividend?

The Commons briefing paper talks about "aggressive accounting", which it defines thus:

‘Aggressive accounting’ is the practice of declaring revenue and profits based on optimistic forecasts, before the money has actually been made. All is well if the forecasts are correct. But if costs rise and revenues fall (say, because of delays and defects), expected profits turn into actual losses.I had a chat with some auditor friends about this. They told me that as a construction company, Carillion would have been doing "percentage-of-completion" accounting. So I looked up the relevant accounting standard. This is how IAS 11 says construction companies should book revenue and margin:

If the outcome of a construction contract can be estimated reliably, revenue and costs should be recognised in proportion to the stage of completion of contract activity. This is known as the percentage of completion method of accounting. [IAS 11.22]

To be able to estimate the outcome of a contract reliably, the entity must be able to make a reliable estimate of total contract revenue, the stage of completion, and the costs to complete the contract. [IAS 11.23-24]

If the outcome cannot be estimated reliably, no profit should be recognised. Instead, contract revenue should be recognised only to the extent that contract costs incurred are expected to be recoverable and contract costs should be expensed as incurred. [IAS 11.32]So, under the relevant accounting standard for a company like Carillion, declared profits depend entirely on management forecasts of future cash flows. "Aggressive accounting" would therefore involve taking an overly optimistic view of those cash flows. I am reminded of RBS's overly optimistic view of CDO valuations in 2008. That ended really well, didn't it?

Admittedly, IAS 11 does advise that forecasts should be prudent. But the moral hazard for directors whose bonuses depend on strong profits is obvious.

However, published accounts of public companies are independently audited. Surely the independent auditor would issue a warning if directors took too rosy a view of future cash flows?

KPMG, Carillion's auditor, did warn that revenue recognition was, to put it mildly, a matter of opinion (my emphasis):

The Group recognises revenue based on the stage of completion of construction contracts by reference to the proportion of costs incurred to the balance sheet date compared with the estimated final costs of the contract at completion and therefore relies on estimates in relation to the final out-turn of costs on each contract. Changes to these estimates could give rise to material variances in the amount of revenue and margin recognised. Contingencies may also be included in these estimates of cost to take account of specific risks, or claims against the Group, arising within each contract. These contingencies are reviewed by the Group on a regular basis throughout the contract life and adjusted where appropriate. Finally, variations and claims are recognised on a contract-by-contract basis, both on service and construction contracts, where the Group believes the rights and obligations exist given the progress of negotiations. There is therefore a high degree of judgement in: assessing the level of the cost contingencies to recognise; appropriately recognising variations and claims; and estimating the revenue recognised by the Group based on the projected final out-turn on contracts.But there it ended. The rest of the commentary is all about justifying KPMG's decision to accept the directors' judgement. The company's financial position was clearly deteriorating; it had zero free cash and both its short-term borrowing and its trade receivables (customers who owed it money) were rising sharply. Yet KPMG saw no reason to warn shareholders about the possibility that deteriorating cash flows might cause serious difficulty for the company.

I struggle to see how this is consistent with its role as "independent" auditor. But then I also struggle to see how Carillion's Audit Committee evaluating the independent auditor's "effectiveness", as it did in February 2017, is consistent with independence, either. Or the revelation, in the 2016 Audit Report, that KPMG was also doing non-audit work for Carillion. How can independence be assured if the auditor is working for the company it is auditing?

To be sure, the notes to the accounts do indicate that management was aware of the risks. Note 31 says this:

...management believes it is reasonably possible, on the basis of existing knowledge, that outcomes within the next financial year that are different from these assumptions could require a material adjustment.But they still went on to declare a dividend.

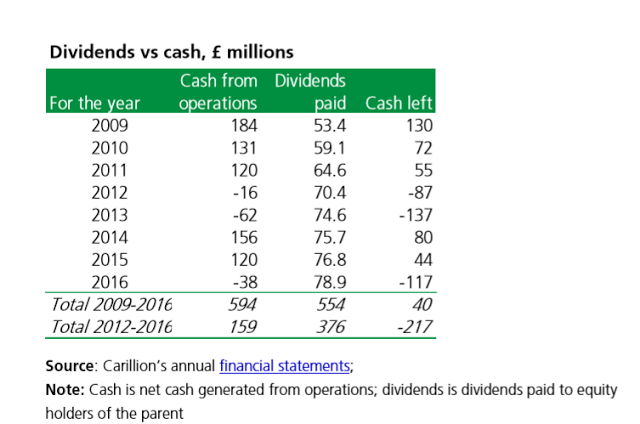

Carillion's accounting approach and dividend policy systematically worsened its cash position. Over-optimistic cash flow forecasts led to overstated profits, on which the company paid dividends that (with hindsight) are hard to justify. Dividends have to be paid in cash. If there wasn't enough cash from operations to pay the dividend, then the company was effectively borrowing to pay its shareholders.

