Do you have a poorly-performing company that you don't know what to do with? Bitcoin fixes this! At least, that's what Michael Saylor seems to think. Since August 2020, Microstrategy, the company of which he is simultaneously CEO, chairman and principal investor, has invested heavily in Bitcoin. And Saylor has joined the select group of billionaires fronting the campaign to promote Bitcoin's widespread adoption (and talk up its price). Microstrategy has been bumping along the bottom for...

Read More »European banks and the global banking glut

In a lecture presented at the 2011 IMF Annual Research Conference, Hyun Song Shin of Princeton University argued that the driver of the 2007-8 financial crisis was not a global saving glut so much as a global banking glut. He highlighted the role of the European banks in inflating the credit bubble that abruptly burst at the height of the crisis, causing a string of failures of banks and other financial institutions, and economic distress around the globe. European banks borrowed large...

Read More »Lars P. Syll — a question of economic methodology

Radical uncertainty is feature of a complex adaptive system a chief characteristic of which is emergence. Emergence is at the heart of evolution theory. Emergence in this context means that there is no way to predict what will emerge from a complex adaptive system based on investigation of the past and present state of the system. This implies that surprise is a characteristic of such systems. This also implies that complex adaptive systems are like open systems rather than closed,...

Read More »Tyler Durden — BIS Issues Alert: Tightening “Paradoxically” Leading To Excessive Risk Taking; Reminds What Happened Last Time

What’s really puzzling Claudio Borio, however, is that the market euphoria, or “ebullience” as he terms it, has continued as the Federal Reserve has proceeded with its tightening. While Borio acknowledges the BoJ has left its accommodative policy unchanged and the ECB may have “at least relative to expectations”, he notes that the Fed is the “issuer of the dominant international currency and its sway on markets remains unparalleled”. In Borio’s view this has led to a paradox, as he...

Read More »William Nelson — Setting the record straight on why leverage ratio must change

A recent op-ed on this blog by Paul Kupiec misstates the Clearing House’s criticism of the supplementary leverage ratio. Kupiec’s article indicates that the Clearing House’s position is contained in a recent article by Darrell Duffie, a professor at Stanford University. Although Professor Duffie’s article appeared in the Clearing House’s quarterly journal “Banking Perspectives”, his views were his own, and he received no compensation from the Clearing House. We will let Mr. Kupiec debate...

Read More »If only we could return to the glorious 1990s…..

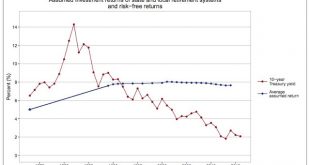

The chart below comes from Silver Watch on Twitter. I haven't been able to identify the original source, but it illustrates perfectly the point I have been trying to make for quite some time now. Pension funds are not taking on more risky investments because the risk premium has fallen, but because the risk-free rate has fallen: In fact, as the chart shows, the risk-free rate has been falling steadily for over thirty years. This is not a post-crisis blip. It is a secular trend. Yet pension...

Read More »The safe asset scarcity problem, 2050 edition

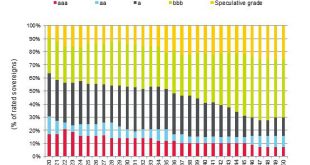

This is a silly chart: Why is it silly? Just look at what it implies for government and investor behaviour - and the future of the ratings agency that issued it.S&P forecasts a serious shortage of safe assets by 2050 if the developed nations, in particular, do nothing to adjust their fiscal finances in the light of ageing populations. Clearly, therefore, the price of sovereign bonds in the three "A" categories will rise significantly. S&P doesn't indicate which nations would be the...

Read More »Asset allocation in a period of wealth mean reversion

In-depth analysis on Credit Writedowns Pro. Should FIFAA Be Red-Carded? Absolute Return Letter, November 2015 “When I want your opinion, I will give it to you.” Samuel Goldwyn No, I haven’t gone bonkers – the focus of the Absolute Return Letter has not all of a sudden switched to football. Nor have I lost the ability to spell correctly, although I am sure that there are one or two like-minded readers out there who would also like to see the rear side of Sepp Blatter one final time....

Read More »A Return to Fundamentals?

In-depth analysis on Credit Writedowns Pro. The Absolute Return Letter, July 2015 “In a world that is changing really quickly, the only strategy that is guaranteed to fail is not taking risks.” Mark Zuckerberg Greece on the brink A Greek, an Irishman and a Portuguese walk into a bar and order a drink. Who picks up the tab? A German . . . Months (years!) of upheaval in Greece have taught me one important lesson. Don’t take anything for granted in politics. The referendum scheduled for...

Read More » Heterodox

Heterodox