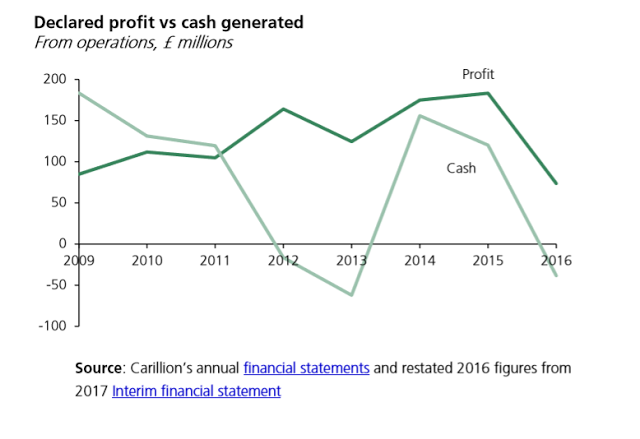

In both 2012 and 2013, Carillion had declared dividends despite failing to generate enough cash to pay them:

And it did so again in 2016. Declaring a dividend on a negative cash position when you haven't managed to make up the shortfall from the last time you did that is utterly foolhardy. To me, this smacks of a management that wasn't paying nearly enough attention to cash flow and its risks.

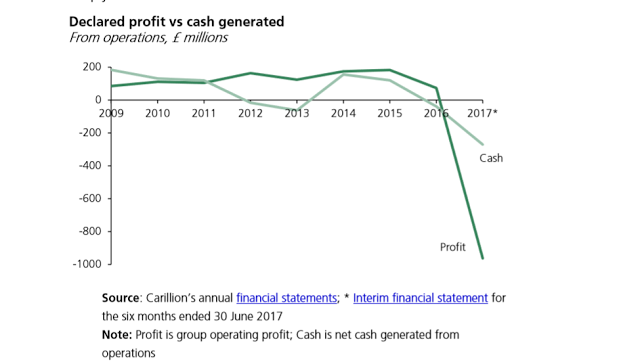

Just how important cash flow was to Carillion is graphically demonstrated by this chart. When Carillion's management was forced to write down its cash flow forecasts in 2017, the result was a sudden massive loss:

The Commons researchers observe that the declared loss of £1.2bn in June 2017 wiped out all the declared profits from the previous eight years. But then those profits were never real anyway, were they?

Taking an over-optimistic view of future cash flows didn't just overstate Carillion's profits and weaken its cash position. It also gave a false impression of the company's solvency. Had the cash flows been more realistically estimated, the goodwill asset that made up one third of the company's asset base would have been materially impaired in 2016 and possibly previous years too.

But KPMG didn't warn shareholders about this, either. It observed that Carillion's goodwill valuation critically depended on management estimates of future cash flows, and that even small deviations from forecast could have a material impact (my emphasis):

The risk – The Group’s balance sheet includes goodwill, principally arising from historical acquisitions in the UK. The risk is that the goodwill allocated to cash generating units (‘CGU’) is not recoverable and should be impaired. Due to the inherent uncertainty involved in forecasting and discounting future cash flows, which are the basis of the assessment of recoverability, this is one of the key judgemental areas for our audit. The Group annually carries out an impairment assessment of goodwill using a value-in-use model which is based on the net present value of the forecast earnings of the cash-generating unit (‘value-in-use’). This is calculated using certain assumptions around discount rates, growth rates and cash flow forecasts. Given the relative size of the goodwill in the Group balance sheet, particularly in the UK Services CGU, relatively small changes in these assumptions could give rise to material changes in the assessment of the carrying value of goodwill.But it nevertheless accepted the directors' view of cash flows. As a result, KPMG did not query the "going concern" basis on which the accounts were prepared. Rather than qualifying the accounts, it kept quiet and prayed for something to turn up. We could call this the Micawber school of auditing.

The truth is that Carillion was living on borrowed time from about 2011 onwards. It survived as long as it did because accounting standards enabled it to disguise its true financial position, and auditors turned a blind eye. Had the accounting been done on a more prudential basis, it might have been obvious much sooner that Carillion had no cash, no profits, no assets, and no future.

Related reading:

The Carillion whitewash

Carillion's Failure: The Many Questions That Need Answers - Forbes

The "true and fair" questions that dog Carillion - Financial Times

Carillion reports & accounts 2009-2016.

All charts and tables are from the Commons briefing paper cited in the text, except for the Note 18 table from Carillion's 2016 report & accounts.